CHICAGO — With a hike in debt service already looming, Chicago's public school district needs to spell out how it can afford a $1 billion fiscal 2019 capital program without risking fiscal gains that have cut recent borrowing costs, say market participants.

Mayor Rahm Emanuel and Chicago Public Schools Chief Executive Officer Janice Jackson unveiled a nearly

The operating plan illustrates both the district’s gains – from new state cash approved last year along with higher property tax levies for pensions approved over the last two years -- and its deeper struggles to dig itself out of the red ink that saddled it with junk bond ratings. CPS is rebuilding its operating fund balance that had been in the red, but it also anticipates relying on as much as $1 billion of costly short-term borrowing.

Emanuel and Jackson on Friday billed the capital program as the “district’s largest single-year capital investment in more than two decades.”

The district – with three of its four general obligation ratings at junk – is planning to borrow $313 million of GOs and up to $125 million under its capital improvement tax levy credit. Separately, the district is planning on a $500 million refunding this year.

“CPS will bring these bonds to market when market conditions are most favorable,” said a CPS representative. “The remainder will get financed at a later date as the capital project expenditures are needed.”

The full fiscal 2019 package primarily relies on $189 million from the district’s new money issuance of last year, $43 million of federal funds, and $750 million from future borrowing and “other capital funds” such as state aid and “outside resources as they become identified.”

While the appropriations for projects will be approved when the Chicago Board of Education takes up the budget at its July 25 meeting, the timing of expenditures is less clear based on data included in the capital plan.

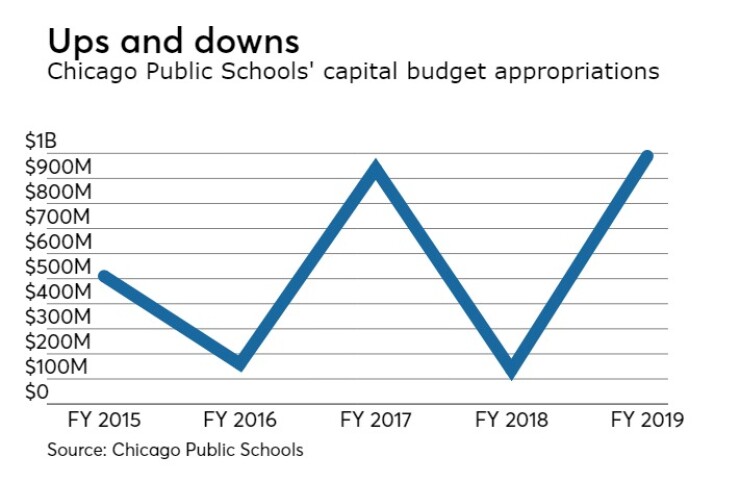

CPS expects to spend a total of $522 million in fiscal year 2019 but just $200 million would cover the fiscal 2019 appropriations. Another $242 million would pay down projects included in the $938 million fiscal 2017 capital plan, $70 million from the $136 million fiscal 2018 package, $10 million from the $160 million fiscal 2016 plan, and $2 million from the $510 million fiscal 2015 package. That leaves nearly $1.5 billion of remaining appropriations.

The Chicago Civic Federation budget watchdog group said it’s waiting for a more detailed briefing from CPS officials, but the lack of financing details raises concerns.

“The Civic Federation is urging CPS to be transparent and provide details on how they will pay for their $1 billion proposal,” the federation's president, Laurence Msall, said in an interview, adding that while the district “clearly has capital needs” it needs to disclose revenue sources to cover borrowing costs because it has so little in reserves and should also disclose backup plans should state funding lag in the future.

“We are concerned about their ability to borrow at a reasonable cost. It’s not unreasonable to invest in infrastructure and maintenance and other needs but it is unreasonable to borrow at excessive rates,” Msall added.

With rising interest costs in the coming years, Msall said the district doesn’t appear to have much near-term capacity to structure its debt repayment in a more “traditional” fashion instead of pushing off repayment.

CPS spreads have come down, but remain costly. The district’s GOs maturing in 2039 with a 2024 call and a 5.25% coupon traded Monday at about 200 basis points over the Municipal Market Data’s AAA benchmark, said MMD strategist Daniel Berger. The district’s GO paper “is thinly traded,” Berger added.

Uninsured spreads in the district’s recent GO refunding ranged from 193 bp to 224 bp while insured tranches ranged from 120 bp to 135 bp. Before passage of the state funding and city’s commitment to also provide funding for safety expenses the district saw spreads of more than 450 bp. The district’s Capital Improvement Tax-backed bonds sold late last year at a spread of about 150 bp last fall compared to 309 bp in 2016.

The buyside will look beyond the $1 billion headline that gives Emanuel an investment to boast about as he heads into the 2019 mayoral campaign, said Brian Battle, director of trading at Chicago-based Performance Trust Capital Partners.

“Short-term they averted a crisis with the state funding” and are now “off the ledge, but long term their problems persist,” he said. “CPS will have to show specifically where the money to repay the debt is coming from” and how it is spending the proceeds.

The school district will benefit from its improved market perception and a dearth of supply, especially paper that offers extra yield. “The district will have market access” and won’t likely face any new spread penalties, Battle said.

DEBT

The capital budget would finance maintenance, energy efficiency measures, information technology and security infrastructure upgrades, new and expanded schools to relieve overcrowding and allow the district to accommodate its newly announced goal to provide free, full-day pre-kindergarten for all by 2021.

New borrowing will add to a total debt load of $8.2 billion of general obligation, capital improvement tax-backed, and city public building commission issued bonds as of June 30 with $607 million earmarked for debt service in fiscal 2019. The district will use $328 million of its state aid to cover debt service.

Counting principal of $7 billion and interest of $6.8 billion, the district will pay a total of $13.8 billion through 2046 to retire its GO debt.

The city’s capital improvement tax levy first imposed in fiscal 2016 and used to back a roughly $730 million borrowing in fiscal 2017 and roughly $65 million in fiscal 2017, will rise from its original $45 million to $56 million. Principal repayment on CIT bonds doesn’t start until 2033. Counting principal and interest, the district will pay a total of $1.82 billion on the existing debt through 2046.

Fitch Ratings assigns an A rating to the bonds and Kroll Bond Rating Agency a BBB rating.

The district’s GOs carry a BB-minus rating and stable outlook from Fitch, a mix of BBB-minus and BBB ratings with a positive outlook from Kroll, a B rating and positive outlook from S&P Global Ratings, and a B3 rating and stable outlook from Moody’s Investors Service. The district’s ratings or outlook have all benefited from the new state aid package.

New money borrowing will add to the district’s debt service burden, already set to grow by $100 million to more than $700 million in fiscal 2020 and remain there until fiscal 2031 when it drops to about $625 million.

It then falls to about $450 million in fiscal 2032 where it holds steady until 2043 when it drops to about $350 million and then lands at $300 million in 2045.

CASH FLOW

On the operating side, the district expects an increase of $65 million in evidence-based state funding and $18.5 million in early childhood funding. The district will receive $239 million in state pension help.

The state in 2017 shifted to the evidence-based model and approved new funding for pensions in line with what other districts have long received.

The district anticipates a $75 million increase in property tax revenues and $12 million more from a personal property replacement tax levy. Total local tax revenue accounts for $3.5 billion of the operating budget with the state accounting for $2.2 billion and federal sources making up much of the remainder.

The operating budget of $5.9 billion is about $280 million more than fiscal 2018. The budget relies on just $22 million from a city-declared tax-increment financing surplus, down $66 million from fiscal 2018.

The district will contribute $809 million to its teachers’ fund in the next fiscal year with $239 million coming from the state. Much of the remainder will come from its property tax levies for pensions. The fiscal 2018 contribution included $551 million of CPS funds and $233 in state help.

Growth in its local dedicated levy and state funding are expected by fiscal 2037 to “cover the entire annual teacher pension cost,” budget documents say.

The district projects a $231 million operating fund balance in fiscal 2019 that marks a turnaround from a negative $275 million balance it began fiscal 2018 with, according to documents.

While the district’s improved liquidity allowed it to trim total borrowing to $1.1 billion from $1.55 billion in fiscal 2018 due to the “historic statewide education funding reform, budgetary savings, improved cash flow forecasting, and active cash management,” the district “plans to issue TANs of a similar size to support liquidity” in fiscal 2019, according to the budget documents.

The fiscal 2018 reduction trimmed about $68 million off short-term interest expenses. The budget allocates $21 million for interest in the new fiscal year. About $600 million of the district’s $1.1 billion of fiscal 2018 short-term tax anticipation note borrowing debt remains outstanding and is slated to be repaid by mid-December.

The district is paying 70% of the three-month London Interbank Offered Rate plus a spread of 330 basis points on recent TAN tranches.

While liquidity remains strained, the district managed to spend three months in fiscal 2018 in a positive net cash position.