-

Middle East unrest, oil price volatility and a Fed policy meeting all combine to weigh on this week’s $10B new-issue calendar.

September 16 -

Municipal yields and issuance plans both rose, showing market participants aren't uncertain about the meeting, with a quarter point cut in interest rates baked in.

September 13 -

Municipal traders and managers said the tax-exempt market’s early strength translated into weakness before the end of trading — due to taxable and overseas influences.

September 12 -

Los Angeles and Broward County deals were offered while some say the municipal market feels "heavy" and in retreat.

September 11 -

It was a big day for the municipal bond market as billions of dollars of new deals hit the screens.

September 10 -

Issuers jump into the market as yields remain near record low levels.

September 9 -

Fed still divided, but 25 basis point cut is a good bet.

September 9 -

With supply looking up, traders and analysts expect new issues to be well absorbed even if Treasuries correct futher.

September 6 -

The Chicago Public Schools also came to market with a $349 million GO deal.

September 5 -

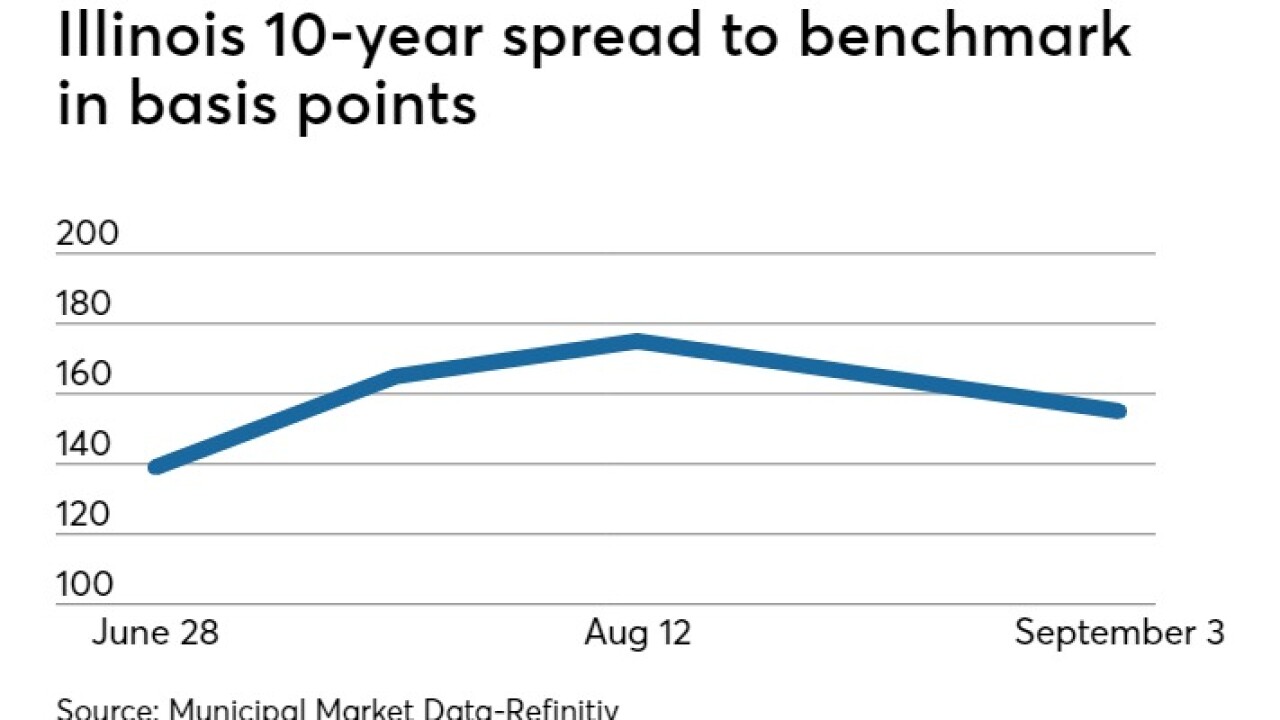

“I think there’s enough demand for Illinois bonds," said Vikram Rai, head of Citi's municipal strategy group.

September 4 -

California's $2.4 billion GO deal was priced for retail investors on Wednesday.

September 4 -

A pre-marketing scale was released on California's $2.3 billion GO deal.

September 3 -

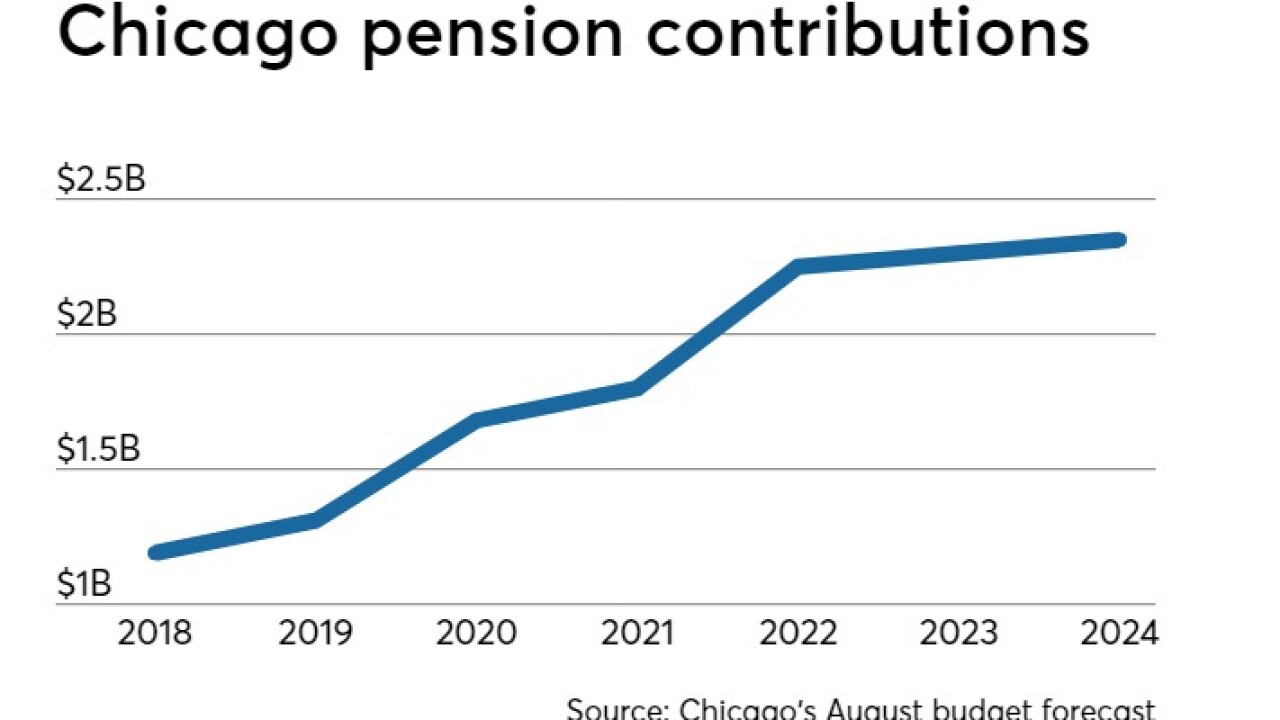

Market observers says Lori Lightfoot should go light on one-time maneuvers, avoid fiscal gimmicks, and move the city toward structural balance.

September 3 -

The market will see $7.6 billion of bonds plus a $1 billion note sale coming up in a holiday-shortened week.

August 30 -

The state's GOs recovered by 20 basis points or more late Thursday and into Friday, but a promised appeal hangs over the credit.

August 30 -

There are no reasonable grounds for the lawsuit to proceed, said the order from Jack D. Davis II. An appeal is planned.

August 29 -

Many market participants were already planning their getaways before the unofficial end of summer hits next Monday.

August 29 -

Lynn Martin, President and COO of ICE Data Services, talks with Chip Barnett about ICE's acquisitions and expansion, and discusses transparency and liquidity in the municipal bond market and the firm's introduction of a real-time AAA muni curve.

August 29 -

NYC to continue Wells' muni underwriting ban as Fed's Powell opines on the firm's woes.

August 28 -

Deals from Atlanta, Massachusetts, Ohio and Miami-Dade County led Tuesday's primary activity.

August 27