Municipal yields hovering at near record lows are enticing issuers into the market, even in a holiday-shortened trading week. Bond volume is estimated at $7.6 billion and this doesn’t even count the more than $1 billion in note sales slated for the week.

Primary market

On Tuesday, Jefferies circulated a pre-marketing scale on California’s (Aa3/AA-/AA) $2.3 billion various purpose general obligation bonds, which consists of $1.637 million of refunding GOs and $652.945 million of new-money GOs that will be priced for retail on Wednesday and for institutions on Thursday.

The scale showed short yields for the refunding GOs at 1.01% with a 3% coupon in 2020 and long yields in a 2039 split maturity yielding 2.07% with a 4% coupon and 1.82% with a 5% coupon. The scale showed short yields for the GOs at 1.06% with a 3% coupon in 2023 to long yields in a split 2049 maturity yielding 2.66% with a 4% and 2.01% with a 5% coupon.

On Wednesday, the New York Metropolitan Transportation Authority will competitively sell $1.2 billion of transportation revenue bond anticipation notes in two offerings. The deals consist of $1 billion of Series 2019D-1 BANs, due Sept. 1, 2022, and $200 million of Subseries 2019D-2 BANs, due July 1, 2020. Public Resources Advisory Group and Backstrom McCarley Berry are the financial advisors. Nixon Peabody and D Seaton & Associates are the bond counsel.

On Thursday, Morgan Stanley is expected to price Massachusetts’ (Aa1/AA/AA+) $600 million of Series G consolidated loan of 2019 GOs.

JPMorgan Securities is set to price the Chicago Board of Education’s (NR/BB-/BB/BBB) $370 million of dedicated revenues unlimited tax GO refunding bonds backed by dedicated revenues on Thursday.

Barclays is slated to price the University of Virginia's (Aaa/AAA/AAA) century bonds — $350 million of taxable Series 2019A general revenue pledge bonds due 2119.

In the competitive arena on Thursday, North Carolina (Aaa/AAA/AAA) will sell $600 million of Series 2019B public improvement GOs under the Connect NC program.

Tuesday’s bond sales

Secondary market

Munis were mixed on the

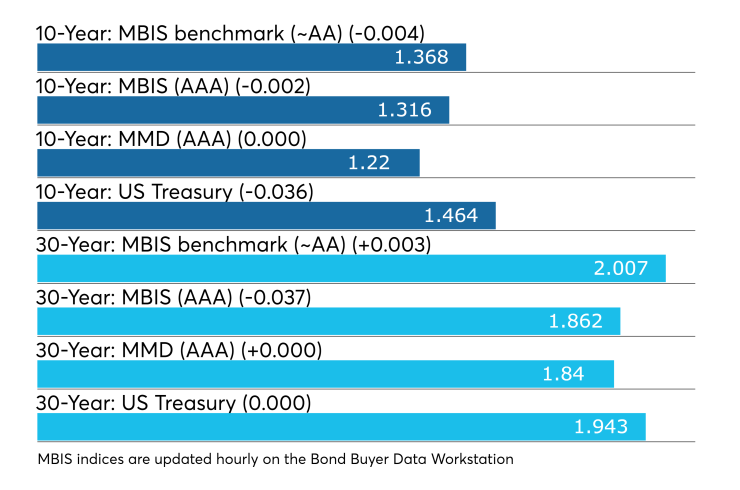

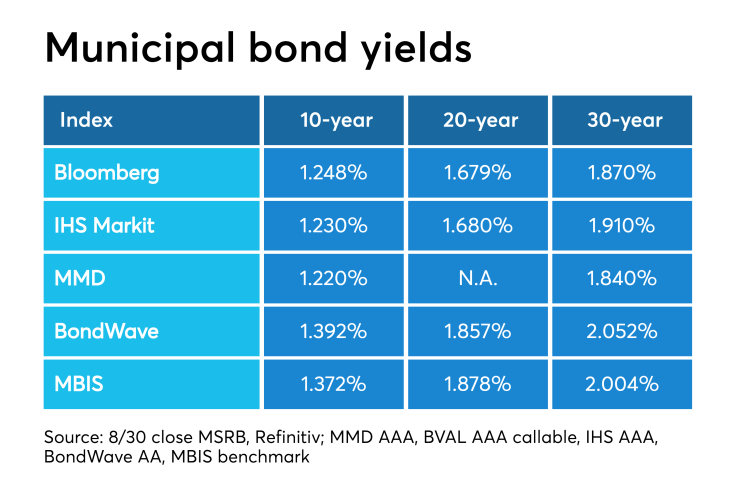

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10- and 30-year year muni GOs were steady at 1.22% and 1.84%, respectively.

“The ICE muni yield curve is flat out to seven years, little changed from Friday,” ICE Data Services said in a Tuesday market comment. “The 2-year/10-year spread that came in to 20 basis points on Thursday continues to hover at 21 basis points as investors continue to rotate capital into the sector. The tobacco and high-yield sectors are unchanged, along with Puerto Rico.”

The 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 94.1%, according to MMD.

Weak economic data pushed Treasury yields downs as stock prices traded sharply lower. The Treasury 10-year note was flirting with its record low of 1.32% set in 2016.

The Treasury three-month was yielding 1.958%, the two-year was yielding 1.472%, the five-year was yielding 1.338%, the 10-year was yielding 1.464% and the 30-year was yielding 1.943%.

Previous session's activity

The MSRB reported 18,252 trades Friday on volume of $4.87 billion. The 30-day average trade summary showed on a par amount basis of $10.90 million that customers bought $5.75 million, customers sold $3.13 million and interdealer trades totaled $2.02 million.

California, New York and Texas were most traded, with the Golden State taking 15.151% of the market, the Empire State taking 10.118% and the Lone Star State taking 9.277%.

The most actively traded security was the Illinois 2003 GO 5.1s of 2033, which traded 21 times on volume of $47.87 million.

Last week's actively traded issues

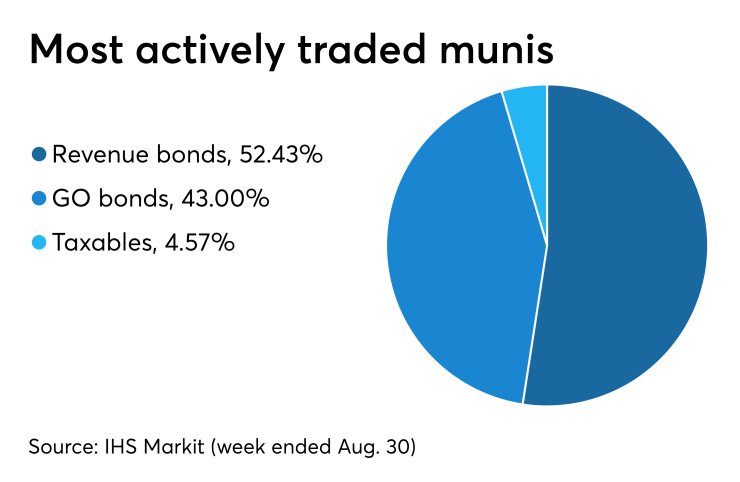

Revenue bonds made up 52.43% of total new issuance in the week ended Aug. 30, up from 51.81% in the prior week, according to

Some of the most actively traded munis by type in the week were from Texas and Massachusetts issuers.

In the GO bond sector, the Houston 1.95s of 2024 traded 31 times. In the revenue bond sector, the Texas TRANs 4s of 2020 traded 97 times. In the taxable bond sector, the Massachusetts 2.663s of 2039 traded 52 times.

Friedlander: Taxable muni issuance rises

Although volume for the month of August reached a 20-month high, tax-exempt issuance rose from last year by only a hairsbreadth — up 4.5% from last year, while taxable muni issuance was up 120% year-over-year, according to George Friedlander, managing partner at Court Street Group Research.

"A significant part of what drove all of this was refundings, largely of three kinds," he said. "First, issuers that had not done advanced refundings prior to the Jan. 1, 2018, prohibition and are now eligible for current refundings took advantage of the massive collapse in borrowing costs on all fixed income."

Second, Friedlander continued, there has been a groundswell of taxable advanced refundings, as any issuer can switch over to the taxable side, and use taxable bonds to advance refund tax-exempts that are not yet callable.

"Given the utter collapse in taxable bond yields, some issuers are discovering that borrowing in the taxable market has all of a sudden become a cost effective way of replacing older, higher yielding tax-exempt bonds that are not yet callable."

Third, some callable Build America Bonds that do not have make-whole calls are being replaced, according to Friedlander.

"And finally, the sheer collapse in yields has prevented credit spreads from widening out much, despite the growing risk coming out of the overall weakening economy and growing concerns about pension total returns," he said. "Issuers in this category are well-served to get their deals done as soon as possible, before concerns about credit deterioration grow."

He also noted that as a consequence, total refunding issuance in August was up $1.5 billion in August from last year, and he expects that the trend will get even more as we head into September.

"Low borrowing costs combined with concerns about higher penalties for credit deterioration in the future — has shown up in the new-money, tax-exempt market as well," Friedlander said. "As a consequence, new-money issuance 'popped' in August—up 22.8% over last year, and we expect that this pattern will continue in coming months as well, both in the tax-exempt and taxable markets."

In CSG's view, this remains a good time for issuers to issue, and for investors to stay in higher-quality credits despite low yields.

"Investors seeking wider credit spreads may be better served as we move more deeply into the post-Labor Day environment," Friedlander said. "We note that historically, new-money issuers in most muni sectors haven’t been all that borrowing-cost sensitive — the difference this time is how remarkable the drop in yields has become, and highly appropriate concerns that issuers who don’t get in soon might be looking at wider spreads to the triple-A curve."

Midweek awakening, after sleepy start

A sleepy, post-holiday market opened Tuesday with a decidedly better tone in U.S. Treasuries — even though municipals were largely unchanged and not following the improvement by its taxable counterparts, municipal sources said Tuesday afternoon.

Although municipal sentiment may be aligned with Treasuries, municipal price movement was less pronounced, Peter Delahunt, managing director of municipals at Raymond James & Associates, noted Tuesday afternoon.

“This makes it challenging for secondary selling, with the hedging basis overwhelming any incremental uptick in muni cash,” Delahunt said. “The secondary market is in a spectator mode at the moment,” he said.

“Buyers can afford to be patient and wait for the primary market. Despite the lackluster market tone, players said the $2.3 billion California general obligation sale slated for Thursday will jump start their interest. “The deal is expected to be well received as the market continues to be starved for new issuance and inventory in general,” Bill Walsh, president of Hennion & Walsh in Parsippany, N.J., said Tuesday afternoon.

“Retail demand may have subsided a bit with yields being so low, but there aren’t many safe alternatives,” Walsh said.

Overall market conditions, he said, continue to create strength in the municipal market — and that trend should continue in the foreseeable future.

“Munis are pretty much unchanged not following the improvement in Treasuries,” said a New York trader, who also said investors are salivating over the California GO deal, which is pricing for retail Wednesday and institutional pricing on Thursday.

Meanwhile, although redemption flows are slowing following the usual June to August surge in maturing debt and redemptions, other technical indicators remain positive for municipal markets, noted Alan Schankel, managing director and municipal bond strategist at Janney Capital Markets.

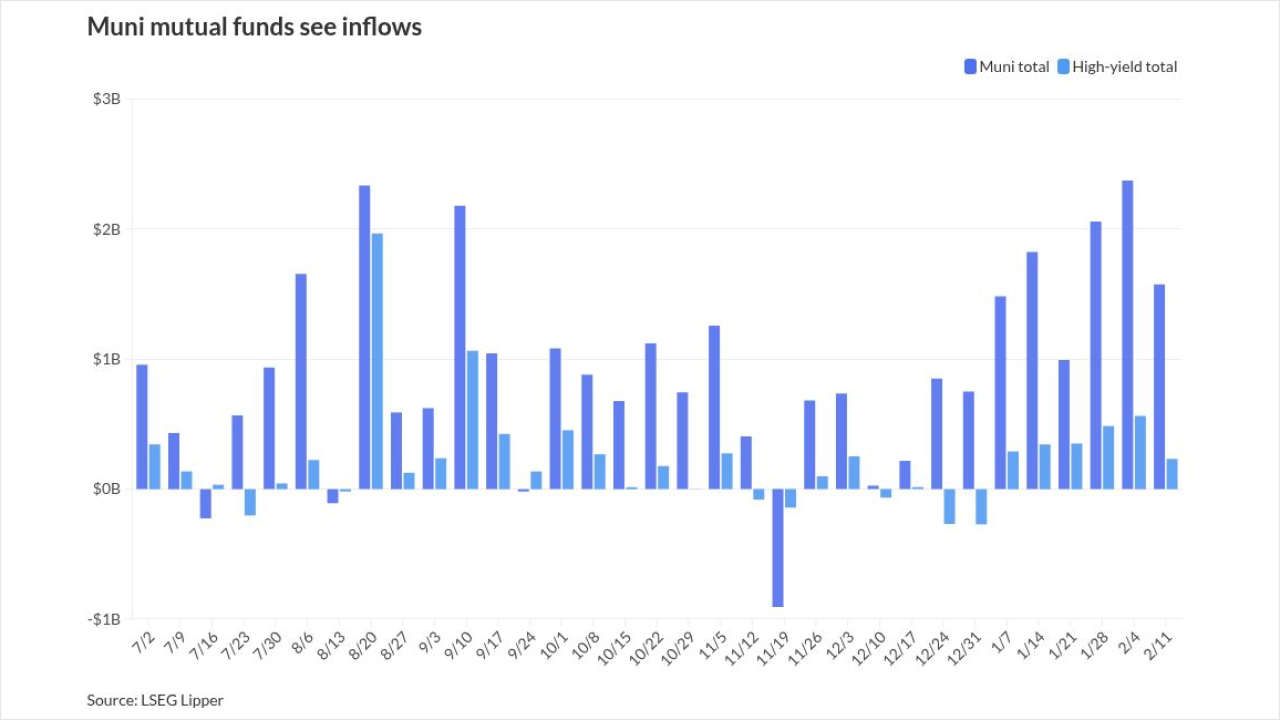

“Relative value indicators are flashing ‘cheap’ after the 10-year muni to Treasury ratio topped 86% last week — well above the 2019 average of 79%, according to Schankel. He said mutual fund and exchange traded fund inflows continue to be as strong as they have been in 2019 — with an additional $1.5 billion of new money added to funds and ETFs last week.“

With the strength of $1.5 billion of municipal fund inflows for the 34th week in a row, the New York trader said investors are cash-flush, but cautious. “There is lots of cash out there, but lots of investors are careful about investing in long bonds keeping their investments short,” he noted.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.