Municipal bond and note deals hit the market on Wednesday as supply-starved investors snapped up the paper.

Primary market

The New York Metropolitan Transportation Authority (MIG1/SP1/F1+/K1+) competitively sold $1.2 billion of transportation revenue bond anticipation notes in two offerings.

Seven groups won the $1 billion of Series 2019D-1 BANs, due Sept. 1, 2022, with a 5% coupon. The winners included BofA Securities ($1400 million), Citigroup ($200 million), JPMorgan Securities ($100 million), BNY Mellon Capital Markets ($100 million), Morgan Stanley ($100 million), Goldman Sachs ($50 million) and UBS Financial Services ($50 million).

Four groups won the $200 million of Subseries 2019D-2 BANs, due July 1, 2020, with a 4% coupon. The winners included TD Securities ($50 million), RBC Capital Markets ($50 million, Morgan Stanley ($50 million), and JPMorgan ($50 million).

Public Resources Advisory Group and Backstrom McCarley Berry were the financial advisors. Nixon Peabody and D Seaton & Associates were the bond counsel.

Jefferies priced for retail investors California’s (Aa3/AA-/AA) $2.36 billion general obligation deal consisting of $1.697 million of various purpose refunding GOs and $664.935 million of various purpose GOs. Underwriters circulated a pre-marketing scale on Tuesday and will price the deal for institutions on Thursday.

The retail pricing showed the refunding GO short yields at 1.01% with a 3% coupon in 2020 and long yields in a 2039 maturity at 1.82% with a 5% coupon. The retail pricing showed the GO short yields at 1.06% with a 3% coupon in 2023 and long yields in a 2049 maturity at 2.66% with a 4% coupon.

RBC Capital Markets priced the Chaffey Community College District, San Bernardino County, California’s (Aa2/AA/NR) $185 million of Election of 2018 Series A GOs.

JPMorgan Securities priced the North Fort Bend Water Authority (NR/AA-/A+) a political subdivision of the state of Texas’ $168.625 million of Series 2019A water system revenue and revenue refunding bonds.

Morgan Stanley priced Massachusetts’ (Aa1/AA/AA+) $400 million Series H consolidated loan of 2019 taxable GOs.

On Thursday, JPMorgan is set to price the Chicago Board of Education’s (NR/BB-/BB/BBB) $370 million of dedicated revenues unlimited tax GO refunding bonds backed by dedicated revenues on Thursday. And Barclays is slated to price the University of Virginia's (Aaa/AAA/AAA) century bonds — $350 million of taxable Series 2019A general revenue pledge bonds due 2119.

In the competitive arena on Thursday, North Carolina (Aaa/AAA/AAA) will sell $600 million of Series 2019B public improvement Connect NC GOs.

Wednesday’s bond sales

ICI: Muni funds see $1.96B inflow

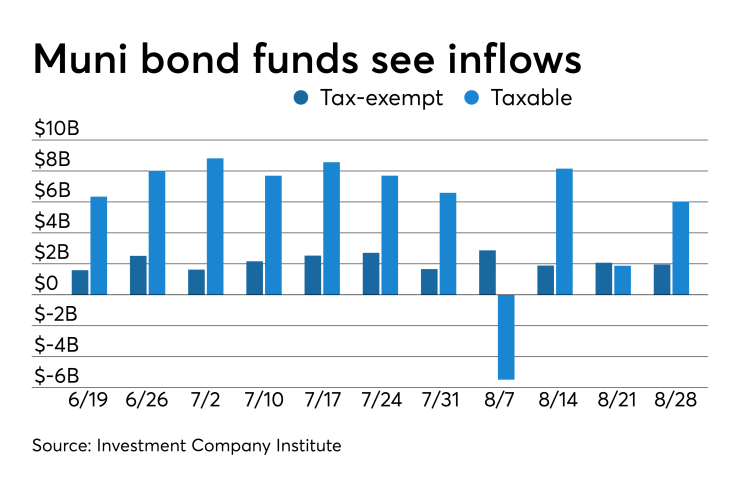

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.960 billion in the week ended Aug. 28, the Investment Company Institute reported on Wednesday.

It was the 35th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $2.074 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.633 billion after an inflow of $1.805 billion in the previous week; ETF muni funds alone saw an inflow of $327 million after an inflow of $269 million in the prior week.

Taxable bond funds saw combined inflows of $5.998 billion in the latest reporting week after inflows of $1.876 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $1.211 billion after outflows of $10.179 billion in the prior week. Equity funds were the biggest losers of the week, seeing $9.505 billion of outflows.

Secondary market

Munis were mixed on the

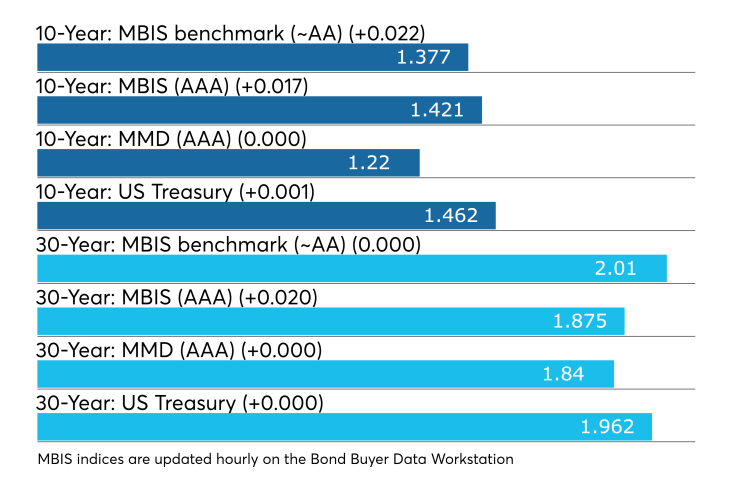

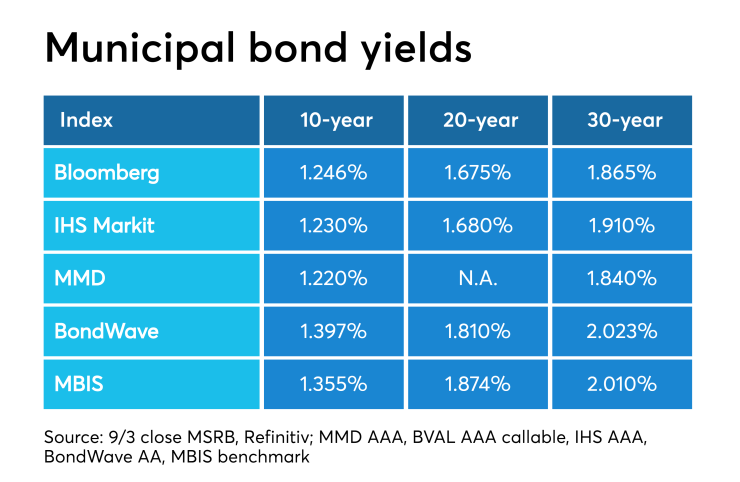

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10- and 30-year year muni GOs were steady at 1.22% and 1.84%, respectively.

“The ICE muni yield curve is steady. Tobaccos, high-yield and Puerto Rico are unchanged,” ICE Data Services said in a Wednesday market comment. “Taxable yields are down about two basis points in the belly of the curve.”

The 10-year muni-to-Treasury ratio was calculated at 83.6% while the 30-year muni-to-Treasury ratio stood at 94.3%, according to MMD.

Treasuries were stronger as stock prices traded higher. The Treasury three-month was yielding 1.961%, the two-year was yielding 1.440%, the five-year was yielding 1.318%, the 10-year was yielding 1.462% and the 30-year was yielding 1.962%.

The burst of post-holiday supply this week and ongoing fund flows are not enough to get municipals out of the trading range they have been stuck in for quite some time, a New York trader at a Wall Street firm said on Wednesday afternoon.

“There is not much going on,” he said. “There has been a little bit of steady supply and decent fund flows into the market, but munis are having a little problem gaining traction versus Treasuries.”

He said the ups and downs on the geopolitical front has spurred volatility making investors queasy.

“The low rates have shocked the market a little bit and it is caught in a holding pattern,” he said, "There is some money, and new deals are getting done, but the secondary market is having a hard time managing the relationship between munis and Treasuries and it’s hard to hedge with all the volatility.”

He described the market as “treading water” and being “stagnant” and without a pulse in the midst of some shadowing of Treasuries.

“New deals come and go and the Cal deal this week will be the big news,” he said. “I think there is enough money out there and these deals are done on the cheaper side, but the secondary is not that exciting.”

Previous session's activity

The MSRB reported 28,903 trades Tuesday on volume of $7.90 billion. The 30-day average trade summary showed on a par amount basis of $10.93 million that customers bought $5.81 million, customers sold $3.11 million and interdealer trades totaled $2.01 million.

California, New York and Texas were most traded, with the Golden State taking 14.402% of the market, the Lone Star State taking 11.5% and the Empire State taking 9.72%.

The most actively traded security was the Port Authority of New York and New Jersey taxable 3.287s of 2069, which traded 10 times on volume of $33.25 million.

Block: Munis underperform Treasuries

Munis posted positive returns in August but massively underperformed Treasuries due to investor resistance to low absolute yields, according to Peter Block, managing director of credit strategy at Ramirez.

"Munis underperformed by an average of +9.65 ratios across the curve, with the most acute underperformance occurring in the front-end (2yrs: 10.79 ratios; 5yrs: 14.62 ratios)," he said. "Front-end underperformance was due to a combination of the broad-based, aggressive Treasury rally in Aug and the run-up of short-dated bond prices at the beginning of July, which caused investors to seek better relative value (but still relatively expensive) in intermediate and longer duration bonds — which we have been favoring all year."

Block added that the new-issue supply of $44.5 billion in Aug. was met with a mixed reception, depending upon the week, credit, and structure that came to market.

"In many instances, underwriters had to reprice bonds to wider levels/spreads, including sub-5% coupons; however, even with sizable adjustments, in some cases, underwriters were forced to position significant portions of deals," Block said.

The 30% more issuance the muni market saw in Aug. of 2019 compared to the same month the previous year, was driven mostly by upsized refundings given the significant MMD bumps of -6.7 basis points in 2-years through 5 years, versus an astounding average of -36.3 BPs in 10- through 30-years, Block noted.

"Reinvestment available from maturities and calls declines dramatically in September through December (compared to the previous several months) but appears roughly balanced with expected new issue supply at about $30 billion per month through year-end," he said. "Fund inflows driven by taxes and safe-haven demand should also remain strong, which combined with reinvestment, should be sufficient to absorb supply."

He added that the 30-day visible net supply is negative $6.27 billion comprised of plus $13.13 billion. New issue against negative $19.41 billion of maturing (negative $11.11 billion.) and called bonds negative -$8.3 billion.).

"The states that stand to experience the largest change in outstanding debt include New Jersey (negative $1.1 billion.), Pennsylvania (negative $1.02 billion), Texas (negative $1.01 billion), Washington (positive 965 million.) and Kansas (negative $860 million.)

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.