-

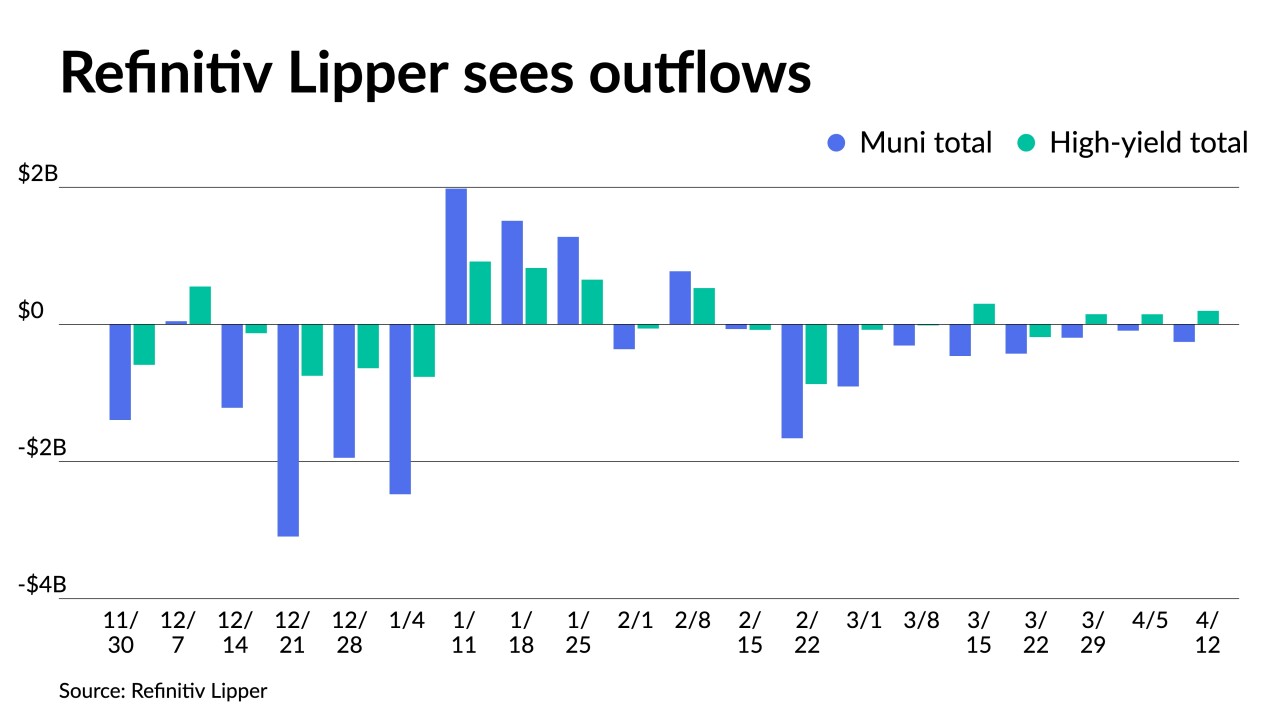

For the week ending Wednesday, outflows intensified as Refinitiv Lipper reported $255.794 million was pulled from municipal bond mutual funds after $91.713 million of outflows the week prior. High-yield saw inflows.

April 13 -

Massive mutual fund selloffs this year have returned the market to a pre-1976 investor landscape, when portfolios focused on individual demand, said MMA's Tom Doe.

October 21 -

The 15% corporate minimum tax may hurt the muni market the most during outflow cycles by cramping demand and leading to higher borrowing costs for states and cities.

August 17 -

Issuers come to market more often and with larger deals when muni bond funds are enjoying inflows, a new paper contends. But not all market participants agree.

July 19 -

Municipal bonds ended the week unchanged for the sixth consecutive trading session as inflows surged as more than $7 billion is headed to market next week.

August 20 -

A project that dealt municipal bond investors one of the biggest high-yield defaults of the past decade is about to ask them for more cash

August 5 -

Trading showed firmer prints, with Georgia general obligation bonds, Maryland GOs and Los Angeles Department of Water and Power bonds trading up.

June 10 -

As most participants await Friday's jobs report, the municipal market Thursday sustained a firm tone as rates remained on a gradual path of decline.

June 3 -

Federal Reserve Bank of Chicago President Charles Evans says monetary policy will need to remain “accommodative for quite a while,” since inflation won’t hit a 2% average for “a long time.”

January 4 -

The new-issue calendar builds from almost nothing to $2.4 billion in the first week of the New Year, with deals ranging from education to taxables to social bonds on tap for investors.

December 31 -

After one of the worst sell-offs in municipal market history as COVID-19 began its rampage in March, the market rebounded to set the all-time record.

December 31 -

Dominick D'Eramo, head of fixed income at Wilmington Trust Investment Advisors, talks with Chip Barnett about how the municipal bond market did in 2020 and what may be on tap for munis in the new year. (12 minutes)

December 31 -

Municipal bond funds saw $2.086 billion of inflows in the week ended Dec. 22, the Investment Company Institute reported Wednesday after a $2.517 billion inflow the week prior.

December 30 -

The muni market headed into holiday hibernation on the last full trading day of the week.

December 23 -

Munis were flat Monday as the entire curve was said to be undergoing a consolidation.

December 21 -

The Investment Company Institute reported municipal bond funds saw $2.675 billion of inflows in the latest reporting week.

November 25 -

Large blocks of New Jersey paper changed hands with yields that pushed spreads below 100 basis points on some maturities for the recently downgraded state.

November 19 -

A supply/demand imbalance allowed New Jersey and Massachusetts to reprice to lower yields while the beleaguered New York MTA will head back to the Fed for liquidity.

November 18 -

Municipal bonds strengthened Thursday as yields fell by as much as four basis points on AAA curves but coronavirus vaccine rally in stocks slowed and UST, munis regained ground.

November 12 -

To little surprise, the Federal Reserve left interest rates unchanged. Refinitiv Lipper reported tax-exempt muni bond funds lost about $954 million.

November 5