Top-rated municipal bonds firmed on Wednesday, with yields falling by as much as three basis points on the long end while New Jersey general obligation bonds traded up and Massachusetts upsized its tax-exempt and taxable deal, lowering yields in a repricing.

Since Nov. 12, when the market began to firm after a brief sell-off, yields on the 10- and 30-year maturities have fallen by about 13 basis points.

The strength in munis is part due to a lack of new-issuance since October, a lot of cash on the sidelines and some sense of hope that a vaccine will slow COVID-19.

However, the increasingly dire news of the virus' spread — New York City public schools, the largest system in the country, has closed indefinitely after the infection rate topped 3% in the city — hangs over the markets. In the Spring before the city became the epicenter in the U.S., many commentators noted that closing schools in New York was a signal that spread would shutter many businesses and disrupt public transit as well.

This comes as the New York Metropolitan Transportation Authority said it would need to cut service by 40% to its subways, buses and commuter rail in 2021 — axing more than 9,000 workers — if Washington doesn't send aid.

The MTA Board also on Wednesday approved up to $2.9 billion bond anticipation note sale

The sale would be followed up by a $2.9 billion municipal bond sale to repay the BANs. In August, the MTA, one of the largest municipal issuers with $46.5 billion of debt including special credits, sold $450 million of bond anticipation notes to the MLF. Only the MTA and Illinois, the lowest-rated state, have used the facility.

In the muni market, though, deals were getting done and dealers appear to be quite light on inventories as they shed a lot of munis prior to the election.

“With two weeks of little to no issuance since before the election, this is dealers’ first real opportunity to source bonds in the primary and they are gobbling them up,” said Greg Saulnier, managing analyst at Refinitiv MMD. “Massachusetts was upsized to $1 billion and they bumped it quite well so they must have had plenty of demand.”

To point to just how much cash is sitting out on the sidelines, several traders said the New Jersey GOs were in some cases up 10 to 20 basis points through original levels.

“There is a lot of cash and demand around, just nowhere near enough bonds,” a New York trader said.

On Wednesday, high-grade Massachusetts came to market with $1.4 billion of tax-exempt and taxable general obligation bonds one day after New Jersey handed investors billions of high-yield paper.

"Jersey dipped its toe Monday and Tuesday the deal was priced to go with the ratings downgrade overhanging, but it's clear that investors were ready to dive in and did," the trader said. "Massachusetts came in just in time to get investor attention."

Dan Urbanowicz, director and fixed income portfolio manager at Washington Crossing Advisors said “following-through on the $38 billion in orders for New Jersey's GO deal yesterday, most of the new issues today, including Massachusetts GO, are oversubscribed and repricing 5 to 10 basis points lower in yield.”

Elsewhere, market technicals are being impacted by the COVID-19 climate.

“We're seeing a renewed supply/demand imbalance in the market,” he said.

The significant oversubscription was a sign of the times, according to John Mousseau, president of Cumberland Advisors.

“Pandemically affected yield sells,” he said after the pricing.

BofA Securities priced New Jersey’s (A3/BBB+/A-/A) $3.7 billion of COVID-19 tax-exempt emergency GOs on Tuesday to widespread investor demand.

“Drivers in New Jersey are accustomed to traffic jams and the new deal did not disappoint in that respect,” said Kim Olsan, senior vice president at FHN Financial. “With a reported order book a multiple of the issue size, final yields were pared as much as 20 basis points. The use of three different coupon structures ranging between 3% and 5% addresses the needs of a broad audience, while maturity values in 2030 through 2032 totaling almost $1.3 billion offer solid liquidity post-syndicate.”

One of the merits of the state’s new offering was its wide buyer base, she said.

“While some traditional muni buyers might scoff at a rating closer to the bottom of investment grade, the success of the N.J. deal is owed in part to what was likely a domestic and international buyer base with cross-market yields an obvious draw,” Olsan said. “Considering the unusual economic circumstances this year, the state was able to finance its new 2032 maturity at a lower yield than a comparable maturity from its January offering.”

Lisa Washburn, managing director of Municipal Market Analytics, said she expected the deal would be well-received and said that certainly was the case.

"The favorable pricing allowed the state to downsize the principal component of the deal and still receive about $4.3 billion in proceeds with a bigger portion coming from the premium,” Washburn said. “There aren’t many good things to say about a 12-year deficit borrowing of this size to fund the current budget, but being able to get it all done in the tax-exempt market versus the higher-cost taxable market or MLF is a relative positive."

Primary market

Morgan Stanley priced and repriced

The Series E tax-exempt GOs were repriced as 5s to yield 0.15% in 2022 and to yield from 0.31% in 2025 to 1.12% in 2033, 1.63% in 2045 and 1.68% in 2050. The Series E tax-exempt GOs had been tentatively priced as 5s to yield 0.22% in 2022 and to yield from 0.34% in 2025 to 1.23% in 2033, 1.71% in 2045 and 1.76% in 2050.

The Series 2020D tax-exempt GOs were repriced to yield from 1.36% with a 4% coupon in 2034 to 2.01% with a 3% coupon in 2042. The Series 2020D tax-exempt GOs had been tentatively priced to yield from 1.44% with a 4% coupon in 2034 to 2.04% with a 3% coupon in 2042.

The Series 2020E taxables saw price guidance ranging from 15 basis points above the comparable Treasury in 2022 to 115 basis points above Treasuries in 2034.

“Today’s Massachusetts’ GOs should find no problem with distribution and could even present the state with tighter final yields,” Olsan said.

UBS Financial Services priced Baltimore, Md.’s (Aa2/AA-/NR/NR) $108.48 million of tax-exempt Series 2020A water projects revenue bonds. The deal was priced to yield from 0.26% with a 5% coupon in 2022 to 1.79% with a 4% coupon in 2040; a 2045 maturity was priced as 4s to yield 1.97% and a 2050 maturity was priced as 5s to yield 1.82%.

Siebert Williams Shank priced California’s (Aa1:VMIG1/AAA:A1+/AA:F1+/NR) $100 million of Series 2020A variable-rate general obligation bonds. The bonds were priced at par to yield 0.11% in 2048 with a weekly reset mode.

In the competitive arena, the Metropolitan Council, Minn., sold $178.52 million of GOs in three offerings. Morgan Stanley won the $125.16 million of Series 2020C GO grant anticipation notes with a true interest cost of 0.2989%. Piper Sandler won the $36.14 million of Series 2020E GO wastewater refunding bonds with a TIC of 0.5418%. Wells Fargo Securities won the $17.22 million of Series 2020D transit refunding bonds with a TIC of 0.578%. Baker Tilly Municipal Advisors was the financial advisor; Kennedy & Graven was the bond counsel.

Proceeds of the Series 2020C notes will be used to temporarily finance part of the construction of the Southwest Light Rail Transit Project in anticipation of receiving federal grants; proceeds of the Series 2020E bonds will be used to refund part of the Series 2010F taxable GO Build America Bonds; proceeds of the Series 2020D bonds will be used to refund part of the Series 2009A and Series 2010E taxable GO BABs.

The Lincoln Public School District No. 1, Neb., sold $122 million of Series 2020 taxable interest GO refunding bonds. Baird won the deal with a TIC of 1.7536%. Piper Sandler was the financial advisor; Gilmore & Bell was the bond counsel.

RBC Capital Markets received the official award on Mesa, Ariz.’s (Aa2/AA-/NR/NR) $108.745 million of Series 2020 utility systems revenue and revenue refunding bonds.

On Thursday, BofA is set to price the Port of Oakland, Calif.’s $531 million deal consisting of $344.29 million of Series 2020R (A1/A+/A+/NR) taxable senior lien refunding revenue bonds and $186.79 million of Series 2021H forward delivery intermediate lien refunding revenue bonds subject to the alternative minimum tax.

BofA is also expected to price Hawaii’s $242 million of harbor system revenue bonds, consisting of Series 2020A AMT bonds, Series 2020B taxables and Series 2020C non-AMT bonds.

ICI: Muni bond funds see $2.1B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.089 billion in the 7 weeks.

Long-term muni funds alone had an inflow of $1.318 billion in the latest reporting week after an outflow of $254 million in the prior week.

ETF muni funds alone saw an inflow of $771 million after an inflow of $11 million in the prior week.

Taxable bond funds saw combined inflows of $16.352 billion in the latest reporting week after an outflow of $3.102 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $41.451 billion after an outflow of $20.035 billion in the previous week.

Secondary market

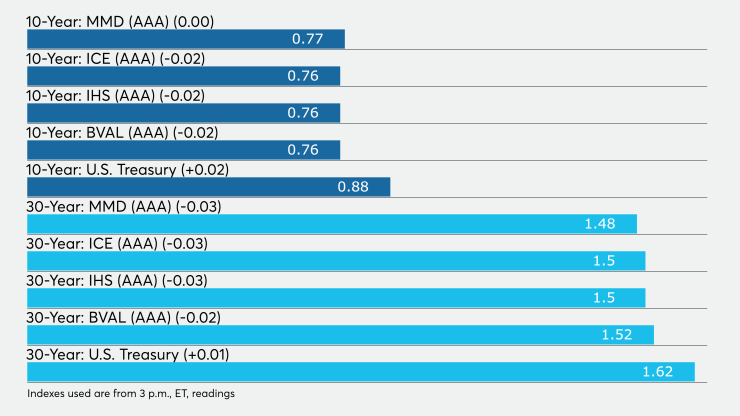

High-grade municipals were mixed Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were unchanged at 0.15% in 2021 and 0.16% in 2022. The yield on the 10-year muni was steady at 0.77% while the yield on the 30-year dropped three basis points to 1.48%.

The 10-year muni-to-Treasury ratio was calculated at 87.2% while the 30-year muni-to-Treasury ratio stood at 91.2%, according to MMD.

The ICE AAA municipal yield curve showed short maturities remaining steady at 0.15% in 2021 and 0.16% in 2022. The 10-year maturity dropped two basis points to 0.76% and the 30-year yield fell three basis points to 1.50%. The 10-year muni-to-Treasury ratio was calculated at 87% while the 30-year muni-to-Treasury ratio stood at 92%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields steady at 0.15% and 0.16% in 2021 and 2022, respectively, and the 10-year falling to 0.76% as the 30-year yield dropped to 1.50%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.15% and 0.16% in 2021 and 2022, while the 10-year dropped two basis points to 0.76% and the 30-year fell two basis points to 1.52%.

Treasuries were weaker as stock prices traded mixed. The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.88% and the 30-year Treasury was yielding 1.62%. The Dow fell 0.19%, the S&P 500 decreased 0.17% and the Nasdaq gained 0.10%.

Andrew Coen and Lynne Funk contributed to this report.