New York’s Metropolitan Transportation Authority — its revenues battered, its credit standing weakened and with no federal rescue aid in sight — is proceeding with plans to borrow its remaining $2.9 billion available through the Federal Reserve’s short-term liquidity program.

“We submitted our notice of intent to borrow from the [Municipal Liquidity Facility] to the Federal Reserve, and have been invited to submit our application,” Chief Financial Officer Robert Foran said at Wednesday’s board meeting.

The MTA would pledge payroll mobility tax revenues, according to Foran.

“The proposed payroll mobility tax resolution and credit have been presented to the rating agencies and discussions continue,” he said.

In August, the MTA, one of the largest municipal issuers with $46.5 billion of debt including special credits, sold $450 million of bond anticipation notes to the MLF. Only the MTA and Illinois, the lowest-rated state, have used the facility.

Its expiration date is Dec. 31 with little sentiment in Congress for extending it.

“The window ends 12/31 and right now there’s no opportunity after that, so we want to be prepared to borrow the full amount,” Foran told reporters.

The advocacy group Reinvent Albany said the MTA should work with the Fed and U.S. Sen. Charles Schumer, D-NY, to improve the program.

“The MLF program is not a substitute for direct emergency aid, but could support the MTA with a low-interest bridge loan as it weathers the COVID-19 crisis,” Reinvent Albany senior research analyst Rachael Fauss told board members.

Favorable conditions, according to Fauss, include program extension through 2022; lower interest rates; expanding bond terms to five years from three and raising the borrowing cap.

Debt service could account for 27% of the MTA’s revenues next year.

MTA’s primary transportation revenue bond credit has taken multiple hits from Wall Street.

JPMorgan intends to price $258 million of MTA Series 2020E transportation revenue refunding green bonds on Thursday.

According to data on the Municipal Securities Rulemaking Board's EMMA website, a block of Series 2014C transportation revenue bonds maturing in 2035 that originally priced at 110.395 cents on the dollar and a 5% coupon, sold to a customer Wednesday at a price of 102.118 cents and a 4.489% yield.

According to Howard Cure, director of municipal bond research for Evercore Wealth Management, spreads on MTA bonds have widened out “quite a bit,” but have come back in, given the importance of the authority to the city’s and state’s economies, and the state’s economic strength overall.

“If the MTA was in a region where it’s a weaker state, say the state of Illinois, which is having its own extreme budget problems, investors might not be as sanguine about the MTA,” Cure said on a Volcker Alliance webcast. “The market has had somewhat of a muted response, although it certainly had an effect on the MTA and its costs of borrowing right now.”

Fears of more downgrades, negative headlines and further turbulence from Washington or Albany "all make a rebound to pre-COVID trading levels highly unlikely over the next year," Municipal Market Analytics said, "which suggests that any post-election rally may be met with as much gains taking as buying, keeping spreads wider than otherwise warranted."

Foran said MTA officials would present two operating budget scenarios to the board next month — one assuming federal aid, the other without it. The authority is seeking up to $12 billion in the next rescue package.

“We’ll have a better idea after next week what the possibilities are,” Foran said, referencing the national elections. “We’ll know even more in December and are prepared to revise again in January.”

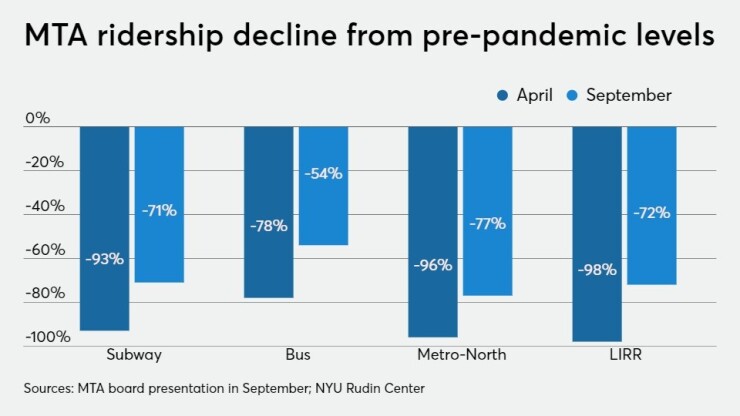

Without that $12 billion, the MTA has said it will have to reduce subway and bus service next year by up to 40% and commuter rail service by up to 50%. Sharp cuts in planned capital spending may also be in store.

Economic consequences would be severe, said a

A capital spending reduction by $4.8 billion below the level previously planned would directly and indirectly result in a loss of 23,264 jobs, with nearly $2 billion in earnings, in the region in 2021. Further cuts would directly and indirectly result in even greater job losses.

"Substantial federal financial assistance now appears to be the only feasible alternative," wrote Rudin Center director Mitchell Moss and Hugh O'Neill, president of city-based economic consulting firm Appleseed.

Roughly half the MTA’s operating revenue comes from the farebox, putting it second behind San Francisco in that category. While the farebox has been a constant, other revenue streams have been cyclical, notably borne of crises. A recent example is the payroll mobility tax, which the state legislature enacted in 2009 at the height of the last recession.

“We’re stuck in the last century or even the previous century about how we finance these things,” board member Norman Brown said.

“Each financial crisis has its own DNA,” Brown said. “And when you start comparing this to the period in the early 70s and the municipal bankruptcy, I think there are a few obvious differences.

This time, “it’s not New York City against the U.S. or New York City against the world, which we generally sort of wear as a badge of honor in New York City.”