The municipal market firmed Wednesday as it got ready for the Thanksgiving holiday and looked ahead to next week’s supply slate.

IHS Ipreo estimates volume for the week of Nov. 30 will be $7.68 billion, up from the under $1 billion seen this week. The calendar is composed of $6.99 billion of negotiated deals and $688 million of competitive sales.

In secondary trading, municipals were steady. Yields on top-quality munis were unchanged on the AAA scales, with Treasury bond yields mixed. Equities were mixed in late trading.

Heading into the holiday, the tone reflected a muted bias as cash-flush investors did some pre-holiday shopping.

“After a noted absence, retail has been putting money to work through November given reinvestment needs,” said Jeff Lipton, head of municipal credit and market strategy at Oppenheimer & Co.

But not all retail investors are spending their available cash. “Having said this, the market has become richer and there still remains retail resistance,” he said.

Overall, Lipton continues to believe technicals will usher in some additional performance through year-end.

Financial markets are closed on Thursday and open for a half-day of trading on Friday, but only the most die-hard of traders will be working with most people taking the day off.

Thanksgiving came early for those municipal investors who were looking for yield as bond buyers gobbled up Tuesday's JFK Airport deal, leaving barely any scraps remaining in an otherwise quiet market ahead of the upcoming holiday.

JPMorgan Securities priced the New York Transportation Development Corp.’s (Baa1/NR/BBB/NR) $331.57 million of special facility revenue refunding bonds for the John F. Kennedy International Airport Terminal 4 Project in a deal that sources said was massively oversubscribed.

“It’s been a busy couple of travel days before Thanksgiving — the busiest it’s been since COVID broke — and there are good headlines around airports, so that got people excited,” a New York trader said.

“There’s no supply and a lot of money coming in — so the supply/demand imbalance is leaning toward the demand component right now — especially in the high-yield sector,” he added. “It’s interesting, because people wouldn’t touch airport paper six months ago.”

He said the combination of supply scarcity and seasonal factors helped prop up the airport industry in conjunction with the JFK pricing causing the deal to get devoured by hungry investors. “I heard it was very well received — and that was an understatement. There are no bonds around,” he said.

Investors are scrambling for spread wherever they can get it — and for the JFK deal that meant the 2042 maturity got a lot of attention having a 4% coupon that yielded 143 basis points over the MMD AAA scale. The trader said investors looking for yields also flocked to the 10-year JFK paper — both the 4s and 5s were 150 basis points over the MMD scale.

Overall, the trader said municipal fundamentals are strong.

“As the economy gets back on its feet, you’re going to see the credits that got beat up the most — airports, convention centers and tourist and tax-driven sectors — those are really coming back in line,” he said. “It will take some time, but we still have some positive news out there — and airports will be the first to come back as people begin to travel.”

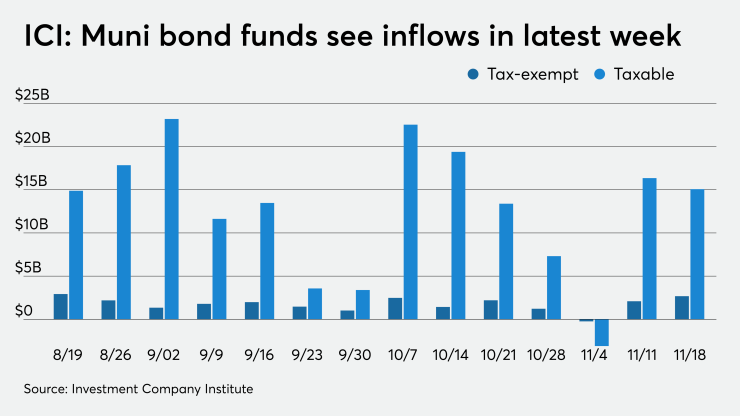

ICI: Muni bond funds see $2.7B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.675 billion in the week ended Nov. 18, the Investment Company Institute reported Wednesday. In the week ended Nov. 11, muni funds saw an inflow of $2.089 billion, ICI said.

Long-term muni funds alone had an inflow of $2.145 billion in the latest reporting week after an inflow of $1.318 billion in the prior week.

ETF muni funds alone saw an inflow of $511 million after an inflow of $771 million in the prior week.

Taxable bond funds saw combined inflows of $15.072 billion in the latest reporting week after an inflow of $16.352 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $11.488 billion after an inflow of $41.451 billion in the previous week.

Primary market

Topping next week’s calendar is the

Siebert Williams Shank is set to price the Illinois State Toll Highway Authority’s (A1/AA-/AA-/) $500 million of Series 2020A toll highway senior revenue bonds on Tuesday. Siebert is also set to price the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+/NR) $494 million of tax-exempt fixed rate bonds on Wednesday after a one-day retail order period.

The New York State Housing Finance Agency (Aa2/NR/NR/NR) is coming to market on Thursday with two deals totaling $483.44 million. JPMorgan Securities is set to price the $287.55 million of Series 2020L-2 climate bond certified affordable housing revenue sustainability and Series 2020M-2 sustainability bonds. Wells Fargo Securities is expected to price the $195.89 million of Series 2020L-1 climate bond certified/sustainability bonds and Series 2020M-1 affordable housing revenue bonds.

BofA Securities is expected to price the Regional Transportation District, Colo.’s (Baa2//A-/) $343 million of Series 2020A tax-exempt private activity bonds not subject to the alternative minimum tax and Series 2020B taxable private activity bonds for the Denver Transit Partners Eagle P3 Project on Tuesday.

In the competitive arena, the Metropolitan St. Louis Sewer District., Mo., is selling $120 million of Series 2020B wastewater system revenue bonds on Thursday. PFM Financial Advisors and Independent Public Advisors are the financial advisors. Gilmore & Bell and White Coleman are the bond counsel.

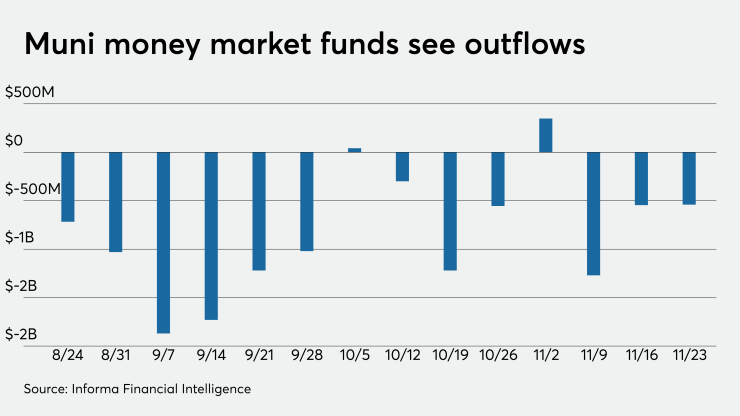

Informa: Money market muni funds fell $541M

Tax-exempt municipal money market fund assets fell $540.6 million, bringing total net assets to $109.74 billion in the week ended Nov. 23, according to the Money Fund Report, a publication of Informa Financial Intelligence. In the prior week, assets fell $545.5 million to $110.28 billion.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds remained at 0.01% from the previous week.

Taxable money-fund assets decreased $1.65 billion in the week ended Nov. 24, bringing total net assets to $4.152 trillion. The average, seven-day simple yield for the 781 taxable reporting funds remained at 0.02% from the prior week.

Overall, the combined total net assets of the 968 reporting money funds fell $2.19 billion in the week ended Nov. 24.

Secondary market

Some notable trades Wednesday:

New York State Urban Development Corp. 5s of 3/15/2050 [650036CL8] traded in a block of over 5 million at 127.270 at a yield of 1.925% while the NYS UDC 5s of 3/15/2042 [650036AM8] traded in a block of 5 million-plus at 129.234 at a yield of 1.740%.

California 5s of 11/1/2029 [13063DZN1] traded in a block of 5 million at 136.322 at a yield of 0.777% while Cal 5s of 11/1/2029 [13063DWQ7] traded in a block of 5 million at 136.394 at a yield of 0.770% and Cal 5s of 3/1/2031 [13063DTY4] traded in a block of 3 million+ at 139.949 at a yield of 0.910%.

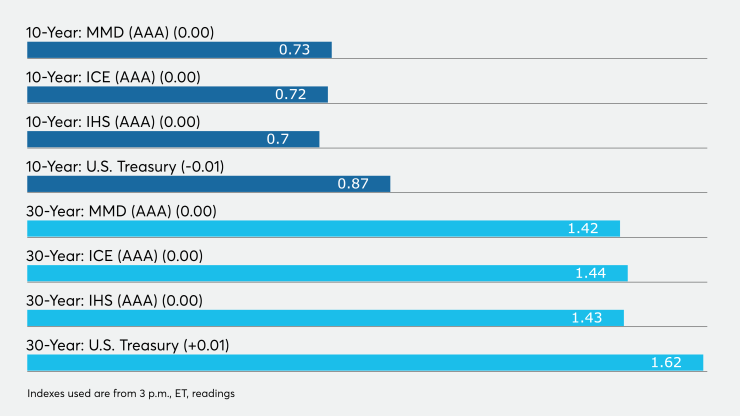

High-grade municipals were steady on Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were flat at 0.14% in 2021 and 0.15% in 2022. The yield on the 10-year muni was steady at 0.73% while the yield on the 30-year was unchanged at 1.42%.

The 10-year muni-to-Treasury ratio was calculated at 83.1% while the 30-year muni-to-Treasury ratio stood at 87.8%, according to MMD.

The ICE AAA municipal yield curve showed short maturities unchanged at 0.15% in 2021 and 0.16% in 2022. The 10-year maturity was flat at 0.72% while the 30-year yield was steady at 1.44%.

The 10-year muni-to-Treasury ratio was calculated at 84% while the 30-year muni-to-Treasury ratio stood at 88%, according to ICE.

The IHS Markit municipal analytics AAA curve showed short yields at 0.13% and 0.14% in 2021 and 2022, respectively, and the 10-year steady at 0.70% as the 30-year yield remained unchanged at 1.44%.

Treasuries were mixed as stock prices traded mixed. The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.87% and the 30-year Treasury was yielding 1.62%. The Dow fell 0.65%, the S&P 500 decreased 0.25% and the Nasdaq rose 0.45%.

Bond Buyer indexes move lower

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell three basis points to 3.51% from 3.54% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dropped six basis points to 2.13% from 2.19% from the previous week.

The 11-bond GO Index of higher-grade 11-year GOs decreased six basis points to 1.66% from 1.72%.

The Bond Buyer's Revenue Bond Index declined three basis points to 2.58% from 2.61%.