-

The transaction, which supports the Navajo community in Ganado, Arizona, represents a major landmark in furthering Native American health care infrastructure, overcoming hurdles tribal governments typically face in issuing municipal debt to open a replicable path to market other indigenous health systems can follow.

December 2 -

Ten winners across five regions and five additional categories will be celebrated Dec. 2 in New York City, where one will be crowned the overall Deal of the Year.

November 17 -

The Bond Buyer's Deal of the Year awards will mark the 23rd year it has recognized outstanding achievement in municipal finance. The event, to be held Dec. 3 in New York City, will also include the presentation of the Freda Johnson Awards for Trailblazing Women in Public Finance.

November 7 -

Issuance this year is "well on its way" to $450 billion, mostly from the tax-exempt supply of new money projects, said Matt Fabian, a partner at Municipal Market Analytics.

June 18 -

"The market has had a solid tone to it recently even with the strong rally seen this month," Roberto Roffo, managing director and portfolio manager at SWBC Investment Management, said of the Nov. 10 rally where municipal yields in 10 years fell by as much as 40 basis points.

November 22 -

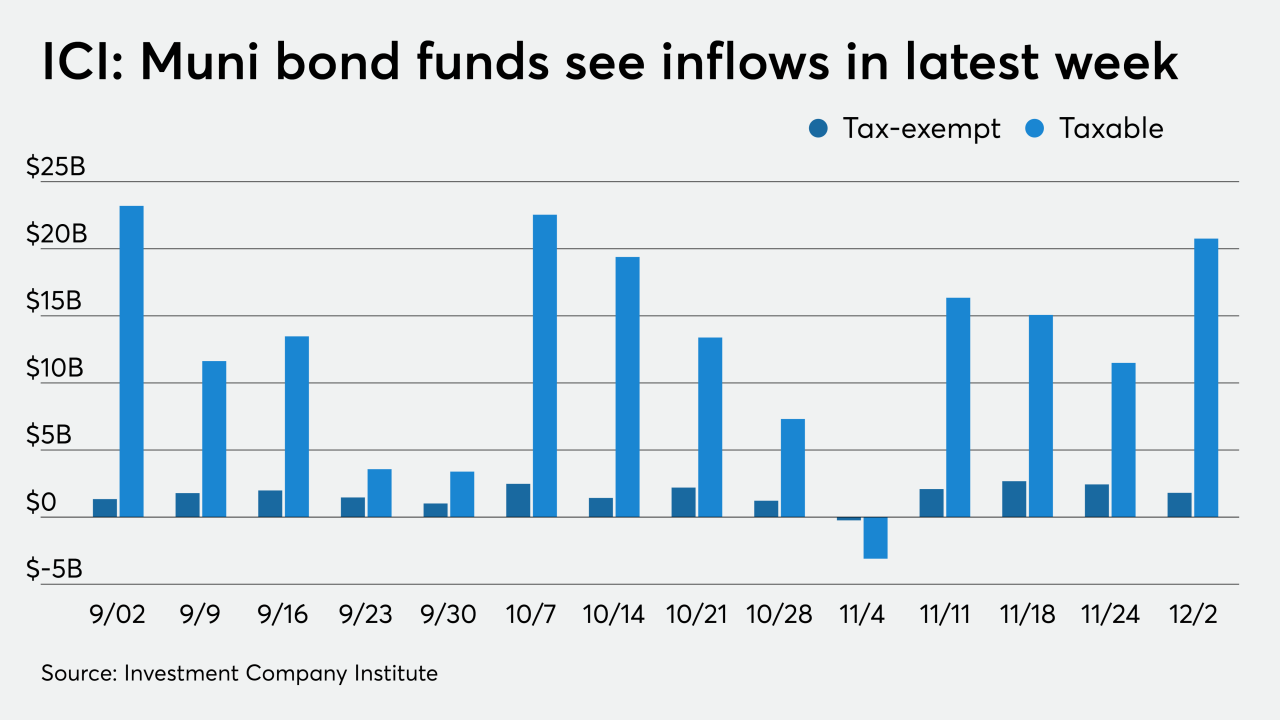

Muni benchmarks were steady while new deals re-priced to lower yields in a tale of two markets. ICI reported more inflows.

December 9 -

The Investment Company Institute reported municipal bond funds saw $2.675 billion of inflows in the latest reporting week.

November 25 -

Sources said the JFK deal was massively oversubscribed, allowing underwriters to lower yields from 15 to 45 basis points.

November 24 -

Municipals held firm ahead of this week's new issue slate, which features deals from issuers in New York and Texas. Treasuries weakened as stocks rose on positive coronavirus news.

November 23 -

Municipals continue to rally as market participants get ready to head into a quiet holiday week.

November 20 -

September got off to a good start as buyers had their pick of a variety of new issues, which priced into a stable market environment.

September 1 -

Price guidance was issued on California's $2.4 billion GO deal as the State of New York Mortgage Agency got ready for its first social bond issue as the ESG muni market expands.

August 31 -

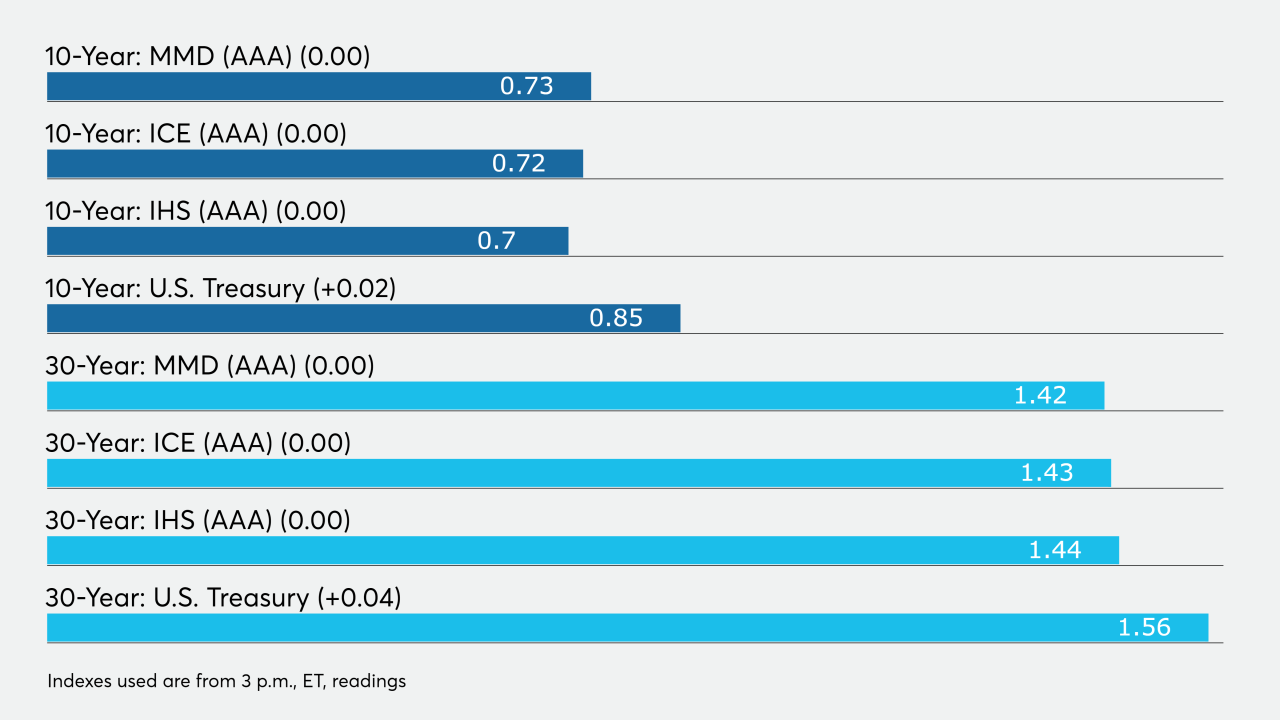

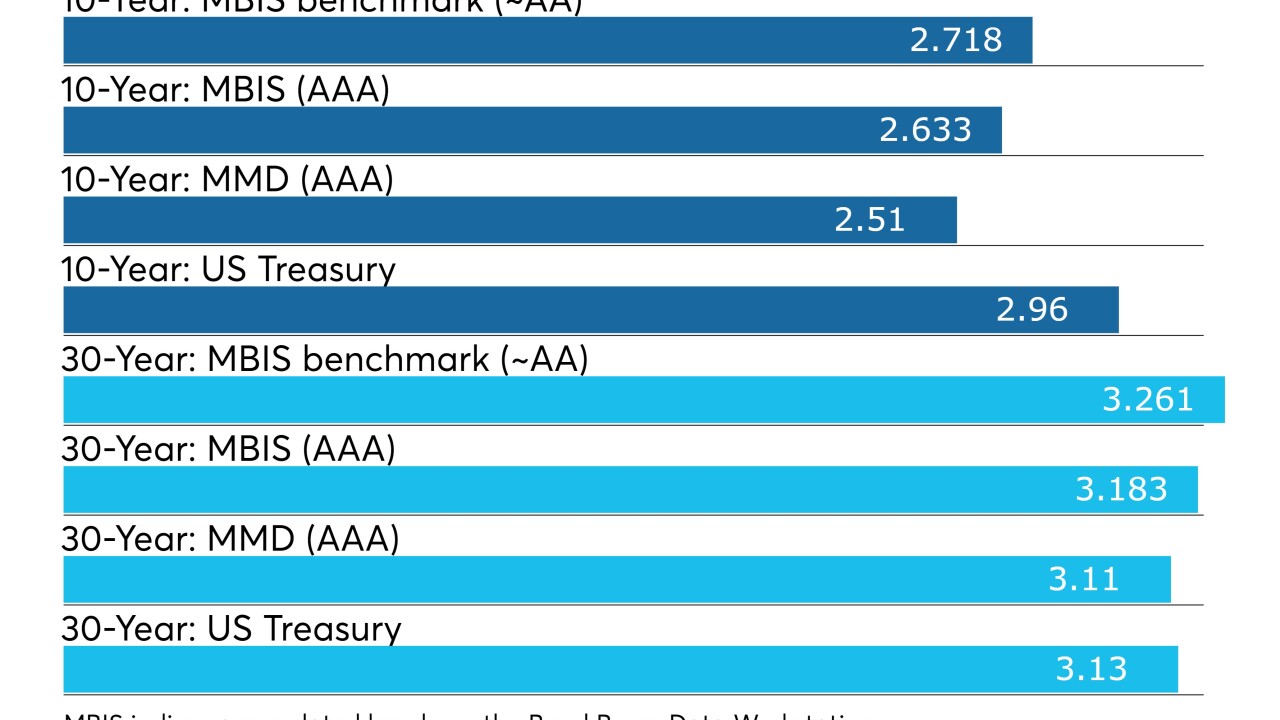

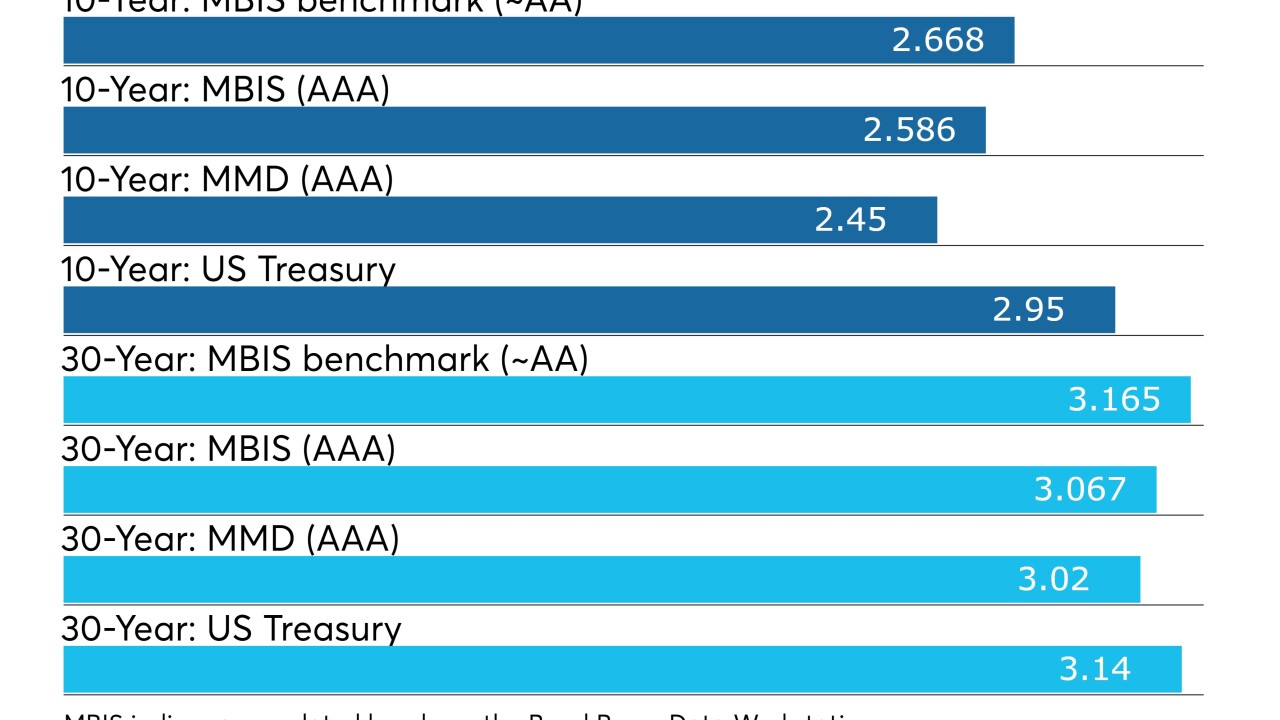

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

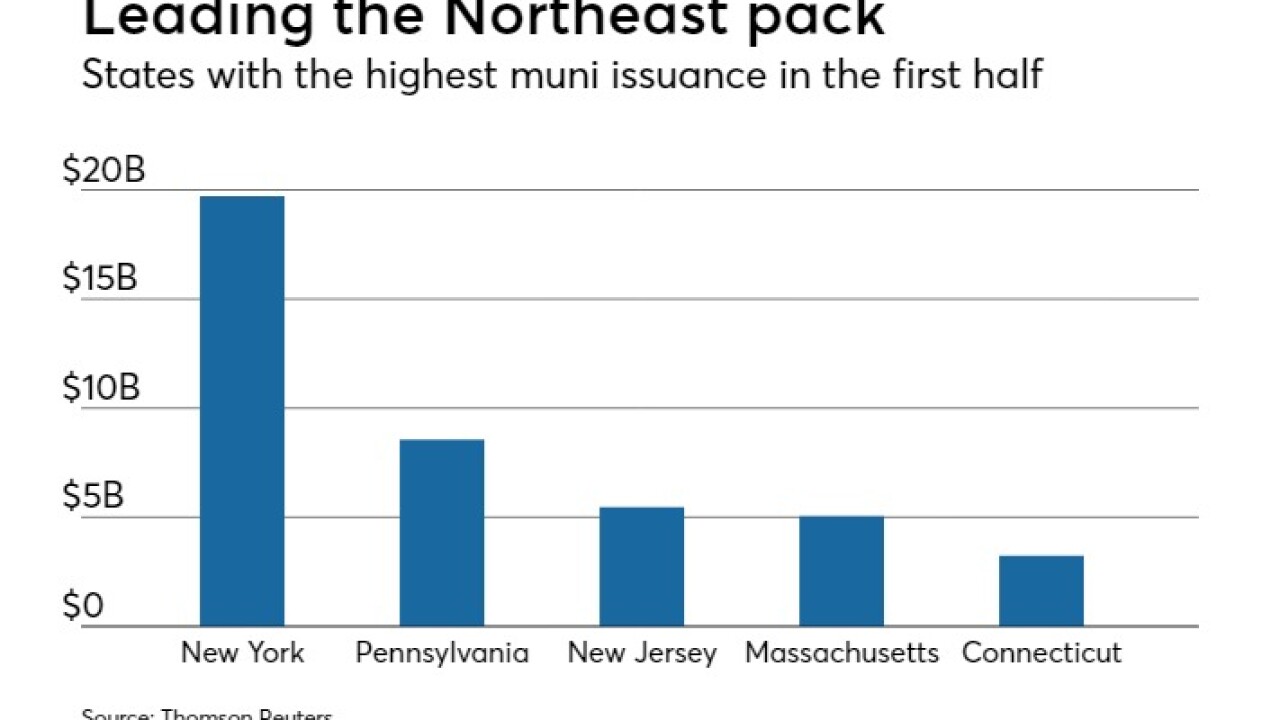

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

The quarterly update showed growth slowed from 3.4% amid declining commercial leasing activity, and sluggish private sector job growth.

May 8 -

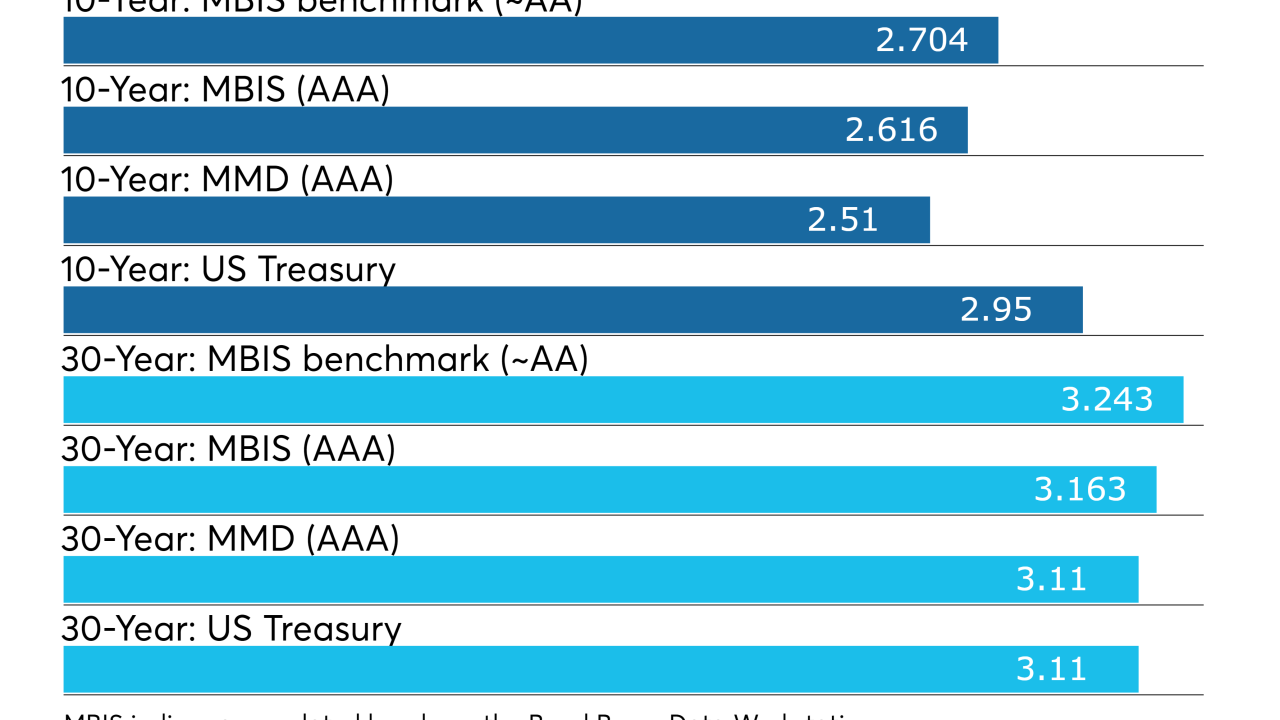

Munis were stronger Monday as bond buyers kept an eye on the Federal Reserve policy makers' meeting.

April 30 -

Municipal bond buyers are awaiting this week’s new issue supply as they keep both eyes firmly on the Federal Open Market Committee’s monetary policy meeting.

April 30 -

Weekly municipal bond volume will be down with the Federal Open Market Committee set to meet, though no interest rate increase is expected.

April 27 -

The municipal bond market will see a light new issue calendar next week as the Federal Reserve meeting on monetary policy puts a damper on new debt issuance.

April 27 -

With tax season in the rear view mirror, supply is set to rise to $7.8 billion as demand rebounds.

April 20