Municipal bonds were unchanged Wednesday as the market prepares to go into holiday hibernation ahead of the Christmas and New Year’s holidays. Yields on top-rated muni bonds were flat, remaining steady across the AAA scale. Treasury bonds were weaker as equities traded up.

In the primary, there are no negotiated or competitive deals over $50 million slated for this week or next.

“Considering the decline in new issuance it isn’t that surprising that secondary flows are showing a slowdown as well," said Kim Olsan, senior vice president at FHN Financial. “Static yields and stubbornly-low ratios mean that inquiry has time to bide into the end of the year and look ahead to early 2021 supply.”

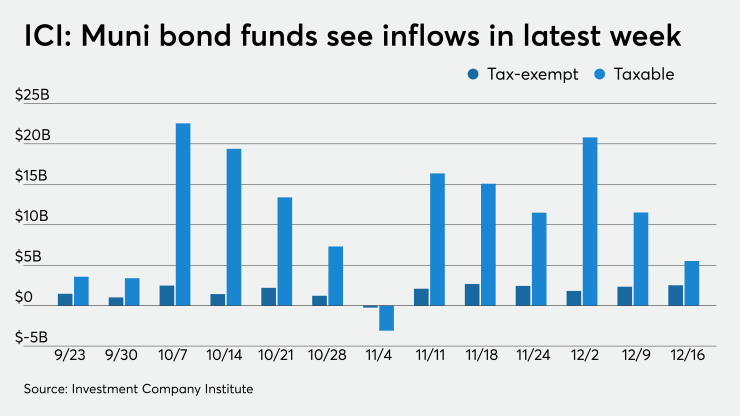

ICI: Muni bond funds see $2.5B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.517 billion in the week ended Dec. 16, the Investment Company Institute reported Wednesday.

In the previous week, muni funds saw an inflow of $2.338 billion, ICI said.

Long-term muni funds alone had an inflow of $1.789 billion in the latest reporting week after an inflow of $1.859 billion in the prior week.

ETF muni funds alone saw an inflow of $728 million after an inflow of $479 million in the prior week.

Taxable bond funds saw combined inflows of $5.519 billion in the latest reporting week after an inflow of $11.516 billion in the prior week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $15.102 billion after an inflow of $12.047 billion in the previous week.

Fitch: Ill. has budget troubles, but can fix them

Illinois has deep budget challenges, but also has the fiscal tools to address them if it has the political will to do so, according to Fitch Ratings.

Illinois' $2 billion

Gov. J.B. Pritzker has proposed $711 million in budget reductions and the state legislature may take further action in the 2021 session, such as enacting additional spending cuts and tax increases.

“Fitch considers Illinois notably more constrained in its fiscal choices than other U.S. state. Illinois' BBB-minus issuer default rating (IDR) and GO ratings and negative outlook reflect Fitch's anticipation of a fundamental weakening of the state's financial resilience given its already tenuous position entering the pandemic. Illinois will be challenged to maintain its investment-grade IDR,” Fitch said.

Before the most recent MLF loan, Illinois faced a gap of almost $4 billion in its $43 billion budget. Pandemic-driven shortfalls accounted for about half of the gap, Fitch said, while the remainder reflected the underlying structural issues, which are a key factor in the state's relatively weak credit profile.

“Despite failure of the graduated income

While the governor has ruled out taxing retirement income, other options include raising personal and corporate income taxes and a sales tax expansion to more services. Fitch said it expects the legislature will consider the spending cuts and tax hikes in early 2021.

“While the state retains broad legal capacity, Illinois also has a history of deferring or avoiding difficult fiscal choices and instead implementing short-term, non-recurring budget measures that add to long-term challenges,” Fitch said. “This repeated inability to address its structural challenges remains a key negative rating consideration.”

Secondary market

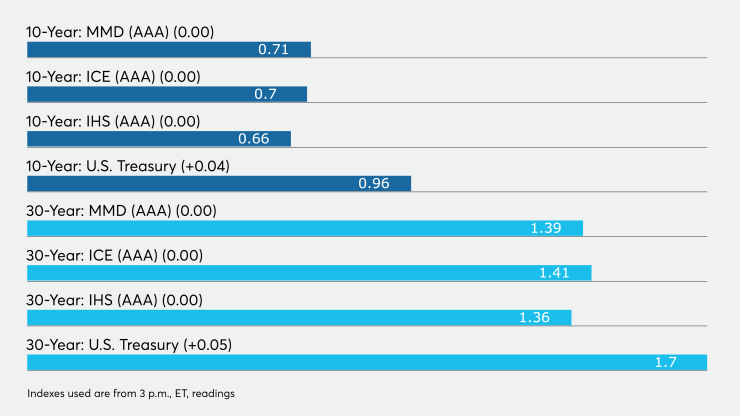

High-grade municipals were flat on Wednesday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were steady at 0.13% in 2021 and 0.14% in 2022. Out longer, the yield on the 10-year muni was flat at 0.71% while the yield on the 30-year remained at 1.39%.

The 10-year muni-to-Treasury ratio was calculated at 74.3% while the 30-year muni-to-Treasury ratio stood at 81.9%, according to MMD.

The ICE AAA municipal yield curve showed short maturities flat at 0.12% in 2021 and 0.14% in 2022. The 10-year maturity was unchanged at 0.70% and the 30-year yield was steady at 1.41%.

The 10-year muni-to-Treasury ratio was calculated at 72% while the 30-year muni-to-Treasury ratio stood at 83%, according to ICE.

The IHS Markit municipal analytics AAA curve showed yields steady at 0.13% in 2021 and 0.14% in 2022. The 10-year was at 0.66% as the 30-year yield was at 1.36%.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.96% and the 30-year Treasury was yielding 1.70%. The Dow rose 0.75%, the S&P 500 increased 0.45% and the Nasdaq gained 0.09%.