-

January issuance declined by 14.7% year-over-year amid a rising-rate and volatile environment.

January 31 -

Public-private partnerships can play a big role in U.S. transportation over the next decade, DOT Secretary Pete Buttigieg told governors.

January 31 -

The teachers' groups will request a stay of plan implementation.

January 28 -

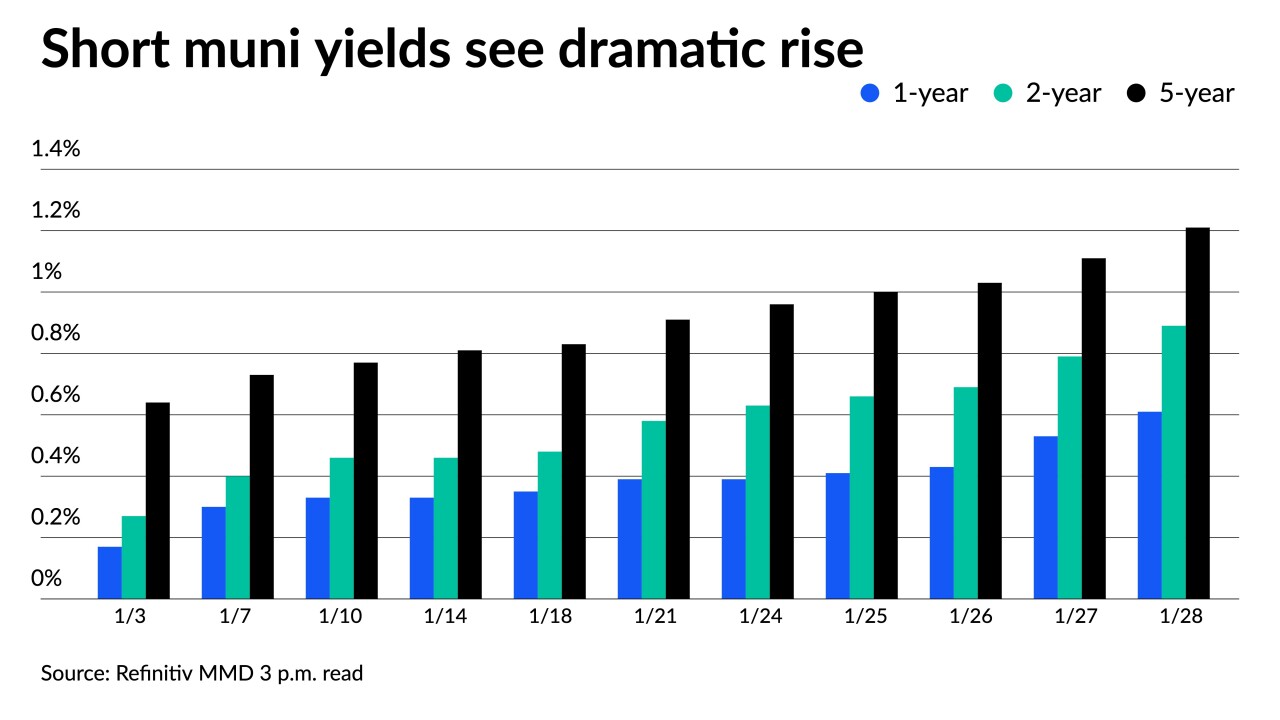

Short-end muni yields have risen more than 30 basis points on some triple-A scales over the past five trading sessions.

January 28 -

"We're going to fix them all," President Biden said of the 45,000 bridges across the U.S. he said need repairs.

January 28 -

Local legislators may be opposed to the current PREPA bond deal.

January 28 -

The platform allows advisors to tailor portfolios that have characteristics including state-specific credits, ESG considerations, duration targets and other criteria.

January 28 -

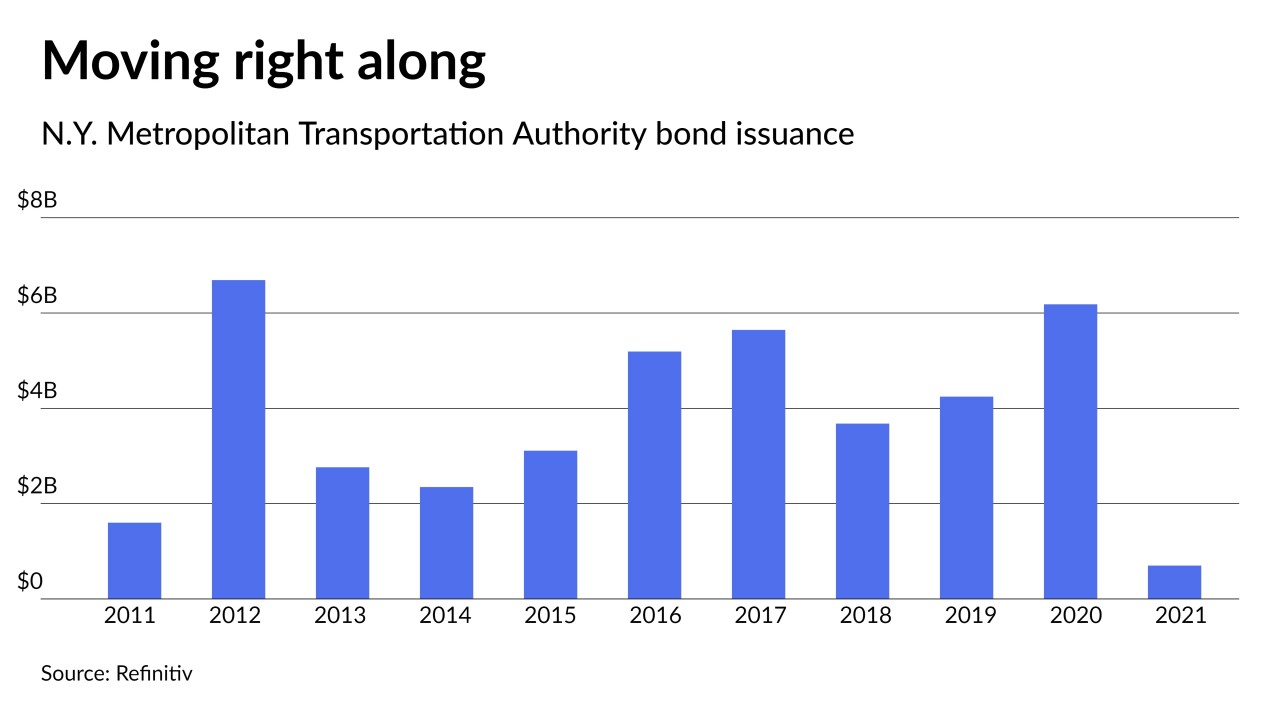

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

January 28 -

More federal Medicaid funding and higher-than-expected economic growth will lead to more revenues, the board expects.

January 27 -

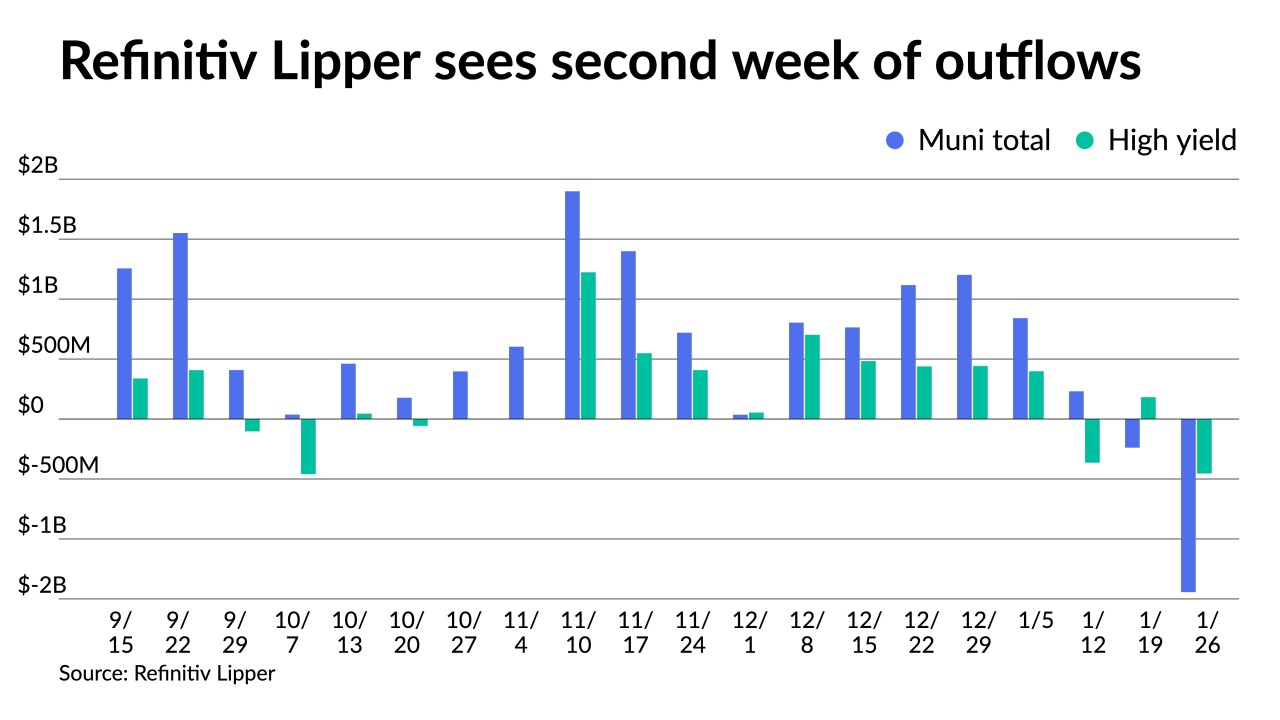

Returns are deep in the red with the Bloomberg Municipal Index at negative 1.85%, while high-yield sits at negative 1.81%.

January 27 -

States want "maximum flexibility" when it comes to implementing the $7.5 billion program in the Infrastructure Investment and Jobs Act.

January 27 -

S&P raised the Metropolitan Nashville Airport Authority, Tennessee's senior-lien airport revenue bonds issued for the Nashville International Airport to A-plus.

January 27 -

The statement offered no surprises, but Fed Chair jerome Powell's refusal to denounce more hawkish scenarios hurt market sentiment.

January 26 -

In his new role, Kurt Summers will look for opportunities to partner with local governments to advance their infrastructure priorities.

January 26 -

Cancellations due to fears of omicron are putting a damper on cruise bookings, says Fitch's Emma Griffith, who adds there is still a lot of pent-up demand.

January 26 -

Better communication will be key in future P3s, a top Maryland transportation official said.

January 26 -

Only one firm remained in the same spot they were at in 2020, while the rest of the rankings saw big shifts from a year prior.

January 26 -

The transition away from Libor presents challenges for small issuers with fewer resources to evaluate legacy contracts.

January 26 -

Triple-A benchmarks were cut two to six basis points across the curve with the largest moves concentrated again on bonds inside 10 years, underperforming Treasuries once again.

January 25 -

Virgin Islands Sen. Kurt Vialet said he expects the legislature to approve the refunding bill by Monday. The current bill does not include an interest rate cap that killed a refunding deal attempted in September 2020.

January 25