-

NABL sends detailed letter requesting guidance on interbank offered rates ruling

November 10 -

The omnibus bill drops a controversial measure to claw back unspent state COVID funds and includes long sought-after language to ease the transition away from LIBOR.

March 10 -

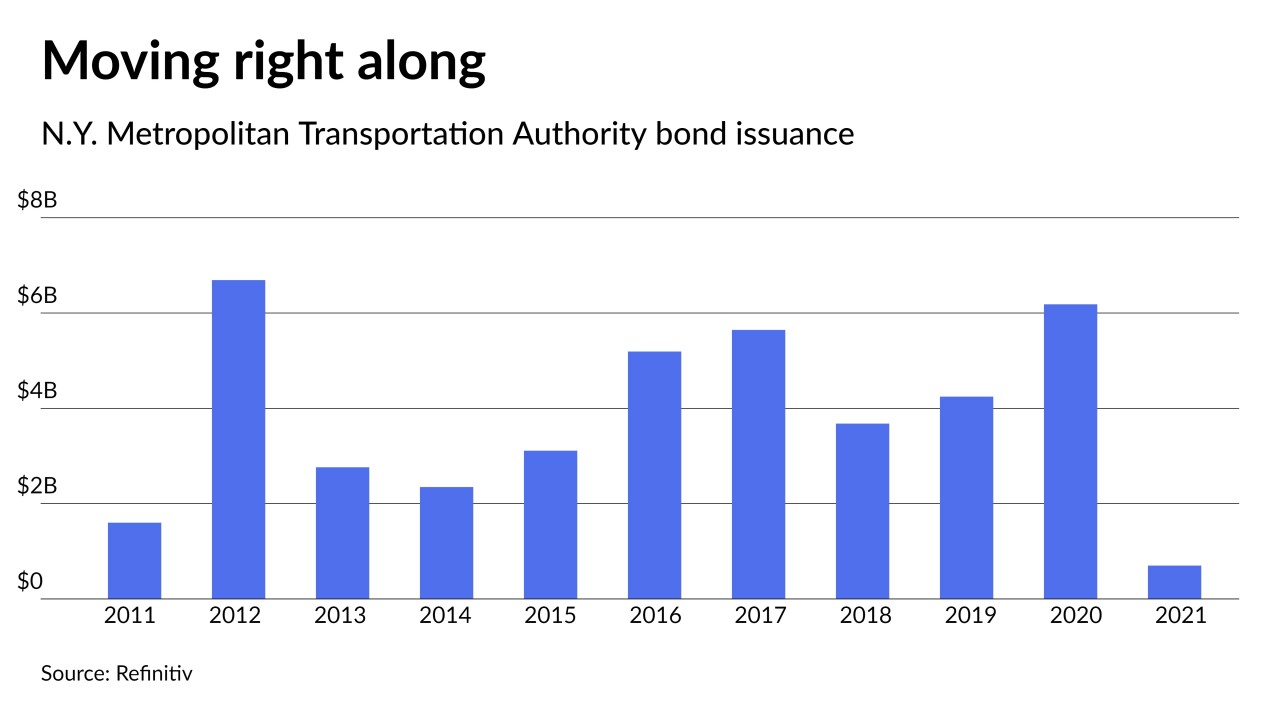

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

January 28 -

The transition away from Libor presents challenges for small issuers with fewer resources to evaluate legacy contracts.

January 26 -

The Internal Revenue Service and Department of the Treasury have released final guidance on the transition away from Libor, designating SOFR as an alternative rate.

January 3 -

Recommending Libor-linked securities triggers important disclosure and fiduciary obligations.

December 8 -

The Federal Reserve told a judge not to scrap Libor as requested by consumers in a lawsuit because it would pose a risk to financial stability and undermine years of global planning for a transition to a new benchmark for borrowing rates.

August 16 -

A new GFOA advisory said the International Swaps and Derivatives Association has developed “more robust fallback language to specify the rate to be used upon a Libor cessation.”

March 4 -

The group specifically revised six of its model disclosure documents for risk disclosure including floating rate notes, fixed-rate bonds, interest rate swaps, forward delivery bonds, tender offer bonds and variable rate demand obligations.

January 14 -

The SEC's Office of Municipal Securities is moving ahead on the Libor transition and issued a detailed advisory Friday to the municipal securities market.

January 13 -

The GFOA Debt Committee is working on issuing a similar Libor advisory in advisory in January or February.

December 11 -

The group of around a dozen issuers, bankers, broker-dealers, bond attorneys, and municipal advisors is sorting out their priorities for educating the public finance community.

November 10 -

The next milestone in the shift to the Secured Overnight Financing Rate is expected to be the announcement from the U.K.’s Financial Conduct Authority before the end of this year declaring Libor as nonrepresentative.

October 29 -

The Louisiana State Bond Commission will refinance $424 million of variable-rate bonds; the deal isn't expected to include the termination of underwater swaps.

October 15 -

New York Federal Reserve President John Williams said the transition away from Libor “continues to be of paramount importance.”

July 15 -

The Financial Stability Board issued a statement April 2 affirming that it is sticking with plans to transition away from Libor by the end of 2021.

May 29 -

GASB will release on April 16 a list of delays to various initiatives because of the coronavirus pandemic.

April 3 -

Members of GFOA’s Debt Committee agreed Monday to form a working committee that will publicize the issues involved in the transition among the organization’s more than 21,000 members.

January 28 -

GASB’s final guidance on the Replacement of Interbank Offered Rates is expected to be issued in March, giving state and municipal governments plenty of time to make adjustments before Libor is phased out by the end of 2021.

December 31 -

In formal comments filed with the federal government and separately to GASB, municipal finance groups have given the regulators generally high marks.

November 27