-

Officials are aiming by fall to finalize a bond exchange offer that would restructure general obligation bonds and resolve a legal dispute with bondholders.

August 4 -

The sudden passing of Walorski and two of her staffers has left municipal market advocates and politicians stunned.

August 4 -

The agency overseeing what has been called the country's most expensive infrastructure project hopes to secure $8 billion in federal dollars and $4.2 billion of state borrowing for the first leg of the bullet train.

August 4 -

The mediation team can operate until Sept. 9, if it chooses to do so.

August 3 -

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

A study commissioned by Orem, Utah, found that creating a school district within the city's boundaries is feasible.

August 3 -

Since 2011, the city has issued about $5.6 billion of debt, with the most issuance occurring in 2021 when it sold $785 million.

August 3 -

Miller Canfield principals voted to put Jeffrey Aronoff on its leadership board.

August 2 -

Chicago will conduct a full-court press of the buy side next week.

August 2 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

The office is aiming to beef up its analytical power with the new hire.

August 2 -

The county wants to enter into a public-private partnership to finance, build and operate a public utility and multiple microgrids that will sell power to advanced manufacturers who require hyper-reliable energy.

August 2 -

John Luke Tyner, fixed income analyst at Aptus Capital Advisors, discusses yield curve inversion with Bond Buyer Managing Editor Gary Siegel. Tyner looks at recession possibilities and how the Federal Reserve’s actions will impact the economy, the yield curve and recession. (23 minutes)

August 2 -

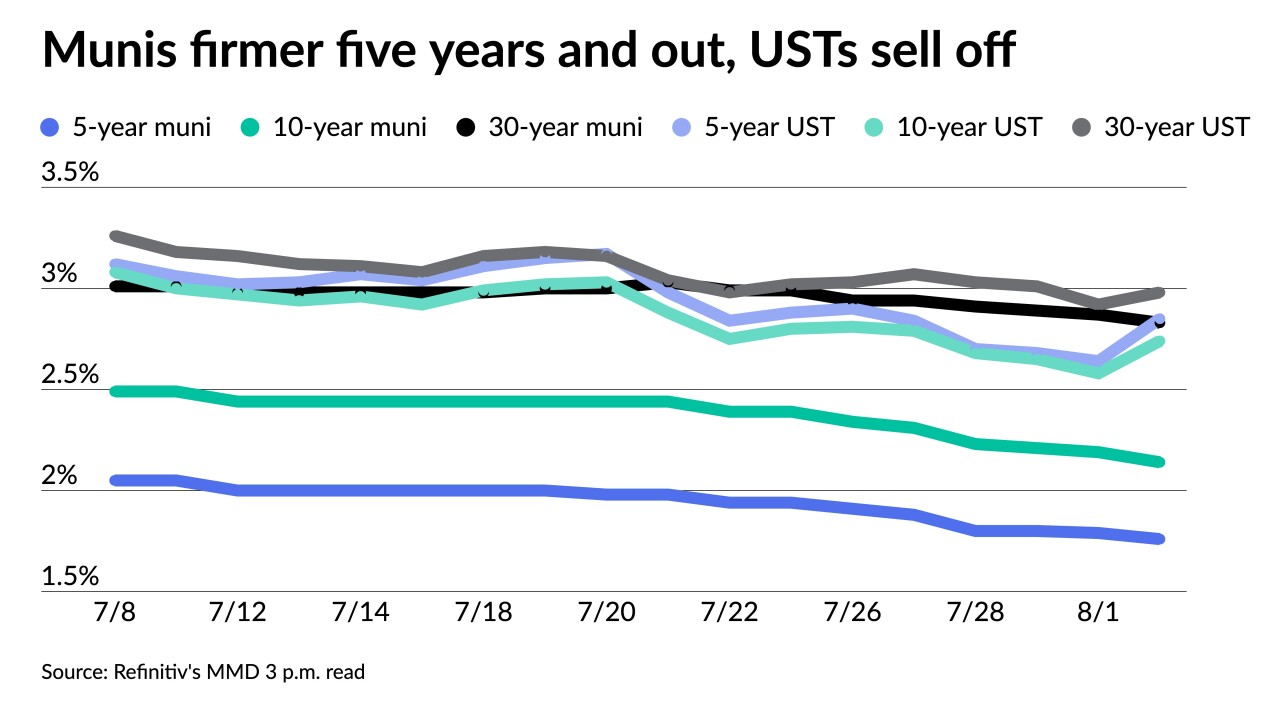

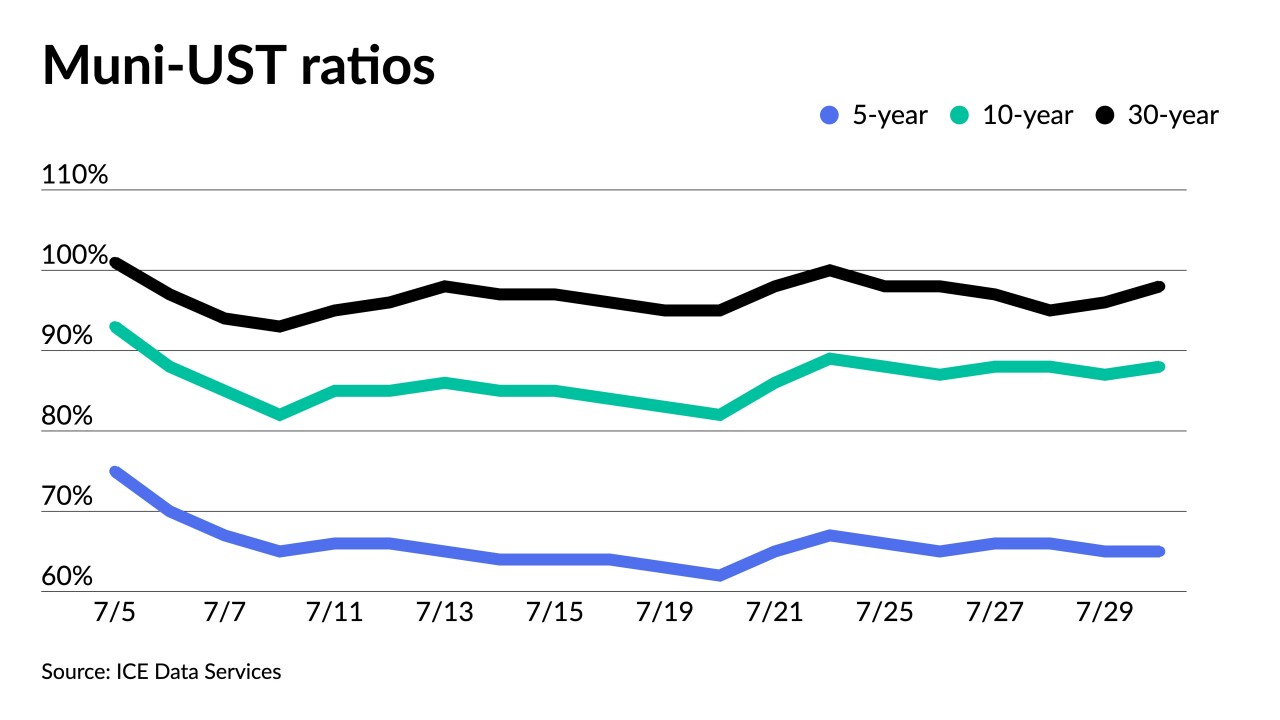

Summer redemption season starts winding down; Net negative supply stands at $18.777 while 30-day visible is at $12-plus billion.

August 1 -

The "no SALT no deal" Democrats appear ready to support the compromise reconciliation package negotiated in the Senate.

August 1 -

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

The authority says the Puerto Rico Oversight Board is illegally telling it how non-debtor government bodies must act.

July 29 -

The deal is the latest in a series of credit offerings the city is using to incentivize and grow the local charter school industry for the future.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

A group of 20 muni bond investment firms have asked U.S. cities to disclose their environmental-related needs and risks, including infrastructure projects, to CDP, a global disclosure firm.

July 29