-

Nearly a trillion dollars worth of state and local government assets are now being held in Local Government Investment Pools.

November 25 -

Some analysts believe that the muni market will ultimately be insulated from any changes in tax status because of the benefit it already provides.

February 20 -

State and local governments are on strong financial footing and are investing in Treasury securities as chaotic federal moves shake out.

January 30 -

-

Mesirow's public finance group will collaborate with the firm's institutional sales and trading team to offer clients defeasance and cash-flow management for their portfolios.

October 10 -

The 10- and 30-year Treasuries haven't reached these levels since November.

March 2 -

John Luke Tyner, fixed income analyst at Aptus Capital Advisors, discusses yield curve inversion with Bond Buyer Managing Editor Gary Siegel. Tyner looks at recession possibilities and how the Federal Reserve’s actions will impact the economy, the yield curve and recession. (23 minutes)

August 2 -

Next month’s Easter holiday in the U.S. is poised to create cash-flow headaches for the Federal Reserve and investors in Treasury debt.

March 14 -

The Treasury Department, for the first time in more than five years, will likely unveil a scaling down of its behemoth quarterly sale of longer-term securities.

November 1 -

Geithner and colleagues including five former central bank heads released a raft of recommendations to bolster the resilience of the market for Treasuries.

July 28 -

The U.S. Treasury kept its quarterly auction of long-term debt, planned for next week, at a record size to help fund the government’s continuing wave of stimulus spending.

May 5 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21 -

The U.S. Treasury expanded its plans for the issuance of longer-term debt in coming months, after depending mainly on shorter-dated bills to fund the federal government’s record spending surge to address the COVID-19 crisis.

August 5 -

The rating agency affirmed the U.S. at AAA but said the outlook cut reflects ongoing deterioration in U.S. public finances.

July 31 -

The Federal Reserve has been proactive and the secondary market could be next up for assistance.

May 6 -

As COVID-19 wreaks havoc on global markets, munis try to keep pace.

March 9 -

As fear and uncertainty over COVID-19 rapidly grow, it has sent yields for both municipals and Treasuries to never before seen low levels — begging the question if we could see zero or negative yields here in the States?

March 6 -

MarketAxess Holdings will buy LiquidityEdge for $150 million.

August 13 -

Treasury Secretary Steven Mnuchin warned that the U.S. government will face a default in “late summer” unless Congress increases the debt ceiling.

May 22 -

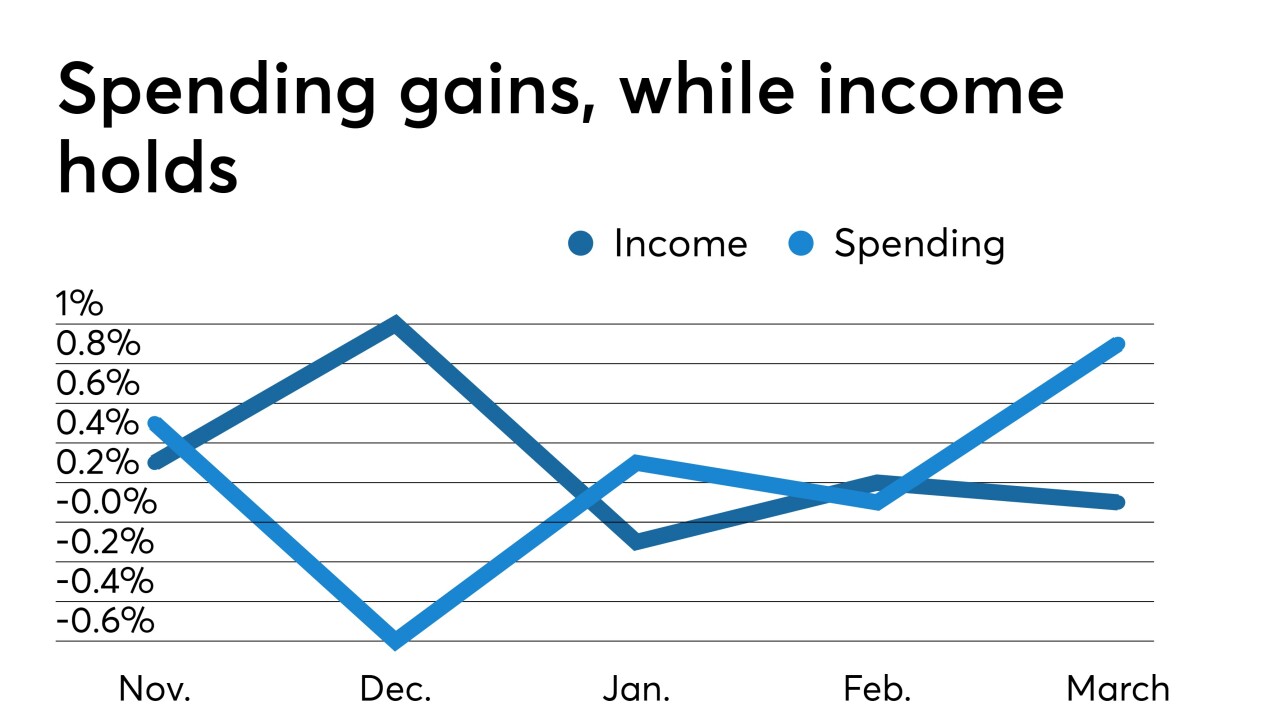

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29