-

Consumer expectations for U.S. inflation over the coming years declined sharply in the latest survey by the Federal Reserve Bank of New York.

August 8 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

July 27 -

“We have to be able to build things better and faster in this country and you don’t have to be a Democrat or a Republican to agree with that."

July 21 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

Considering pension risks within the framework of municipal credit analysis is particularly important now, following a lengthy period in which the global economy experienced low interest rates and low inflation.

July 12 Build America Mutual

Build America Mutual -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5 -

Investors pulled more from municipal bond mutual funds, with Refinitiv Lipper reporting $1.3 billion of outflows, down from the $1.6 billion the week prior and bringing the total to $47 billion year-to-date.

June 30 -

Federal Reserve Bank of St. Louis President James Bullard said fears of a U.S. recession are overblown.

June 24 -

Refinitiv Lipper reported smaller outflows at $1.6 billion, down from the $5.6 billion the week prior. It brings the total outflows to $45.7 billion year-to-date.

June 23 -

Construction material costs, which often rise faster than the consumer price index, have surged over the last year while a shortage of skilled construction workers has plagued the industry.

June 23 -

The Federal Reserve has started a hiking cycle that's expected to continue with half-point increases in June and July, Marvin Loh, senior macro strategist at State Street Global Markets, will assess the June Federal Open Market Committee meeting and tell what he expects the panel to do in the future.

-

If the inflation figures begin to move lower, then there is a reasonable chance of working through this cycle of rising rates without experiencing a recession.

June 16 UMB Bank

UMB Bank -

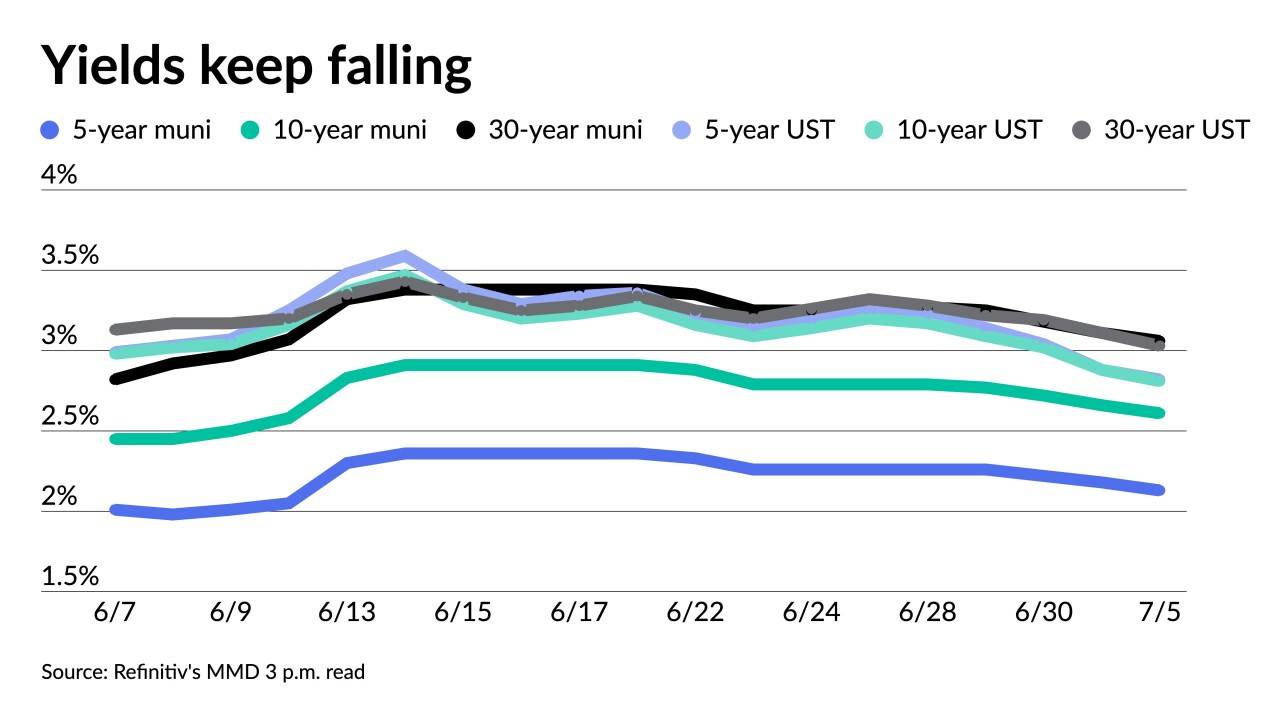

The 25-basis-point move to higher yields is the largest one-day change in triple-As since March 2020 when COVID began roiling markets. Munis could not ignore a continued selloff in UST led by inflation and recession concerns.

June 13 -

Ahead of the FOMC meeting, municipal issuers pull back. Investors will be greeted Monday $2.880 billion of new-issue supply.

June 10 -

More firms are revising issuance projections downward due to lower refunding and taxable volumes. Many participants say it is unlikely the market will hit issuance records reached in 2021 and 2020.

June 10 -

While a document search will not turn up the dreaded word “stagflation,” the minutes mention on multiple occasions that the FOMC sees risk to growth skewing toward the downside, and inflation risk to the upside.

June 9 Build Asset Management

Build Asset Management -

Municipals improved for the fifth session in a row with 10- and 30-year triple-A yields falling 30 basis points since Thursday. Connecticut priced $1 billion-plus of GOs and saw yields lowered in a repricing.

May 25 -

The U.S. economy needs supply-side interventions rather than interest-rate hikes by the Federal Reserve that will fail to bring inflation under control, said Nobel laureate economist Joe Stiglitz.

May 23 -

Given the volatility of risk assets is likely to remain high, and the focus on the flight to safety increases, all fixed-income assets could benefit as a result, including municipals, Barclays strategists say.

May 20 -

Some worry that governments will use new infrastructure funds for generic, shovel-ready projects, or even tax cuts, instead of collaborative plans that could transform regions.

May 19