-

Pandemic-related aid helped raise the proportion of state revenues coming from the federal government to record highs in fiscal year 2020, Pew Research found.

February 25 -

The Illinois Sports Facilities Authority projects a fiscal 2022 shortfall in hotel tax collections needed to repay the annual state advance that covers debt service.

February 24 -

Municipals have been resilient throughout the pandemic — with the help of federal aid — keeping the Golden Age for public finance alive.

February 22 -

“It’s important for the economy and the entirety of the American Rescue Plan that we see each county doing what it can for workers," Biden Senior Advisor Gene Sperling told the National Association of Counties.

February 15 -

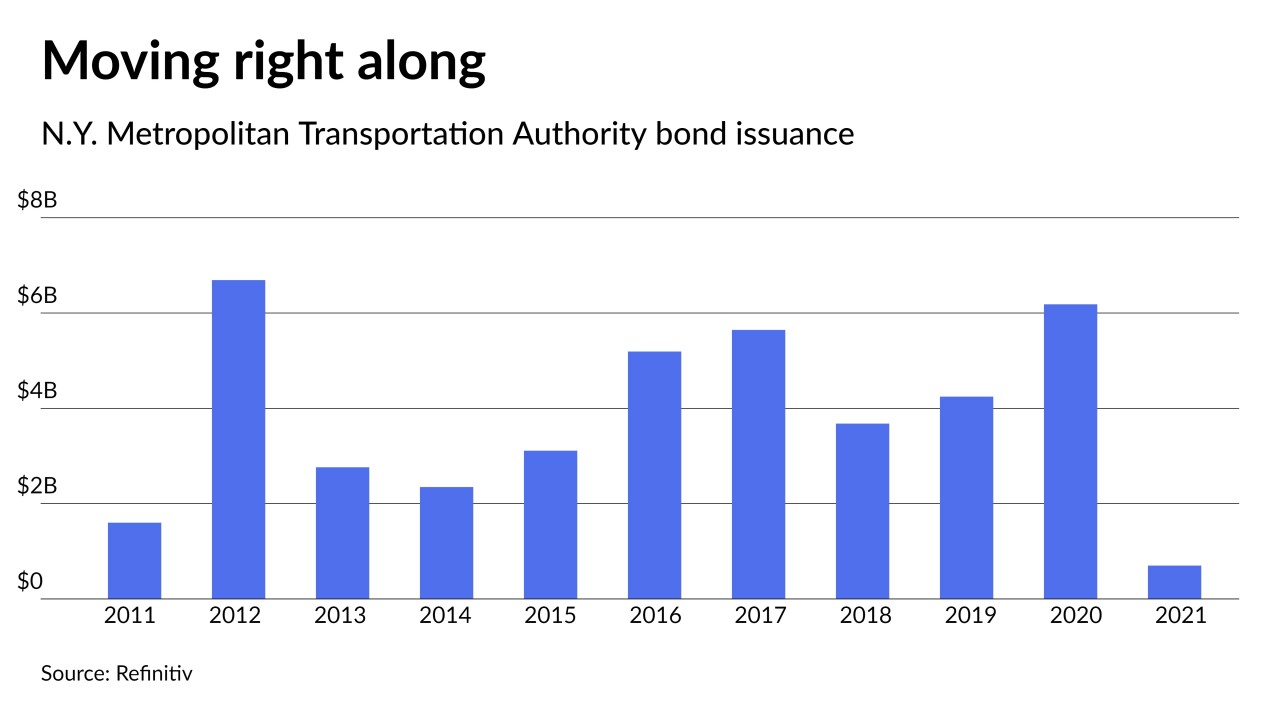

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

January 28 -

John Hallacy of John Hallacy Consulting LLC sits down with Chip Barnett to talk about what the municipal bond market will face in 2022. He discusses inflation, new issuance volume, and the future of infrastructure this year amid the lingering effects of COVID and Omicron. (19 minutes)

January 25 -

Timothy Little said he's looking for input from a diverse array of muni market participants in his new data-gathering role at the New York Federal Reserve.

January 24 -

In the near term, federal aid is sitting on balance sheets ready to be deployed if some of the downside economic risks become reality, experts say.

January 21 -

The Internal Revenue Service has released guidance providing temporary relief for low-income housing tax credit and private activity bond-financed properties due to the ongoing threat of COVID-19.

January 13 -

Treasury’s final ruling issued last week provides tribes with $10 million in revenue loss allowance and a broader list of capital expenditures.

January 11 -

Treasury’s final rule on the State and Local Coronavirus Fiscal Recovery Fund allows counties to use up to $10 million for general public services and expands the list of eligible water, sewer, and broadband infrastructure projects.

January 10 -

The state expects to cut interest costs through the early repayment on the loan taken out through the Federal Reserve's emergency lending program to help pay down healthcare bills.

January 5 -

The university is planning to sell $500 million of taxable 100-year bonds in the first quarter of 2022.

December 28 -

Municipals are sitting out the ups and downs in equities and UST, with $12 million scheduled for the primary in the final week of 2021.

December 23 -

Entering the third year of a pandemic, higher education is expected to gain stability amid a flood of federal aid.

December 23 -

Tax risks continue to linger as they are preserved as a potential offset for whatever level of spending all 50 Democratic senators can agree to, but potential approval of the legislation remains a question mark.

December 22 -

U.S. Treasuries saw losses pushing municipal to UST ratios on the 10- and 30-year lower again.

December 21 -

The Build Back Better in its current form essentially has been killed by Sen. Joe Manchin, likely limiting the potential for tax hikes in the coming year.

December 20 -

The Securities and Exchange Commission has proposed amendments to its money market fund rules, which it has tinkered with repeatedly since the Great Recession.

December 15 -

The port's operating revenue will continue to recover, enabling it to return to a total net revenue debt service coverage ratio of 1.75 times by 2023, the rating agency said.

December 7