Municipals were very lightly traded and little changed Monday, starting off the final two holiday-shortened weeks of 2021 with paltry supply and lightly staffed desks. The U.S. Treasury curve steepened with the long end weaker and equities sold off on continued COVID-19 concerns.

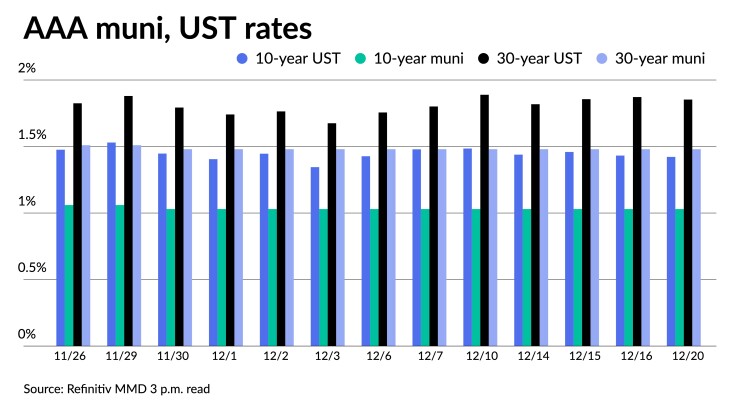

The entire muni AAA curve has been stable for two weeks and counting, despite volatile Treasury rates.

"Static munis for the past two weeks was typical during a volatile Treasury market and speculation about the Fed stance," BofA Global Research strategists noted in a Friday report. "Another reason, perhaps, is the heavier-than-expected December new issuance."

Total December issuance sits at $35.115 billion so far, up from last year's $34.822 billion total.

As for credit products, except for the high yield index — where credit spreads tightened five basis points or so in December so far — there's been little spread moves for the other credit indexes, they said.

Muni-to-Treasury ratios in the 10-year-plus part of the curve are closer to their top ranges for the year, while ratios for the short serial sectors of the curve remain low.

Ratios were at 51% on the five-year, 73% in 10 and 80% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 49%, the 10 at 74% and the 30 at 80%.

"This supports our view that more flattening of the muni curve should be expected now that the uncertainty surrounding the Fed's posture is all removed," the BofA report said.

Now that the Fed has clarified its stance, "the first order of things is the repricing of the short serial rates in munis to reflect the Fed's posture; a very minor rise of the short serial rates would be good enough," they said.

In fact, 10-year-plus muni AAA rates are biased to go down some due to high ratios, they said.

"After those ratio adjustments, we expect the muni curve to follow Treasuries somewhat better," the report said.

Trades in the last week indicate short-term buyers nearly as active as those past 12 years — 37% of all volume was inside 8 years and 44% fell in maturities 2033 or longer, noted Kim Olsan, senior vice president at FHN Financial.

"That’s a change from the last month when longer flows captured 50% of the total," she said. "A new COVID variant with uncertain implications for economic activity appears to have created a more defensive bias."

Trading on Monday continued this trend, with most activity concentrated on the short end again.

California 5s of 2022 at 0.10%. Ohio common schools 5s of 2022 at 0.12%-0.11%. Georgia 5s of 2023 at 0.23%. District of Columbia 5s of 2024 at 0.31%.

Wisconsin 5s of 2025 at 0.45%-0.43%. Connecticut 5s of 2025 at 0.49%. Richland County, South Carolina, 5s of 2025 at 0.42%. Houston ISD 5s of 2025 at 0.40%. Georgia 5s of 2026 at 0.50%.

California 5s of 2030 at 0.99%-0.91%.

Outside of 10-years, Ohio water 5s of 2034 at 1.17%. Ohio water 4s of 2036 at 1.37%-1.36%.

Connecticut 5s of 2041 at 1.50%. Texas water 4s of 2044 at 1.59%-1.49%. Harris County, Texas, 4s of 2047 at 1.62%-1.53%.

What of those tax increases?

Now that Build Back Better

"Tax rates are a main driver of demand and oftentimes annual municipal performance," Olsan said.

She looked at tax rates and changes to them since 2000, noting that from 2000 to 2002, higher tax rates helped generate annual returns over 10%. "The top federal rate stood at 39.6% and the growth of professionally managed investment programs led to a surge in supply from $200 billion to over $350 billion during that period," Olsan said.

The 2003-2012 period saw the longest stretch with useful reference points. Tax rates were lowered to bring the top rate to 35% and average annual muni returns of near 5.5%.

"Greater results might have occurred absent the 2008-09 Great Recession," she said. "Supply topped $400 billion in the later years of that cycle, not that far off from current issuance figures."

Tax rates were increased between 2013 and 2017. "This period included the pivotal 2013 taper tantrum and 2016 election, holding average annual returns to 3.1% (2014 produced an outsized 9.7% gain)," she said.

Following the 2017 tax reform, the top rate was lowered to 37% and the corporate rate fell to 21%.

Average gains have been just below 4%, impacted by reduced buying from 21% buyers (lower tax equivalent yield advantages).

"Future tax hikes could provide more demand in the market based on income sheltering, leading to larger market gains," she said.

As political infighting in Washington is likely to continue, and with the looming midterm elections next fall, those higher rates might not come to fruition.

Economy

The coronavirus and its variants continue to wreak havoc on the economy and prevent a return to life as we knew it. Returning to the office full time for many is pushed back, large gatherings — including the World Economic Forum in Davos — and sporting events have been postponed, and Broadway shows canceled.

The uncertainty of when and how bad the next outbreak will be makes it difficult for economists to make forecasts.

The U.S. economy will begin 2022 “transitioning from acceleration to deceleration,” according to Wilmington Trust’s 2022 Capital Markets Forecast, moving further into the “deceleration stage over the course of the year.”

But this will not necessarily lead into contraction, they economists said. “The path forward depends on the interplay of labor, inflation, and inventories.”

“We continue to believe that the public health crisis will recede further — albeit after a winter bump led by the Delta and possibly Omicron variants — and that the labor and other disruptive forces accounting for this unparalleled resource tightness will be sorted out,” Wilmington said. “However, the labor force, business inventory, and inflation cycles are closely intertwined, and numerous alternative paths could transpire and deflect the natural reversion of the economy to a globally interconnected and fine-tuned machine.”

While the labor market suggests “an economy deep in the deceleration phase,” Wilmington said, that may be skewed by the low participation rate. Although several factors play into the rate, they “expect these forces to partially abate in 2022, but there is a risk of extended labor shortages.”

Inflation also suggests the U.S. is far into the deceleration phase, they added, “but it has been pushed there by the unique nature of the pandemic, the government response, supply shortages, and labor force disruption.” While inflationary pressures should ease in the New Year, “lingering supply-chain issues could combine with wage pressures to hold inflation significantly higher than in past cycles.”

The economic data calendar was light, with only the Leading Economic Index released. The index jumped 1.1% in November to 119.9 (2016=100), after climbing 0.9% in October.

Economists polled by IFR Markets expected a 0.9% rise.

The coincident index gained 0.3% after a 0.5% increase a month earlier, while the lagging index slipped 0.1% in November after growing 0.5% in October.

The numbers suggest “the current economic expansion will continue into the first half of 2022,” said Ataman Ozyildirim, senior director of economic research at The Conference Board. “Inflation and continuing supply chain disruptions, as well as a resurgence of COVID-19, pose risks to GDP growth in 2022. Still, the economic impact of these risks may be contained.”

Stock price gains in the month boosted the index, according to Wells Fargo Securities Senior Economist Tim Quinlan and Economic Analyst Sara Cotsakis. But this assistance “may have been short-lived as markets have since faced a rude awakening due to the emergence of the Omicron variant,” they said. “It will not be until next month's reading that we will be able to see the full effect of the recent surge in new cases.”

On the negative side, “consumer expectations were yet again a dead weight on the index,” Quinlan and Cotsakis said. "This comes as consumer confidence fell to 109.5 in November, despite evidence of a hot job market. Initial results from the University of Michigan's consumer sentiment survey suggest we could see slight improvement in December, but even the first half of the month did not show the full extent of the Omicron variant, which has led some areas to recently reimpose social distancing measures."

AAA scales

Refinitiv MMD's scale was unchanged: the one-year at 0.14% and 0.24% in 2023. The 10-year sat at 1.03% and at 1.48% in 30.

The ICE municipal yield curve showed yields were little changed: 0.15% in 2022 and 0.27% in 2023. The 10-year steady at 1.04% and the 30-year yield at 1.49%.

The IHS Markit municipal analytics curve steady: 0.16% in 2022 and to 0.25% in 2023. The 10-year at 1.01% and the 30-year at 1.48% as of a 3 p.m. read.

Bloomberg BVAL was unchanged: 0.17% in 2022 and 0.22% in 2023. The 10-year was at 1.04% and the 30-year at 1.48%.

Treasuries were better on the short end and weaker on the long end, while equities sold off.

The five-year UST was yielding 1.167%, the 10-year yielding 1.422%, the 20-year at 1.892% and the 30-year Treasury was yielding 1.850% at 3:30 p.m. eastern. The Dow Jones Industrial Average lost 516 points, or 1.46%, the S&P was down 1.29% while the Nasdaq lost 1.26% at 3:30 p.m. eastern.