Municipals were little changed in quiet trading with few prints to direct benchmark yields in any direction while the pendulum swung to risk-on with equities seeing large gains and U.S. Treasuries slumping back to losses.

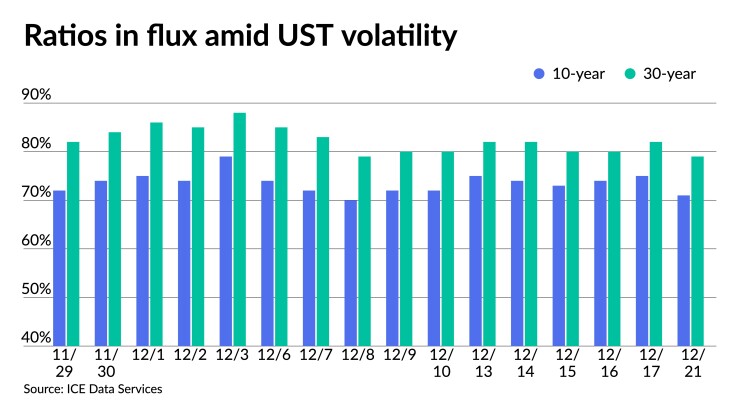

Triple-A benchmarks were left unchanged, and ratios fell. The five-year was at 48%, 69% in 10 and 78% in 30, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 46%, the 10 at 71% and the 30 at 79%.

Tax-exempt municipal benchmarks have remained steady, owing to persistent uncertainty in what investors understand the term "inflation" implies, according to Municipal Market Analytics.

“Our market is now in the throes of year-end, with some modest repositioning" — out of variable rate demand obligations into exchange traded funds — "unlikely to do much to alter an overall stable orientation,” said MMA partner Matt Fabian.

Some modest tax-swap selling is going on, based on losses incurred earlier this year, he said, but the activity is more likely to trend toward pre-Jan. 1 positioning to capitalize on seasonal strength predictions.

The majority of fund flows are "cooperating," but Fabian said traditional mutual fund flows have slowed to the point where they have little prospect of breaking 2019's inflow record while ETF net creations have resumed their upward trend.

The weekend's setback in Democrats' plans for the Build Back Better bill may provide USTs and bonds a boost early this week, but the news on this issue has been unpredictable and episodic enough to suggest caution in reading too much into anything, Fabian said.

“On the other hand, the vertical surge in COVID-19 infections is already setting back economic recovery, setting off new rounds of facility closures and tempering holiday/vacation plans; the related, constructive effect on bond prices here may be more lasting, although concerns for the most pandemic-affected bond sectors are obvious,” he said.

The municipal market is on solid footing heading into 2022, according to analysts at Columbia Threadneedle Investments. Strong tax revenue and unprecedented federal stimulus have largely eliminated credit concerns, and strong equity market returns have improved pension funding ratios for most issuers. This implies that municipalities will be able to fund pensions and pursue infrastructure projects at the same time, the report said.

Catherine Stienstra, Columbia Threadneedle's head of municipal bond investments, Douglas Rangel, fixed-income client portfolio manager and Henry Henderson, municipal research analyst said the Infrastructure Investment and Jobs Act will add to these positive drivers by providing a boost to economic growth.

Many economists believe the bill's construction expenditure will boost GDP growth by 0.2% in the first few years, with gains lasting longer owing to improved infrastructure efficiency.

Historically, greater economic activity and employment development have resulted in increased tax revenue collection for state and municipal governments, they said.

“It is no secret that fixed-income bonds (measured by spreads) are expensive, and municipal bonds are no different in that regard. However, bonds can remain expensive, as they did for extended periods in 2006-2007 and the lead up to the COVID-19 selloff, especially if the economy continues to grow," they said. “As such, we expect income to outpace price return in its contribution to total returns in 2022."

However, investors should not be discouraged from actively pursuing alpha through security selection, and substantial research resources will be necessary to investigate the whole muni universe, including issues outside of benchmarks, to identify bonds that may outperform, they said.

The most significant impact of the IIJA for municipal bond investors is likely to be the incremental supply of muni bonds.

“All else equal, increased supply can put upward pressure on yields,” they said. "However, in this case, provisions of the bill — and clear omissions — may serve to limit a glut of new bonds."

Initial plans to incorporate programs such as a direct-pay option were not included in the final measure and better-than-expected state and municipal tax revenues during the pandemic and recovery have generated budget surpluses for many state and local governments, which can be used to support infrastructure contributions, according to analysts.

The fear of increased taxes, which never materialized, contributed to large inflows in 2021. The funding requirements for the Biden administration's second major proposed bill, the Build Back Better Act, are still being debated.

Regardless of whether tax rates rise or fall, they said municipal bond income remains appealing and is one of the few ways to avoid paying taxes on income.

“We remain constructive on the prospects for municipals in 2022 given healthy fundamentals, strong continued demand and manageable new supply levels,” they said. "That said, expect dispersion in the New Year, and employ active approaches to find risk-adjusted income opportunities."

Secondary trading

California 5s of 2022 at 0.11% versus 0.10% Monday. Texas 5s of 2023 at 0.27%. Maryland Department of Transportation 5s of 2023 at 0.28%.

Charleston County, South Carolina, 5s of 2029 at 0.96%-0.95%. California 5s of 2030 at 1.06%. New York EFC water 5s of 2030 at 0.99%-0.98%.

AAA scales

Refinitiv MMD's scale was unchanged: the one-year at 0.14% and 0.24% in 2023. The 10-year sat at 1.03% and at 1.48% in 30.

The ICE municipal yield curve showed yields were little changed: 0.15% in 2022 and 0.27% in 2023. The 10-year steady at 1.04% and the 30-year yield at 1.49%.

The IHS Markit municipal analytics curve steady: 0.16% in 2022 and to 0.25% in 2023. The 10-year at 1.01% and the 30-year at 1.48% as of a 3 p.m. read.

Bloomberg BVAL was unchanged: 0.17% in 2022 and 0.22% in 2023. The 10-year was at 1.04% and the 30-year at 1.48%.

Treasuries were weaker while equities rallied.

The five-year UST was yielding 1.231%, the 10-year yielding 1.48%, the 20-year at 1.913% and the 30-year Treasury was yielding 1.887% at 3:40 p.m. eastern. The Dow Jones Industrial Average gained 557 points, or 1.60%, the S&P was up 1.67% while the Nasdaq gained 2.14% at 3:30 p.m. eastern.