-

As we enter the fourth quarter, municipals continue their remarkable performance with the market continuing to follow trends of demand outstripping supply and inflows into the asset class.

September 27 -

Low taxable rates will allow the state to reap 10% present value savings while advance refunding $285 million of tax-exempt GO debt.

September 26 -

The muni market started the week hitting the ground running as the second biggest deal of the week priced along with a few others on what was a active Tuesday.

July 16 -

The new budget draws down fund balances for new spending and tax relief but improving reserves and fully funded pensions cushion the state's ratings.

July 15 -

New-issue supply started to trickle into the market Monday, a thin stream that will turn into a torrent by week’s end.

July 15 -

The New York MTA is set to issue $50 million of variable rate revenue bonds on Clarity Bidrate Alternative Trading System, highlighting the uptick in usage of variable rate debt.

May 31 -

Lawsuits accusing banks and broker-dealers of fraud in the variable-rate demand obligation market helped cement the decision to use the platform.

May 23 -

Municipal bond sales sank 28.2% from April 2018 as issuers awaited clarity on federal infrastructure plans.

April 30 -

The new governor included the fuel tax in his budget plan, which would spend $83.4 billion over the next two-year budget cycle.

March 1 -

Mt. Pleasant, Racine County, and the Wisconsin state government all face risks if the Taiwanese manufacturer can't deliver on its big promises.

January 31 -

Capital finance director David Erdman says VRDO fraud lawsuits piqued his interest in Clarity's platform.

January 16 -

Wisconsin's governor-elect named Brian Pahnke budget director, Joel Brennan to head the Department of Administration, and Craig Thompson to lead transportation.

January 2 -

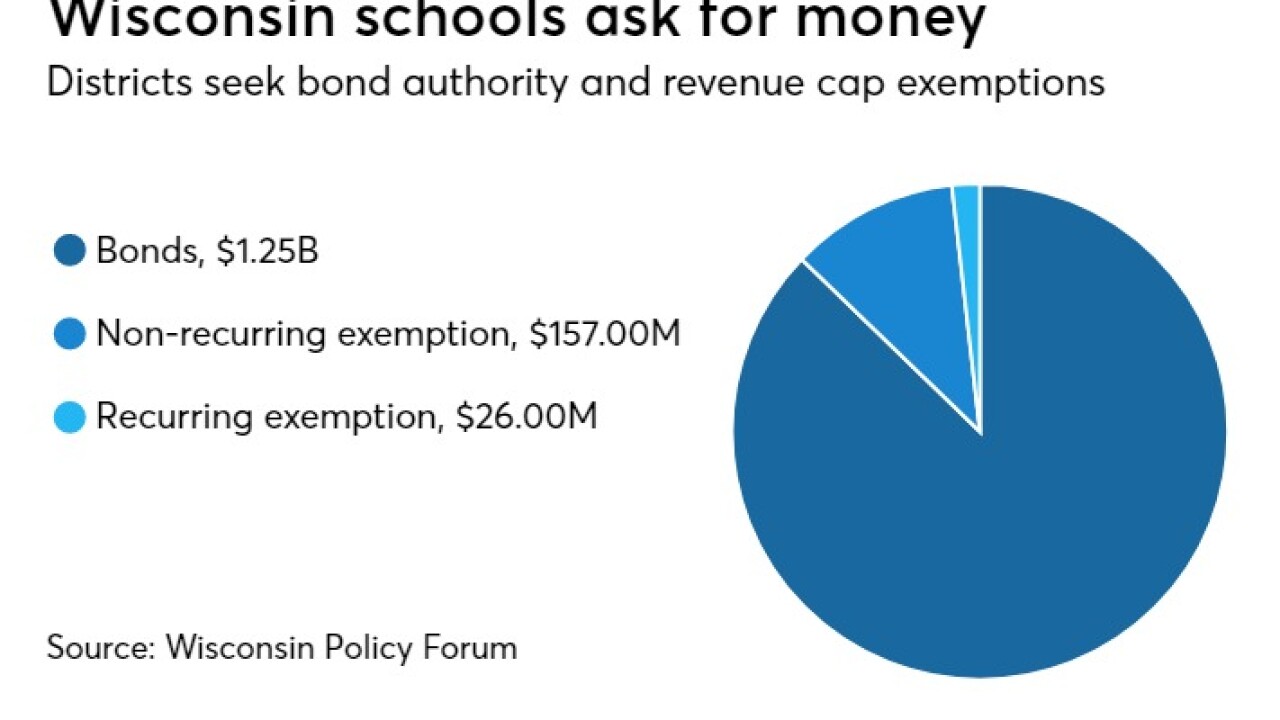

School districts are asking voters for more than a billion dollars while the major candidates pledge more K-12 funding.

October 16 -

Wisconsin sold the biggest deal of the week as investors remained wary ahead of the FOMC meeting.

September 25 -

The biggest deal of the week came to market on Tuesday as Wiscon sold general obligation bonds.

September 25 -

The competitive GO deal will feature five- or eight-year calls.

September 24 -

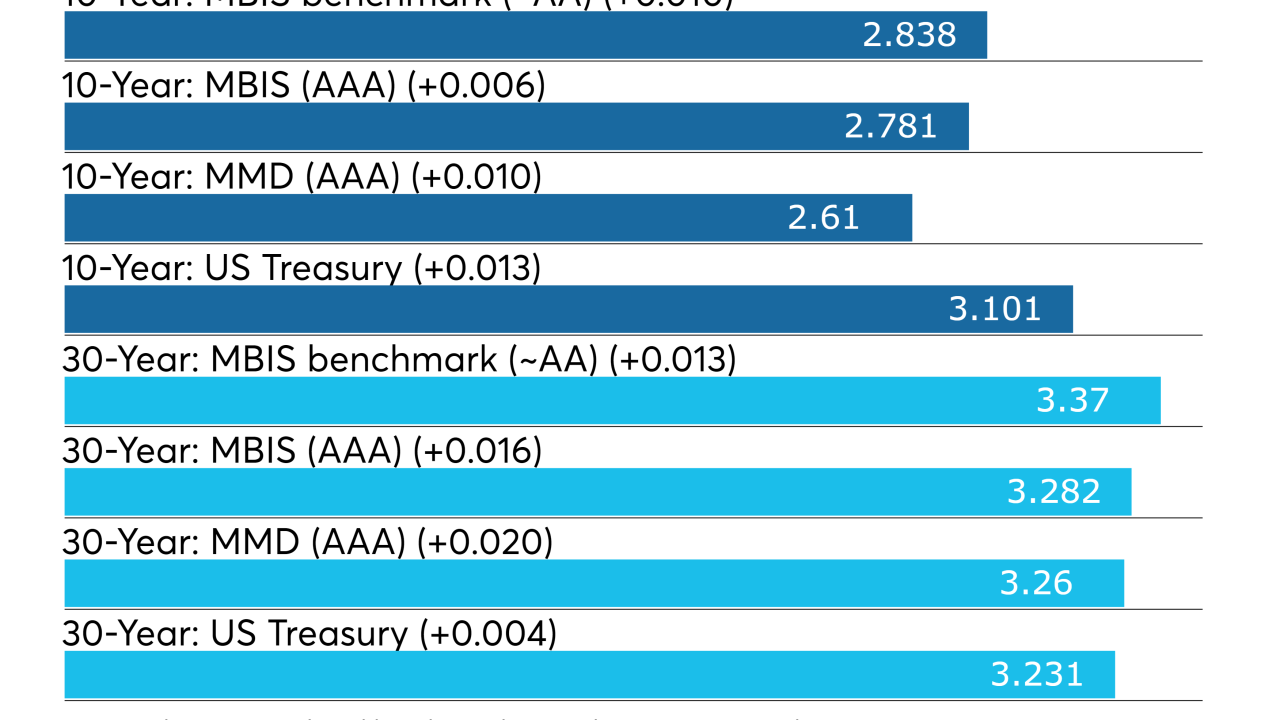

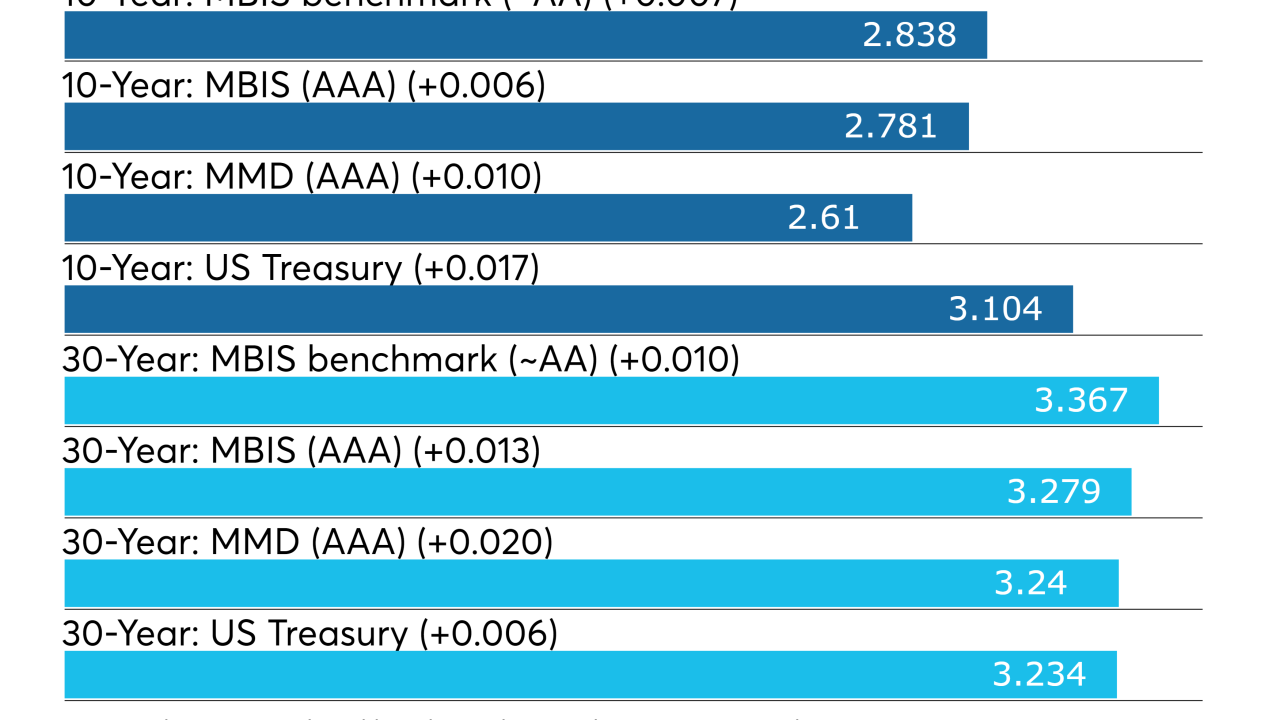

The intermediate and long end has moved cheaper, creating an opportunity to add some yield to muni portfolios, says Triangle Park's J.R. Rieger.

September 24 -

Ahead of the FOMC monetary policy meeting and quarter end wrapup, a slim supply slate awaits muni buyers.

September 24 -

The muni market will see a skinny slate of supply hit the screens this week as volume drops to just over $3 billion ahead of the FOMC meeting and the third quarter wrapup.

September 24 -

Municipal bond issuance is set to drop by half next week as Federal Open Market Committee meets and the third quarter comes to an end.

September 21