The biggest deal of the week came to market on Tuesday as a supply-deprived municipal bond market took a careful look at the sale from the Badger State.

Meanwhile, wary investors were laying low as the first of the two-day Federal Open Market Committee meeting got underway amid a climate of municipal prices remaining unchanged to two basis points weaker in spots, observed a Southeast trader.

“The tone continues to be cautious ahead of the Fed and data this week -- despite having a small calendar,” the trader said on Tuesday morning, pointing to a slew of economic releases this week -- including home sales, GDP, durable goods, personal income, and other economic indicators between Wednesday and Friday.

The Fed meeting has a lot to do with the lighter volume, which is expected to be approximately $3.2 billion this week -- a sharp decrease from $6.3 billion last week.

The end of the third quarter is also contributing to the slower activity, he noted.

“It’s a slow drift,” he explained. “Overall volumes are down and there’s a lot of swapping between dealer to dealer, and customer to dealer.”

Normal market operations should resume next week -- for the official start of the fourth quarter, according to the trader.

Until then, market tone remains skittish and sparse.

“The overall environment is very cautious and that’s sidelining a lot of players and decreasing volume of trading,” he added.

“Until the Fed is out of the way and the data is out of the way this week, customers are being reserved,” he said.

The arrival of October should bring with it strong demand for fall reinvestments, the trader added.

“October is a relatively reasonable reinvestment period, and we’ll have an opportunity to capture some investment dollars,” he explained.

Next week’s calendar is expected to be moderate and manageable, “but it will at least be enough to show some leadership,” and likely offer the availability of 4% coupon structures on new issues.

“The demand from retail is starting to improve as you see 4% out long at a discount,” he explained. “It’s not robust by any stretch of the imagination, but it’s a bright spot.”

Primary market

In the competitive arena on Tuesday,

Barclays Capital Markets won the bonds with a true interest cost of 3.8127%.

Proceeds of the sale will be used for various governmental purposes.

Municipals officials are the financial advisors while Foley & Lardner is the bond counsel.

Since 2008 the Badger State has sold roughly $20 billion of securities, with the most occurring in 2017 when it sold $3.5 billion and the least in 2010 when it sold $1.5 billion.

Greensboro, N.C., sold $145.76 million of GO public improvement bonds.

Wells Fargo Securities won the $135.36 million of Series 2018B tax-exempts with a TIC of 3.1558%. Wells also won the $10.4 million of Series 2018A taxables with a TIC of 2.8053%.

Proceeds of the sale will be used to redeem certain outstanding BANs of the Issuer and to finance various capital improvements.

The financial advisors are DEC Associates with the Local Government Commission; the bond counsel is Womble Bond.

In the short-term competitive sector, Milwaukee sold $180 million of Series 2018M10 school revenue anticipation notes.

Morgan Stanley won the RANs with a TIC of 1.962%

The financial advisor is PFM Financial Advisors and the bond counsel are Katten Muchin and Hurtado Zimmerman.

The Palm Beach County School District sold $115 million of Series 2018 tax anticipation notes.

Morgan Stanley won the TANs with a TIC of 1.9992%

The financial advisor is PFM Financial Advisors; the bond counsel is Greenberg Traurig.

In the negotiated sector, Raymond James & Associates priced the New Orleans Aviation Board’s $109.835 million of special facilities revenue bonds and refunding bonds.

Tuesday's bond sales

North Carolina

Louisiana

Bond Buyer 30-day visible supply at $5.52B

The Bond Buyer's 30-day visible supply calendar increased $67.3 million to $5.52 billion for Tuesday. The total is comprised of $1.99 billion of competitive sales and $3.53 billion of negotiated deals.

Secondary market

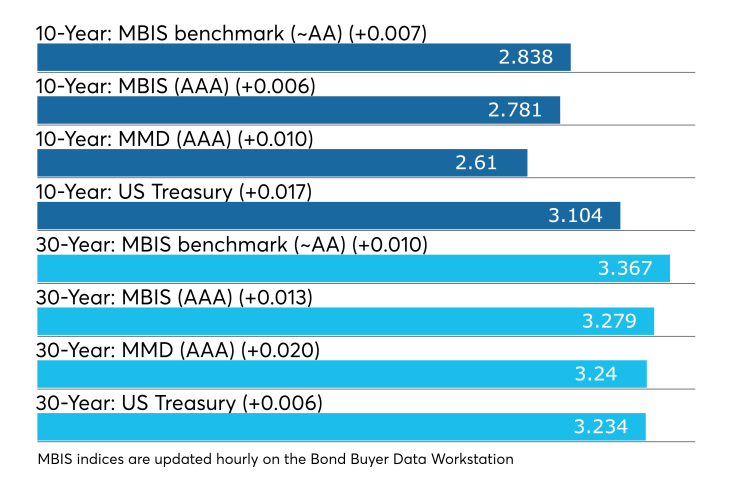

Municipal bonds were weaker on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point across the curve.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising by as much as one basis point while the yield on 30-year muni maturity gained as much as two basis points.

Treasury bonds were weaker as stock prices traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 100.9%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less

Previous session's activity

The Municipal Securities Rulemaking Board reported 38,290 trades on Monday on volume of $7.61 billion.

California, Texas New York were the municipalities with the most trades, with Golden State taking 15.808% of the market, the Lone Star State taking 10.096% and the Empire State taking 9.66%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.