New-issue supply started to trickle into the municipal bond market on Monday, a thin stream that will turn into a torrent by week’s end.

The pause that refreshes

BofA is moderately bearish on the muni market during the summer months, but turns bullish for the autumn and winter, according to a research report released Monday.

Volatility in the stock market, a healthy economic outlook tempered by a moderate growth forecast, worries about the U.S.-China trade negotiations and dovish talk from the Federal Reserve have been driving a 110-plus basis point rally in the municipal bond market since last October, BofA said.

“However, signs of exhaustion have emerged despite the continued, favorable demand/supply environment. As such, we believe the market is likely to pause and reflect during the next several weeks, with the 10-year AAA benchmark rising only moderately,” according to Yingchen Li, BofA municipal research strategist. “The rally should resume by late August to mid-September with the 10-year AAA eventually challenging the all-time low of 1.29% by the end of the year.”

He said that the pause-and-reflect market posture for the next few weeks is more technical in nature, and is a result of the long and extended rally.

Last week's actively traded issues

Revenue bonds made up 48.61% of total new issuance in the week ended July 12, down from 48.82% in the prior week, according to

Some of the most actively traded munis by type in the week were from California, New York and Puerto Rico issuers.

In the GO bond sector, the San Diego Unified School District, Calif., 5s of 2020 traded 49 times. In the revenue bond sector, the New York City Municipal Water Finance Authority 4s of 2049 traded 45 times. In the taxable bond sector, the Puerto Rico GDB Recovery Authority 7.5s of 2040 traded 29 times.

Primary market

On Monday, the Monahans-Wickett-Pyote Independent School District, Texas (PSF:NR/AAA/NR) sold $140 million of unlimited tax general obligation school building bonds. Frost Bank won the issue with a true interest cost of 2.8051%. Proceeds will be used for school buildings and the purchase of school buses. Specialized Public Finance is the financial advisor; McCall Parkhurst and the State Attorney General are the bond counsel.

On Tuesday, Barclays Capital will price the North Texas Tollway Authority’s $679 million of Series 2019 refunding revenue bonds. The issue is composed of Series 2019A (A1/A+/NR) bonds and Series 2019B (A2/A/NR) bonds.

In the competitive arena on Tuesday, Wisconsin (NR/AA/NR/AA+) will sell $223.47 million of Series 2019A GOs. Proceeds will be used for various governmental purposes. The state’s officials are acting as the financial advisor while the bond counsel is Foley & Lardner.

On Wednesday, BofA Securities is set to price the Children's Healthcare of Atlanta Inc.’s (Aa2/AA+/NR) $915 million bond deal. The issue is made up of offerings from the Brookhaven Development Authority, the DeKalb Private Hospital Authority and the Development Authority of Fulton County.

Also Wednesday, New York’s Battery Park City Authority will be selling $223 million of munis which feature tax-exempt and taxable senior revenue bonds and sustainability bonds. Lead managers Morgan Stanley and Ramirez are set to price the triple-A rated deal. Proceeds will be used to pay for ongoing infrastructure and capital improvements in Battery Park City in lower Manhattan and to refund some outstanding Build America Bonds.

The issuer is utilizing BondLink’s debt management platform, which now will provide free digital printing of preliminary and official statements on this issue and others to its subscribers.

"By adding printing services, BondLink’s debt management platform now offers full ‘one-stop shopping’ for municipal issuers. In addition to POS/OS printing, the platform includes digital roadshows, a direct upload to the MSRB’s EMMA website, an investor database, and a corporate-style investor relations (IR) website for issuers to connect with their bond investors," a BondLink release said.

“As former issuers, we know first-hand that nearly all municipal issuers are under-resourced,” said Colin MacNaught, BondLink CEO & Co-Founder. “The only way to bridge the resource gap is with technology. We’re providing significant efficiencies to issuers, and with free digital printing, helping to lower issuers’ costs of issuance.”

Monday’s slate

Secondary market

Munis were stronger in late trade on the

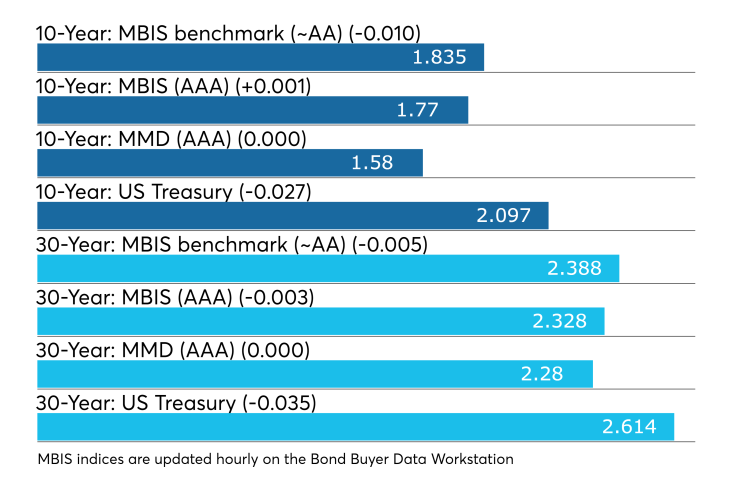

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs remained unchanged at 1.58% and 2.28%, respectively.

"The ICE Muni Yield Curve is within one basis point of Friday’s levels," ICE Data Services said in a Monday market comment. "Tobacco and high-yield are quiet and unchanged."

The 10-year muni-to-Treasury ratio was calculated at 75.5% while the 30-year muni-to-Treasury ratio stood at 87.3%, according to MMD.

Treasuries were stronger as stocks traded little changed. The Treasury three-month was yielding 2.137%, the two-year was yielding 1.837%, the five-year was yielding 1.849%, the 10-year was yielding 2.097% and the 30-year was yielding 2.614%.

Previous session's activity

The MSRB reported 29,944 trades Friday on volume of $10.95 billion. The 30-day average trade summary showed on a par amount basis of $11.80 million that customers bought $6.24 million, customers sold $3.56 million and interdealer trades totaled $2.00 million.

California, Texas and New York were most traded, with the Golden State taking 21.836% of the market, Lone Star State taking 11.553% and the Empire State taking 9.638%.

The most actively traded security was the Illinois Series 2003 GO 5.1s of 2033, which traded 11 times on volume of $40.77 million.

Puerto Rico bonds weaken

"Puerto Rico’s bonds are up led by the Commonwealth 8% GO bellwether bond, up 1/8 point after news reports this weekend broke that the administration of Gov. Ricardo Rossello was engulfed in a crisis over leaked private messages," ICE Data Services said. "Puerto Rico’s former CFO Christian Sobrino and Secretary of State Luis Rivera Marin resigned their positions on Saturday as a result of the controversy. Last week two former high ranking officials were indicted on federal corruption charges."

Puerto Rico Sales Tax Financing Corp. bonds were some of the most actively traded bonds on Monday amid more tumult on the island, according to the MSRB.

The COFINA restructured Series A-1 4.75% revenue bonds of 2053 were trading at a high price of 97.045 cents on the dollar compared to 99.375 cents on Friday, according to the EMMA website. Volume totaled $127,000 in 27 trades compared to $3.92 million in 24 trades on Friday.

The COFINA restructured Series A-2 4.55% taxable revenue bonds of 2040 were trading at a high price of 96.125 cents on the dollar compared to 96.375 cents on Friday. Volume totaled $22.20 million in 27 trades compared to $10.77 million in 34 trades on Friday.

The COFINA restructured capital appreciation revenue zeros of 2046 were trading at a high price of 22.683 cents on the dollar compared to 23.04 cents on Friday. Volume totaled $903,000 in 28 trades compared to $20.73 million in 40 trades on Friday.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $36 billion of three-months incurred a 2.115% high rate, down from 2.210% the prior week, and the $36 billion of six-months incurred a 2.010% high rate, down from 2.075% the week before. Coupon equivalents were 2.162% and 2.064%, respectively. The price for the 91s was 99.465375 and that for the 182s was 98.983833.

The median bid on the 91s was 2.085%. The low bid was 2.000%. Tenders at the high rate were allotted 57.69%. The bid-to-cover ratio was 2.88. The median bid for the 182s was 1.990%. The low bid was 1.970%. Tenders at the high rate were allotted 61.46%. The bid-to-cover ratio was 3.22.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.