The muni market started the week hitting the ground running as the second biggest deal of the week priced along with a few others on what was a active Tuesday.

On Tuesday, Barclays Capital will priced the North Texas Tollway Authority’s $651.13 million of Series 2019 refunding revenue bonds. The issue is composed of Series 2019A (A1/A+/NR) bonds and Series 2019B (A2/A/NR) bonds.

"Demand was strong," said one Texas trader. "It was two to eight times oversubscribed with the strongest over-subscription was in the front end, but it was well supported through out."

He added that the loan was bumped anywhere from two to eight basis points from original spread.

Since 2010, the NTTA has issued roughly $10.37 billion with the most issuance occurring in 2017 when it came to market with $2.51 billion. The authority did not issue any bonds at all in 2013.

In the competitive arena on Tuesday, Wisconsin (NR/AA/NR/AA+) sold $220.64 million of Series 2019A GOs, that were won by JPMorgan with a true interest cost of 3.1061%.

Proceeds will be used for various governmental purposes. The state’s officials are acting as the financial advisor while the bond counsel is Foley & Lardner.

Goldman Sachs priced State Building Authority of Michigan’s (Aa2/AA-/AA-) $236.405 million of 2019 revenue and revenue refunding bonds.

Barclays priced Sacramento Municipal District’s ( /AA-/AA) $191.815 million of subordinated electric revenue bonds.

Tuesday’s bond sales

Secondary market

Munis were weaker in late trade on the

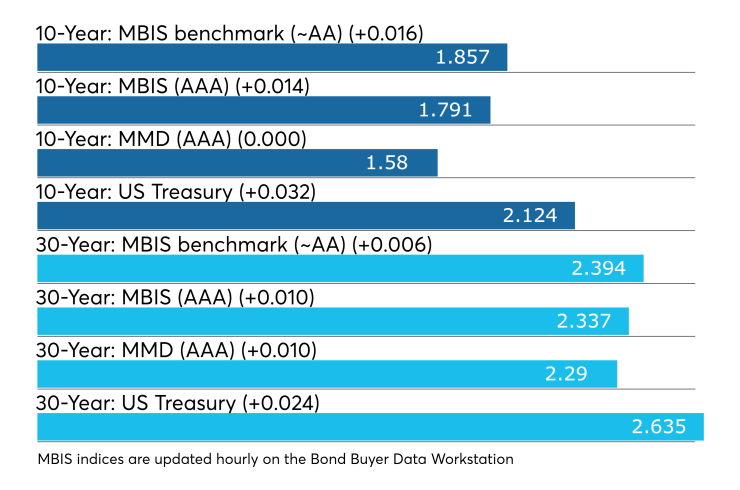

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year was unchanged from 1.58% and the 30-year GOs were higher by one basis point to 2.29%.

The 10-year muni-to-Treasury ratio was calculated at 73.2% while the 30-year muni-to-Treasury ratio stood at 86.2%, according to MMD.

Treasuries were stronger as stocks traded down. The Treasury three-month was yielding 2.154%, the two-year was yielding 1.866%, the five-year was yielding 1.883%, the 10-year was yielding 2.124% and the 30-year was yielding 2.635%.

“The ICE muni yield curve is one to two basis points higher,” according to ICE Data Services. “High-yield and tobaccos drift one basis point higher. Taxables are up three to four basis points, led by the five-year maturities. Puerto Rico is stable, though the GDB Debt Recovery Authority bonds are down 1 ¾ points.”

Previous session's activity

The MSRB reported 30,537 trades Monday on volume of $7.384 billion. The 30-day average trade summary showed on a par amount basis of $11.632 million that customers bought $6.14 million, customers sold $3.51 million and interdealer trades totaled $1.98 million.

California, New York and Texas were most traded, with the Golden State taking 15.94% of the market, The Empire State taking 13.589% and the Lone Star State taking 13.416%.

The most actively traded security was the Kansas City, Missouri, Industrial Development Authority special obligation 5s of 2049, which traded 11 times on volume of $34.52 million.

Treasury auctions year bills, to sell notes

The Treasury Department auctioned $26 billion of one-year bills at a 1.915% high yield, a price of 98.063722, an investment rate of 1.976%. The bid-to-cover ratio was 2.87.

Tenders at the high yield were allotted 47.96%. The median yield was 1.880 while the low yield was 1.855%.

Treasury also said it will sell $35 billion of four-week discount bills and $35 billion of eight-week bills on Thursday.

Chip Barnett contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.