-

California's $2.4 billion GO deal was priced for retail investors on Wednesday.

September 4 -

A pre-marketing scale was released on California's $2.3 billion GO deal.

September 3 -

The market will see $7.6 billion of bonds plus a $1 billion note sale coming up in a holiday-shortened week.

August 30 -

Volume bounced back from second lowest monthly total of the year in July as yields plunged to historic lows and issuers came out in droves.

August 30 -

Many market participants were already planning their getaways before the unofficial end of summer hits next Monday.

August 29 -

NYC to continue Wells' muni underwriting ban as Fed's Powell opines on the firm's woes.

August 28 -

Deals from Atlanta, Massachusetts, Ohio and Miami-Dade County led Tuesday's primary activity.

August 27 -

Massachusetts taxable deal hits $858 million.

August 26 -

The last full trading week ahead of the Labor Day holiday will see a variety of credits come to market.

August 23 -

Houston issued bonds in the negotiated sector, while Long Beach competitively sold two issues.

August 22 -

The state comptroller's office reported receiving 67 bids worth $22.77 billion,

August 22 -

The Lone Star State sold $8 billion of notes to buyers with an endless appetite for short-term muni paper.

August 21 -

The municipal team at PIMCO see several areas of opportunity for muni investors in the second half of 2019.

August 20 -

Texas issues are headlining this week's slate of supply.

August 19 -

Houston also will offer investors $1B of utility system revs.

August 19 -

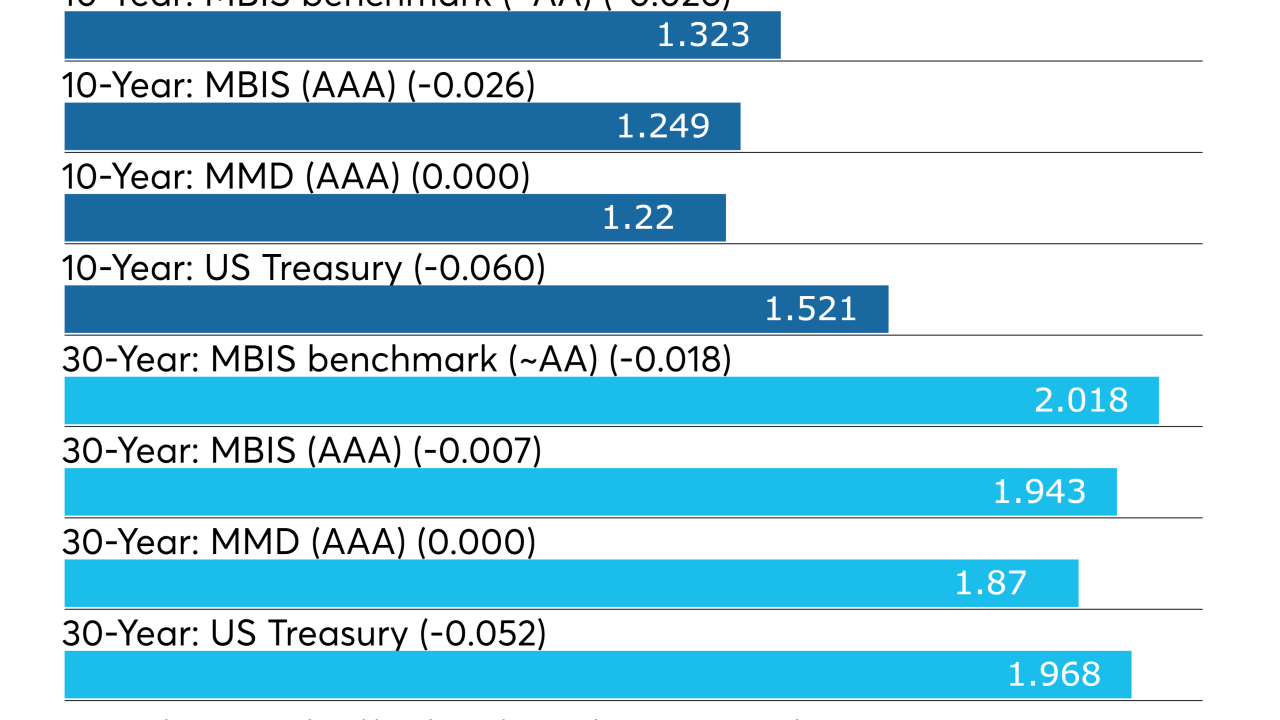

After a wild and crazy week that saw the yield curve invert for the first time in 12 years, recession talk, and record lows for muni yields — there was a much calmer tone on Friday.

August 16 -

The municipal bond market took a breather on Thursday as the last of the week’s larger deals came and went.

August 15 -

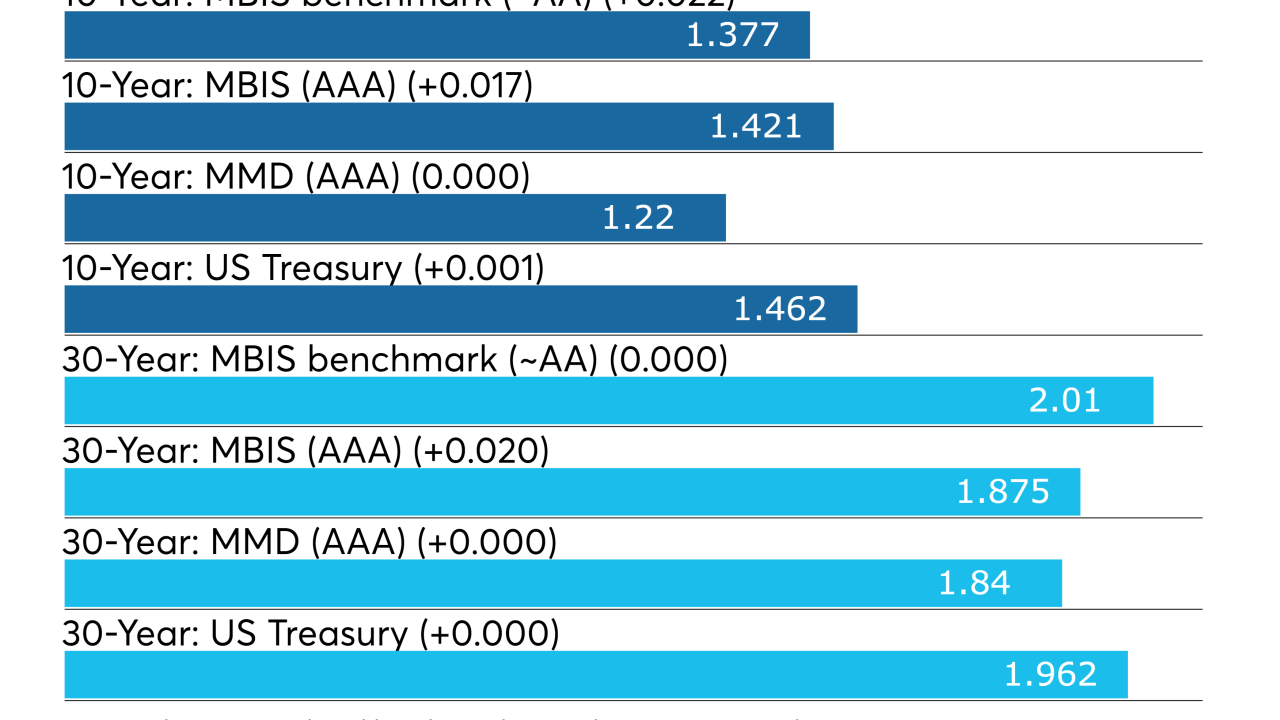

Municipal bonds continued their rally on Wednesday, and pushed tax-free yields to their lowest levels ever.

August 14 -

Deals from Texas and Virginia led the slate of new issues that hit the market on Tuesday.

August 13 -

Issuers and buyers will both be watching the direction bond yields take this week.

August 12