-

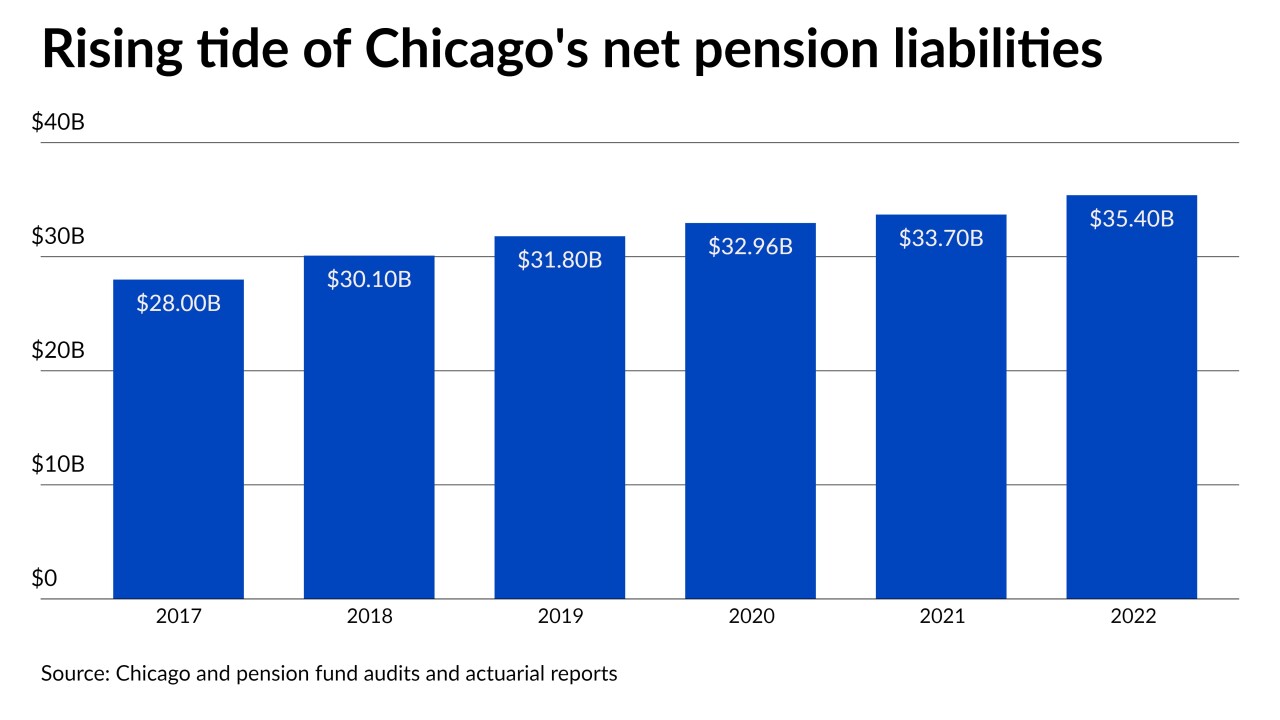

While all four of Chicago's weakly funded pension funds hit a milestone by posting modest increases in their funded ratios in 2021, they lost ground in 2022 due to investment losses driving up the city's pension burden to $35.4 billion

July 5 -

The state plans to enter the market before the fiscal year closes June 30th with eyes turned to Fitch and whether it will follow Moody's and S&P with an upgrade.

March 21 -

Illinois Comptroller Susana Mendoza talks with Yvette Shields about the state's progress on building up reserves and paying down debts that have helped lift the state's bond ratings, efforts to make further headway and the challenges of making sure fresh legislative faces understand the pains suffered during the two-year budget impasse. (35 minutes)

March 21 -

The Skyway sale "proves that sophisticated global investors who can buy assets anywhere view Chicago as a great place to invest," said a spokesperson for Mayor Lori Lightfoot.

September 13 -

Illinois trimmed yield penalties in its latest sales tax-backed sale with spreads of 40 and 45 basis points on its 10-year compared to 89 bp three years ago.

September 16 -

Illinois' tardy fiscal 2020 financial statements offer a view of COVID-19's early impact on the state's finances.

August 31 -

After more than a decade of ratings deterioration, the lowest-rated state won an upgrade Tuesday, taking its Moody's rating to Baa2.

June 29 -

Fitch revised Illinois' outlook to positive but the rating remains BBB-minus, the lowest investment grade.

June 23 -

The budget pays off Municipal Liquidity Fund loans, goes easier on local governments, cuts some corporate incentives, and begins drawing down federal relief.

June 1 -

The state Supreme Court upheld with the original circuit court ruling tossing out the lawsuit, which sought to invalidate more than $14 billion of GO bonds.

May 20 -

Gov. J.B. Pritzker is now willing to fully fund a scheduled education funding hike but other contentious issues remain, notably corporate tax breaks.

May 10 -

Municipal bond issuers in the State of New York accounted for half of the top 10, while issuers from California held two of the top four spots.

April 9 -

The first quarter of 2021 concludes with $102.1 billion, slightly higher than the $95.3 billion that the market saw in the COVID-ravaged first quarter of 2020.

March 31 -

Transportation fare and tax revenues lost to the coronavirus can be countered with federal relief funding, says the Illinois Economic Policy Institute.

March 30 -

Moody’s followed S&P in lifting Illinois’ outlook to stable, where it stood before the COVID-19 pandemic, but a lot more needs to happen for an upgrade.

March 26 -

Moody's is the second rating agency this month to bring its outlook on Illinois to stable, though all ratings remain at the lowest investment grade.

March 25 -

Illinois Supreme Court justices offered little indication of how they lean in the case seeking to invalidate more than $14 billion of outstanding bonds.

March 18 -

Illinois rode the tailwinds of market demand for higher-yielding paper and its rosier fiscal picture, sending its primary market spreads to their lowest since 2014.

March 17 -

S&P moved Illinois' outlook to stable from negative amid revenue numbers that beat pandemic-driven low expectations. The rating remains the lowest among states.

March 9 -

The Illinois attorney general and the head of conservative policy group lay out their positions next week in a case seeking to void $14 billion of state debt.

March 9