-

PREPA bondholders who back the Oversight Board's proposed deal say it will lose their support if not confirmed by Oct. 1.

August 26 -

The management team sees opportunity in pockets that other investors avoid, like American Dream, Midwestern private colleges and senior living facilities.

January 10 -

The three new hires, two from Nuveen and one from Lord Abbett, will report directly to the fund's manager John Miller.

September 23 -

Nuveen LLC reached an agreement to sell its 11% equity stake in Vistra Vision to Vistra Corp., that started as municipal bonds ensnared in a bankruptcy.

September 20 -

When it comes to sectors, Miller said he likes charter schools, healthcare, land-secured debt and some industrial revenue bond positions.

January 12 -

When set against high-profile public finance projects like American Dream and Legacy Cares, Florida's Brightline marks a rare success for investors.

November 1 -

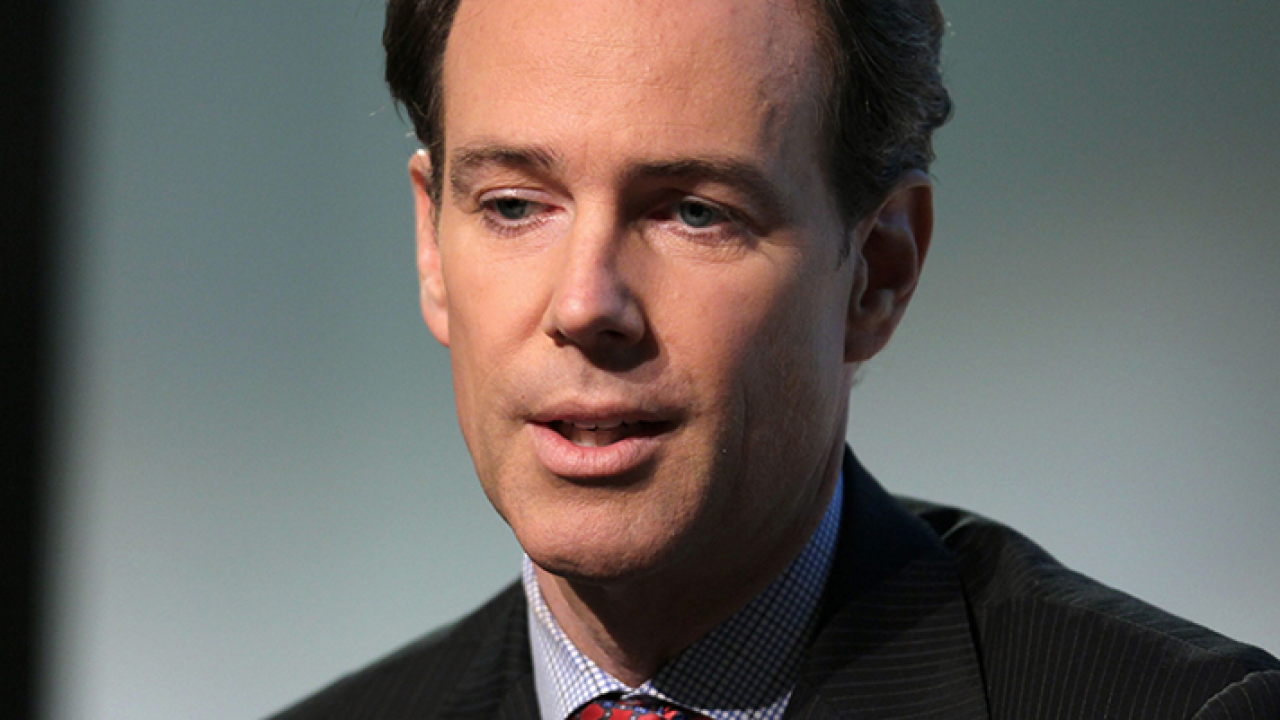

The long-time high-yield muni manager left Nuveen in April when the firm settled a contentious lawsuit with Preston Hollow.

September 22 -

Brightline's luxury train in Florida accounts for half of the Nuveen High Yield Municipal Bond Fund's top 10 positions.

May 18 -

A John Miller-less speculative bond market may mean more diversification and price transparency, say some investors.

April 14 -

The announcement came as a global settlement agreement that resolves Preston Hollow Capital LLC's litigation against Miller and Nuveen was disclosed.

April 10 -

A Delaware Superior Court judge found PHC failed to show it suffered reputational loss from Nuveen's alleged defamation to go to trial. PHC will appeal.

June 28 -

At least 80% of the fund has to be “ESG leaders,” or issuers that have shown leadership in terms of environmental and social stewardship within their communities relative to their peers and that sector.

April 6 -

Nuveen is asking a judge to toss Preston Hollow Capital's defamation claims as a summer trial looms.

March 23 -

An influx of investment into high-yield munis has created challenges for fund managers forced to compete against each other to get in on new bond offerings.

August 20 -

A federal judge denied Nuveen's motion to dismiss Preston Hollow's antitrust lawsuit concluding a "plausible" claim exists to proceed. PHC faces a tougher legal road ahead in proving its rival orchestrated a damaging boycott.

August 11 -

High-yield municipal bond returns are more than 6% so far in the year as Nuveen expands its reach in the sector with a new "interval" high-yield fund.

July 6 -

New evidence in PHC's defamation case against Nuveen has surfaced that involves Citi while a separate judge is considering whether to allow an antitrust charge to proceed

April 20 -

The legal tussle between the Dallas-based private lender and the Chicago-based investment powerhouse continues with defamation and antitrust claims pending in separate courts.

July 21 -

Preston Hollow says another court ruling proves some of its defamation claims. Nuveen counters that accusations fail to rise to defamation because many are opinion or true.

July 1 -

The amended complaint lays out the evidence from recorded calls presented during the former proceedings, naming some Nuveen officials that were referenced as unnamed individuals, broker-dealers and banks.

May 4