Nuveen said it

The fund is the biggest focused on state and local government junk bonds, a corner of the market that’s received a massive influx of cash at a time when the pace of new debt sales has struggled to keep up.

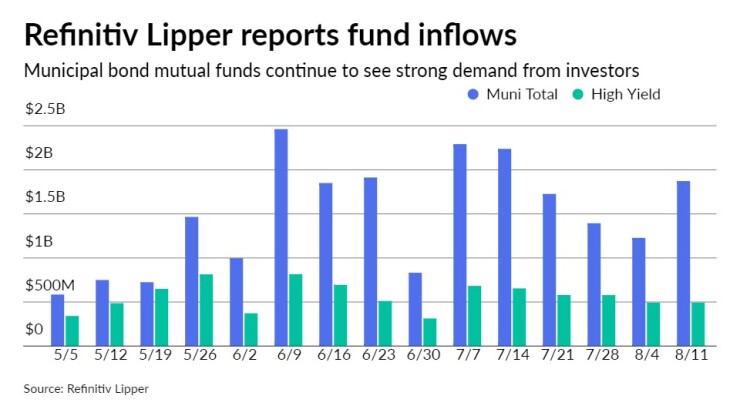

High-yield municipal funds have drawn in new cash week after week this year as the market rallied, delivering out-sized returns at a time when yields on the safest state and local government bonds are holding not far from record lows.

Investors have added nearly $17 billion of new money to such funds since the start of the year, according to Refinitiv Lipper US Fund Flows data.

That influx has created challenges for fund managers forced to compete against each other to get in on new bond offerings. At the same time, surging economic growth and the massive federal rescue package has left local government credit ratings broadly on the rise.

Nuveen’s High Yield Municipal Bond Fund, run by John Miller, is not only the market’s behemoth, with more than $24 billion of assets, but one that has also consistently outperformed its rivals. It has returned more than 14% over the past year, better than all but 2% of its peers, according to data compiled by Bloomberg.

The fund is

Nuveen is also closing its California high-yield muni fund to new investors after Sept. 30, the company said in a statement and

The step follows a similar move by rival Invesco Ltd., which closed its $11 billion high-yield muni fund to new investors.

“Nuveen investment and product teams will closely monitor market conditions and other fund-specific factors and will actively look to reopen the funds when it is deemed to be in the best interest of shareholders,” Nuveen said in a statement to Bloomberg News.