Preston Hollow Capital LLC this week intensified its pursuit of action against Nuveen Investments over what one judge has called the municipal titan’s “successful” attempt to damage its smaller rival’s direct lending business.

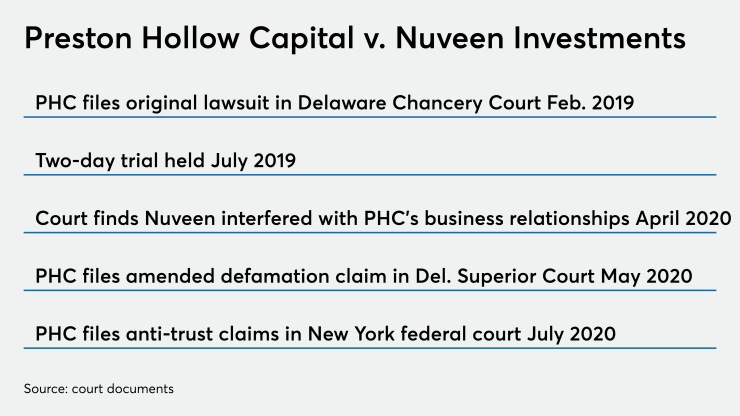

The Dallas-based lender that entered the high-yield space in 2014 filed an antitrust lawsuit Monday in the U.S. District Court for the Southern District of New York naming Nuveen and its Head of Municipals John Miller as defendants.

Similar to the original case PHC filed in the Delaware Chancery Court in 2019 and a

“This case arises from a series of threatening and anticompetitive communications made about Preston Hollow…to the leading broker-dealers in the municipal finance market, and to Preston Hollow’s primary lender, intended to organize a boycott of Preston Hollow by the broker-dealers and to cut off Preston Hollow’s financing,” reads the lawsuit that seeks a jury trial and asks for compensatory damages.

“The unlawful communications by Miller and his subordinates were intended to impair Preston Hollow’s ability to compete against Nuveen for investment opportunities in the high yield municipal bond market and to deprive borrowers of the ability to freely choose to use Preston Hollow’s unique services,” PHC writes.

The communications referenced in the lawsuit were presented to the Chancery Court in transcripts of recorded phone calls between Miller and members of his team with bank and broker-dealer representatives, as well as Deutsche Bank, PHC’s lender, during which Nuveen threatened to withhold its business if firms worked with PHC. The recorded communications ran from April 2018 through January 2019.

During the calls, Nuveen told broker-dealers that PHC “fleeced” borrowers and “engaged in predatory lending,” that deals were “rushed” and “covenant-light,” and that it had “evidence of Preston Hollow’s purported misconduct.”

Nuveen defended its actions in numerous past filings as a lawful effort to maintain its competitive edge and the firm argued it was acting within its rights as a business to shun firms that worked with PHC which Miller believed relied on “predatory” practices that overcharged borrowers and used weak covenants that he said he believed damaged the municipal market.

In the defamation case, Nuveen is arguing it’s not defamation if allegations are true or opinion. “Some or all of the challenged statements or alleged implications … are true or substantially true, and thus cannot give rise to any claim” and others are opinion and protected by the constitution.

PHC argues its 100% direct placement model offers a unique value and flexibility to borrowers and that Nuveen’s “marketplace vigilantism” is inherently anti-competitive.

PHC launched its legal fight in Delaware Chancery Court in February 2019 leveling four charges against its rival. They included tortious interference with business relationships, tortious interference with a contract, defamation, and antitrust violations based on New York’s Donnelly Act. While Miller played prominently in filings, he was not a named defendant.

It ended with an

Glasscock had previously dismissed the contract count and the defamation allegation finding on the latter that it required a jury trial and Chancery Court cases are decided by the judge. Glasscock also declined to rule on the antitrust count because there were several legal questions over the application of the law and injunctive relief as Delaware has a policy against innovating in sister-states’ laws. Glasscock had said questions remained over whether the Donnelly Act authorized injunctive relief for a private plaintiff.

“However, the Court of Chancery found as a matter of fact that Nuveen used its market power to organize an industry-wide boycott to eliminate Preston Hollow as a competitor” a violation of the Donnelly Act as well as the federal antitrust laws, PHC argues in the new complaint.

Because the judge declined to provide the injunctive relief sought by PHC, some municipal market participants said the end result was nothing more than a slap on the wrist for Nuveen. PHC countered that by prevailing on the one count it laid the groundwork to pursue Nuveen in other courts.

The allegations will now play out in Superior Court where PHC filed an amended complaint May 1 and in federal court with the filing of the antitrust allegations in violation of state and federal law. PHC is hoping to parlay the evidence from the Chancery Court proceedings and judge’s opinion to its advantage. Superior Court Judge Mary M. Johnston earlier this month set a schedule that calls for jury selection to begin Dec. 3 with an up to 10-day trial set for Dec. 6.

The case was originally pursued in Delaware Chancery Court given its expertise in corporate laws and the ability to expedite proceedings.

PHC said the New York court is the proper jurisdiction to pursue the federal antitrust case because the many of the broker-dealers on recorded calls are located in New York and Nuveen’s alleged misconduct has significant impact on competition in New York and the Donnelly Act is a New York law.

The firm is seeking monetary damages in both cases. In the newest case, PHC accuses Nuveen of violations of the Sherman Act, the Clayton Act and Donnelly Act. It also seeks damages for tortious interference with prospective business relations.

PHC had not sought monetary damages in the original case but asked the court for a preliminary and permanent injunction ordering Nuveen to cease the alleged conduct and to order Nuveen to rectify the harm already caused by withdrawing and disavowing retaliatory threats. Glasscock said he could not abide by the request for permanent injunctive relief because it is usually applied to prevent an ongoing harm such as an encroachment on real property, but he did give Nuveen a stern warning.

PHC is a Delaware limited liability company formed in 2014 with $2.1 billion in assets and $1.3 billion in equity capital. Nuveen is a global asset manager, with municipal bonds forming a subset of its various asset classes with fixed income assets under management of $150 billion.

When PHC filed the case in late February 2019 it cracked the window open on cutthroat competition in the high-yield municipal market. Its accusations sparked debate on the accusations of whether strong-arm tactics broke the law, broker-dealer complicity and resistance, and what constitutes pricing fairness.

During the proceedings, filings disclosed that a “governmental entity,” which could range from agencies with regulatory oversight or criminal prosecution powers, was interested in the recordings. Court documents showed that the PHC had contacted the unidentified entity about the litigation.