-

A lawsuit accusing underwriter Stifel of negligence on one bond issue is pending and broader claims related to the financings are being considered.

October 5 -

The prominent Chicago health system's refunding will simplify its debt structure, cut interest rates, and provide longer-term fixed financing.

July 20 -

Final payouts are approaching for $170 million of defaulted BHF bonds with haircuts ranging from less than 10% to more than 50%.

April 27 -

The Illinois-based health system, with a balance sheet helped by its insurance arm, will sell $600 million of AA-minus rated debt over the next month.

April 21 -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

April 16 -

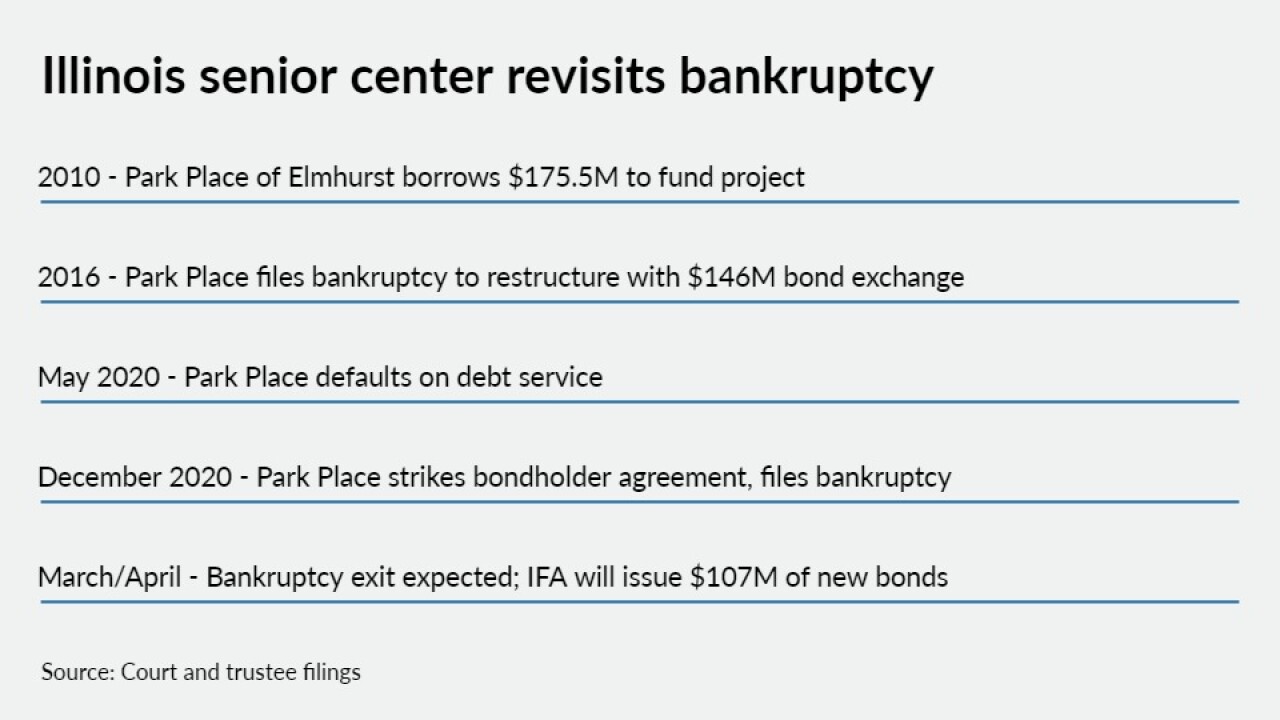

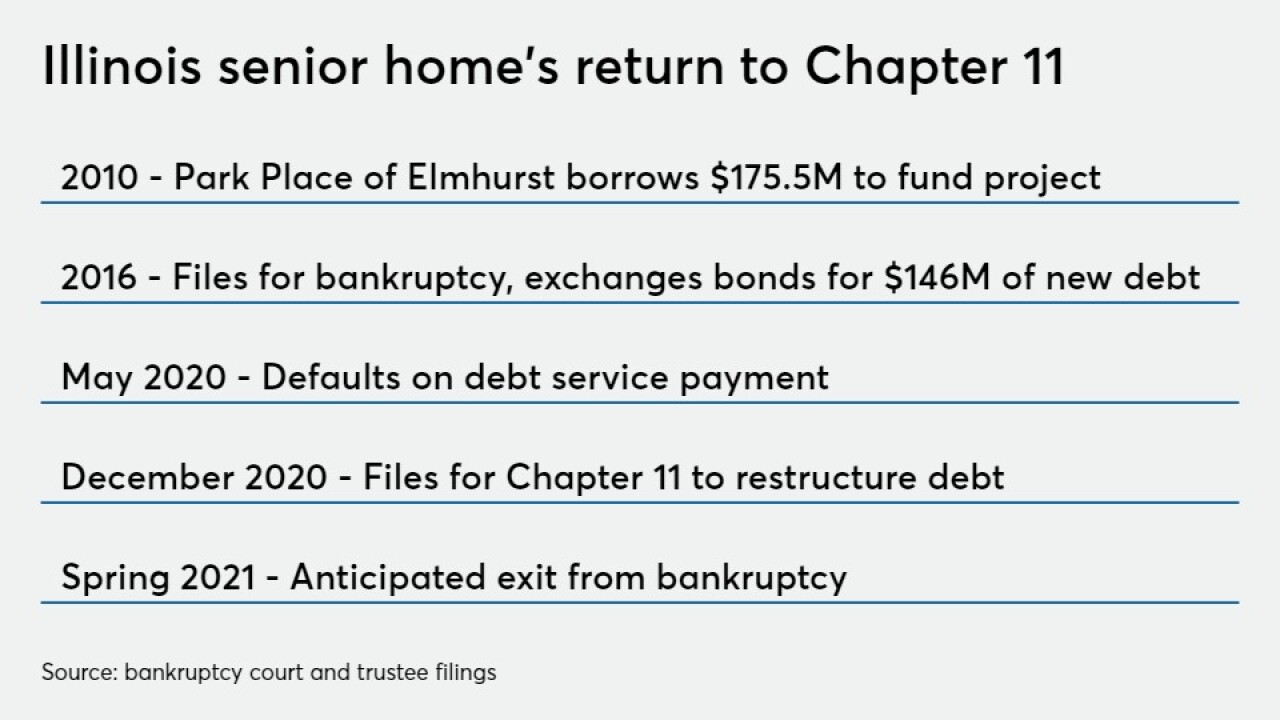

The facility and a majority of bondholders agreed to a restructuring that aims to ease repayment problems not solved by the previous bankruptcy in 2016.

February 24 -

Park Place at Elmhurst would restructure and redeem $141 million of bonds issued to exit its 2016 Chapter 11 under a plan pending before a bankruptcy court.

January 5 -

Deep bondholder losses are expected when the bonds issued for five Better Housing Foundation portfolios in and around Chicago emerge from Chapter 11.

December 8 -

The IFA is hoping to capitalize on growing investor interest in green and sustainable bonds.

November 10 -

The proposed combination of the major not-for-profit healthcare players in Illinois, Michigan, and Wisconsin encountered opposition in Michigan.

October 2 -

The new-issue market saw deals from Houston, the Illinois Finance Authority and the City and County of San Francisco, Calif., hit the screens.

September 17 -

The student housing and academic facility that serves the University of Illinois Chicago campus opened in August.

September 9 -

Northwest suburban Chicago-based Northwest Community Healthcare is joining the NorthShore University which operates five hospitals in the northern sububs and Chicago.

July 9 -

A bankruptcy judge will be asked to sign off on the sale of BHF's Shoreline portfolio in Chicago and will hold an initial Chapter 11 hearing on another portfolio.

June 19 -

The municipal market was hammered Wednesday by the COVID-19 pandemic with a more than quarter point correction in AAA benchmarks, issuers pulling deals off the shelves and more reports of pricing and evaluation confusion.

March 11 -

More than $1 billion of taxable and tax-exempt issuance is planned.

March 3 -

The Illinois attorney general's office is also believed to be looking into the foundation, which issued $170 million of tax-exempt bonds that have defaulted.

February 26 -

Taxable refundings caught on in the Midwest as they did elsewhere in the nation, helping the region post a 19% volume gain.

February 25 -

Bankruptcy hearings are underway for Lindan Properties, one of five troubled bond-financed Better Housing Foundation affordable housing portfolios in the area.

February 24 -

The state conduit that issued $170 million of defaulted Better Housing Foundation bonds is weighing in as S&P prepares housing bond criteria changes.

February 10