A bankrupt affiliate of the not-for-profit Better Housing Foundation is targeting the second quarter to close on the sale of a bankrupt affordable housing portfolio in Chicago that’s mostly vacant due to uninhabitable conditions and unable to repay $13.6 million of municipal debt.

Lindran Properties LLC, owner of the BHF's Shoreline portfolio, filed Chapter 11 late last month after reaching agreement with a stalking horse bidder.

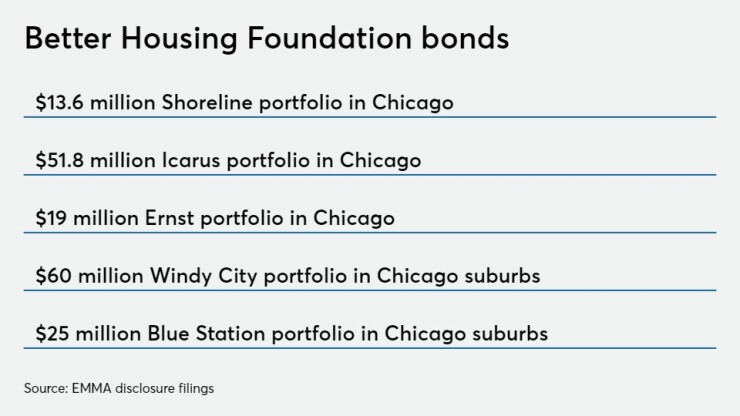

The not-for-profit Better Housing Foundation issued nearly $170 million of investment grade bonds through the Illinois Finance Authority between 2016 and 2018 to acquire three Chicago portfolios and two suburban portfolio.

Bidder PRE Holdings 14 LLC offered $3.9 million for the 13 buildings with 260 units, of which only about 10 have tenants. The others are uninhabitable. If additional bids are received that at least match the PRE Holdings bid, along with other terms, an auction will be conducted.

The “goal is to conclude a transaction in the early part of the second quarter,” Scott Schreiber, an attorney at Clark Hill Plc, said at a hearing last week before Judge Jack B. Schmetterer in the U.S. Bankruptcy Court for the Northern District of Illinois, Eastern Division. Schreiber said the bill for housing court receiver costs grows by about $100,000 monthly.

A proposed schedule may be considered at a hearing slated for later this week. If the order is approved this week, that would set the clock ticking on an up to 60-day deadline for additional bids. An auction and bankruptcy court consideration could then follow quickly.

Whether the sale and bankruptcy court approval will meet that schedule depends on what the final order says, the outcome of a potential bidding process, negotiations with the various creditors, and whether the various parties can resolve the questions posed by Judge Schmetterer at last week’s hearing.

The bankruptcy process allows for the sale of the assets free and clear of many debts and liens, with bondholders in line to collect a portion of the sale proceeds after the housing court-appointed receiver is repaid for expenses and overdue taxes and some other debts are paid.

The final payout for bondholders remains uncertain but given the difficult road for foreclosure and the need for capital funding to rehabilitate the properties so they can again generate rental income, a lawyer for bond trustee UMB Bank NA told the court it did not oppose the asset sale despite the size of losses that loom for investors.

The asset sale is the best option for bondholders from “a menu of poor options,” bond trustee lawyer James Kapp, a partner at McDermott, Will & Emery LLP, told the judge last week.

The trustee could have pursued foreclosure as permitted under the bond indenture but that’s a time-consuming process and could result in a weaker recovery given the poor condition of the properties and mounting liens.

At any time during the foreclosure proceedings, BHF also could have stepped in and filed bankruptcy, usurping the trustee’s efforts. The trustee could not force a bankruptcy and sale or bond restructuring because BHF is a not-for-profit.

The bonds are trading at 22 cents on the dollar, according to trade data on the Municipal Securities Rulemaking Board’s EMMA website.

More information about the rapid deterioration of the properties’ value that led to defaults on the bonds and the stalking horse bidder’s plans and financial resources are likely subjects of discussion in future proceedings based on the judge’s initial questioning of lawyers.

“What happened?” Schmetterer asked.

Lindran’s lawyer told the judge at this point it wasn’t about “finger-pointing” but about “finding a better capitalized company” to repair the properties. That may not be sufficient to appease the judge as the proceedings move forward as he also pushed the attorneys for a commercial valuation on the properties.

Nearly a dozen lawyers stood before the judge at last week’s hearing representing Lindran, the bond trustee, the bankruptcy trustee, the city of Chicago which took BHF to state court for violations, the stalking horse bidder, and other creditors.

The judge quizzed the lawyers on the conditions of the property and whether those with tenants were truly in “fit” condition. The judge was told the rented units passed city inspection but the condition of the vacant units was poor but are being secured by the housing court receiver.

The stalking horse bidder told the judge it intends to invest $10 million in the properties — one of the primary reasons the city supports the sale. The judge said he would make it a condition of his approval that the company, if it’s the sole bidder or prevailing bidder in an auction process, has the financial ability to honor that commitment.

The case is 20-02834.

When the Illinois Finance Authority bonds for the BHF, all carried ratings in the triple-B to single-A category from S&P Global Ratings depending on their senior or subordinate status, with the exception of one unrated series. The Chicago portfolios defaulted last June and the suburban portfolios followed in December.

The fate of and potential recovery rates for the other portfolios remain uncertain, as some are in better shape than others and are occupied and generating revenue, while others are mostly vacant and in disrepair. All options remain on the table as bondholders seek to recoup their investments, said several sources.

The Chicago-based portfolios stumbled out of the gate with reports of code violations, dwindling occupancy, and the loss of Chicago Housing Authority voucher payments. Ownership and management of the properties have traded hands on several occasions. The rapid deterioration has prompted bondholders during investor calls to question whether fraud occurred and that could be a legal avenue to pursue on a separate track.