Debt, pension and retiree healthcare liabilities held by states rose in fiscal 2021 but surging revenue put them in a better position to manage their obligations, Moody's Investors Service says in a report.

The look back based on states' fiscal 2021 results applying factors Moody's uses to calculate some numbers highlights the influence of COVID-19 pandemic dynamics on state liabilities as swelling tax collections that followed early pandemic hits during lockdowns bolstered states' ability to meet their debt obligations.

Moody's expects the pension piece of state liabilities to fall this year and while the picture on debt and revenue metrics is clouded given headwinds from rising interest rates, inflation and wage pressures on expenses, a decline expected in fixed costs as a percentage of revenue bodes well for states to manage the volatility. Rising interest rates also could keep state borrowing at bay.

"States are well prepared for a potential recession" when it comes to managing their fixed costs, said Pisei Chea, a senior analyst and one of the authors of the report published Wednesday. "The trend we saw is that fixed cost compared to state sourced revenues declined due to strong revenue growth. We expect that trend will continue in fiscal 2022."

Pension obligations stood out as the top liability for most states with total adjusted net pension liabilities (ANPL)— which Moody's calculates by applying a set of actuarial factors — rose 21% to $1.97 trillion.

"Below-target investment returns in 2020, the measurement date driving most states' fiscal 2021 pension reporting and falling interest rates contributed to the rise in total state" adjusted pension liabilities in fiscal 2021, Moody's said.

Fiscal 2022 ANPLs are projected to improve, falling an estimated 11% to $1.76 trillion based on the healthy returns being reported by funds for fiscal 2021. ANPLs are also still expected to fall for fiscal 2023 despite tumbling returns this year. That's because the discount rate used by Moody's will rise.

Adjusted net other post-employment benefits liabilities rose $516.1 billion and total net tax-supported debt (NTSD) rose 3.5% to $620 billion in fiscal 2021.

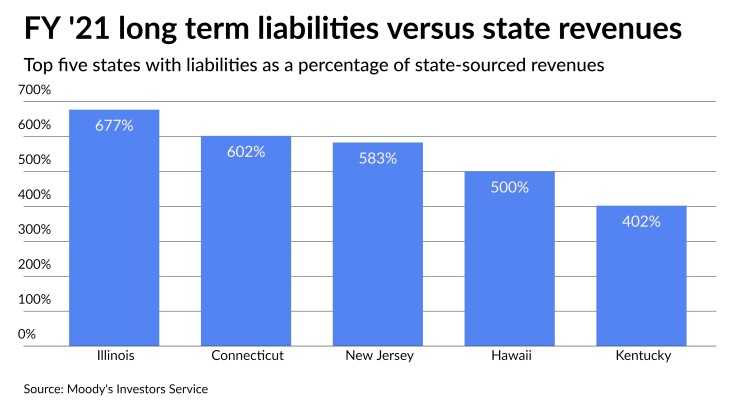

The cost of serving pension debts will "continue to weigh" on Illinois, Connecticut, and New Jersey due to the size of burdens, Chea said.

"With the strong revenue performance states had more capacity to service debt obligations," Chea said.

Hawaii, Aa2 and positive; Illinois, Baa1 and stable; Massachusetts, Aa1 stable; New Jersey, A2 stable; New York, Aa1 stable; Pennsylvania, Aa3 stable; and Virginia, Aaa stable, all added more than $1 billion in debt in fiscal 2021, with percentage increases ranging from 3% in Massachusetts to 15% in Hawaii. NTSD fell in 19 states in fiscal 2021.

Debt per capita and as percentage of personal income grew in fiscal 2021 with the median rising to $1,179 in fiscal 2021 from $1,096 in fiscal 2020.

At least 13 states with higher depreciation ratios of capital assets face pressure to borrow to upgrade aging assets and there's room as "most states have used operating revenue to support infrastructure investment in recent years, providing capacity to issue debt for infrastructure in future," Moody's said.

On pension liabilities, New York; Washington, Aaa stable; and Oklahoma, Aa2 stable are expected to see the sharpest drop in 2022 of their adjustment pension liabilities at more than 30%.

Moody's 2023 total ANPL among states will fall again as it will value liabilities used to calculate the number at a 4.48% discount rate as of last June 30 compared to 2.84% used a year earlier based on the FTSE Pension Liability Index.

"The increase in the discount rate will more than offset the double-digit investment losses in fiscal 2022 that will lead to a rise" in reported net pension liabilities based on governmental accounting standards, Moody's said.

While plummeting returns will sock state funds, the overall toll on balance sheets may be muted. "They have such large budgets and their own sourced revenue so those investment losses in relation aren't very large," Chea said.

The report reflects methodology changes Moody's applied this year. Beginning with the fiscal 2020 revised data, debt outstanding aligns with each state's fiscal year-end and typically includes all debt reported in a state's governmental activities. Moody's revised debt calculations also include unamortized bond premiums/discounts and accreted interest in the total net tax-supported debt calculation.

The report used fiscal 2020 data for Arizona and California as their 2021 financial reports were not available when the report was being written.