Want unlimited access to top ideas and insights?

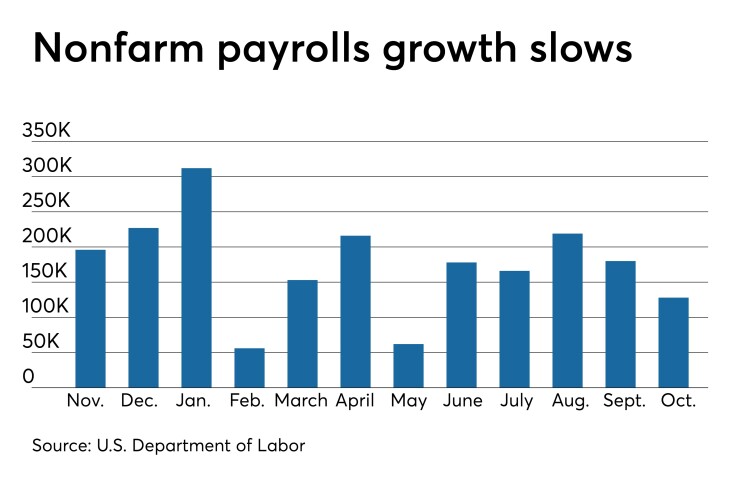

Nonfarm payrolls surpassed expectations, rising 128,000 in October, the labor Department reported Friday, supporting the belief that while slowing, the employment market remains strong, which will allow the Federal Reserve to hold interest rates steady.

“The Fed is looking smart today,” said Edward Moya, senior market analyst, New York at OANDA “The mid-cycle adjustment call seems to tentatively be justified with a robust labor market that continues to keep this record expansion going strong.”

The September payrolls number was increased to 180,000 from the 136,000 reported last month.

Economists polled by IFR Markets expected a 90,000 rise in nonfarm payrolls.

“Job growth has averaged 167,000 per month thus far in 2019, compared with an average monthly gain of 223,000 in 2018,” Labor said in a release. The strike at GM was expected to cost jobs, especially the manufacturing sector, where employment fell by 36,000 in the month. The unemployment rate ticked up to 3.6% from 3.5%, as expected, while average hourly earnings rose 0.2% and the average work week held at 34.4.

“Job creation is firm when you strip out the effects of strikes at GM and a drop in census employment, and aggregate wage growth is steady at around 3% (although alternative measures show wage growth for individuals somewhat higher),” said Charles Seville, co-head of Americas sovereigns at Fitch Ratings. “This is likely to confirm the FOMC in its view that a strong labor market is helping households without leading to significant inflationary pressure.”

“The U.S. has added jobs every month going back to October 2010 and as long as consumers feel confident, the economy should stay on track,” said Tony Bedikian, managing director and head of global markets at Citizens Bank. “The virtuous cycle of U.S. employment growth fueling consumer confidence and steady economic growth continues.”

The job creation despite the GM strike, combined with a “super low unemployment rate” and 3% wage growth, “all but assure consumers will continue to be the engine of economic growth,” said NAR Chief Economist Lawrence Yun. “The recent talk of a possible looming recession appears to have been a stretch.”

Jeffrey Cleveland, chief economist at Paden & Rygel, said, “Job growth remains resilient despite headwinds from multiple sources.” The average monthly increase “provides more than enough growth to push the unemployment rate even lower. After three rate cuts in three months, the Fed is ‘on hold’ barring ‘material changes’ to the economic trajectory. Today’s report does not warrant such a change. In fact, the October report once again displays the U.S. economy’s impressive resilience.”

But Oren Cass, a senior fellow at the Manhattan Institute, said despite the strong report, "the reality remains that we still have many fewer men working than during previous booms, wage growth is lower, and productivity growth is non-existent.”

With slower GDP growth, falling business investment and a federal deficit of nearly “$1 trillion in 2019, at a point in the business cycle when it should be approaching balance ... we should be focusing now on serious economic reforms that might produce healthier booms in the future,” he said.

Clarida

Fed Vice Chair Richard Clarida said the upside surprises on GDP and the employment report are “a good thing” and show the “economy’s in a very good place.” In a televised interview, he said the adjustments the Fed has made “have and will continue to give significant support to the economy.”

But the “balance of risks are still tilted to the downside” because of weak global growth, he added. Consumers will continue to spend, he isn’t concerned about wage inflation, and he’s “more optimistic” than other FOMC members on trend growth.

Clarida said the Fed’s moves that grow its balance sheet are not quantitative easing. He explained that QE targeted the long end, while the Fed’s recent purchases of T-bills have been to boost the short side and increase liquidity.

ISM manufacturing

The manufacturing sector contracted for the third consecutive month in October, as the Institute for Supply Management PMI ticked up to 48.3 from 47.8 in September. Economists expected a 48.8 read.

“Comments from the panel reflect an improvement from the prior month, but sentiment remains more cautious than optimistic,” according to the report.

Rosengren explains dissent

Federal Reserve Bank of Boston President Eric Rosengren explained his dissent at the latest FOMC meeting: “Fiscal and monetary policy are already accommodative. With labor markets tight, inflation near target, real GDP growing around estimates of its potential, and a moderation of the risks surrounding trade and Brexit, I believe further accommodation is not needed.”

Construction spending

Construction spending grew 0.5% in September, better than the 0.2% gain predicted by economists.