For the first time in eight years, tolls will go up on the Garcon Point Bridge in northwest Florida, increasing revenues that are paying back the bonds that built the 3.5-mile, two-lane span.

The bonds, issued 23 years ago, have been in default since 2011.

Leon County Circuit Court Judge John Cooper sided with bondholders Wednesday, ordering the Florida Department of Transportation to increase toll rates in accordance with the recommendations of a traffic and revenue study conducted by CDM Smith that was released in February.

Until Cooper ruled, FDOT disputed that bond documents made it responsible for increasing tolls. Although the Santa Rosa Bay Bridge Authority issued the bonds, there hasn’t been a board of directors for years.

FDOT has a lease-purchase agreement with the authority to operate and maintain the bridge, which also serves as a hurricane evacuation route.

“We are pleased with Judge Cooper’s ruling, which confirmed FDOT’s role and responsibilities under the lease-purchase agreement, as agreed to by FDOT when the bonds were first issued,” said Maria Cheng of MC Advisors LLC. Cheng is a consultant for a group of bondholders. “The judge agreed with the bondholders and FDOT’s own traffic consultant and has ordered the implementation of the toll increase.”

Cooper granted partial summary judgment from the bench, a ruling that was made in response to the December 2018 lawsuit filed by UMB Bank, the bond trustee.

A written ruling hasn’t been released yet.

“The department believes it has and continues to fulfill its obligations, including paying all costs and maintenance of the bridge, and will review Judge Cooper’s ruling to raise the tolls in the absence of a functioning authority on the bridge,” FDOT said in a statement.

Tolls for two-axle vehicles are currently $3.75 for both SunPass transponder holders and cash transactions. The fees are collected in each direction.

CDM Smith, which was hired by FDOT, has recommended tolls be increased by 75 cents for SunPass holders and by $1.25 for drivers paying with cash, for a total toll of $4.50 and $5, respectively. Tolls for vehicles with more axles would also rise.

UMB filed suit after requesting a rate increase in March 2015, which FDOT did not implement, and failing in 2018 to get the Legislature to sign off on restructuring the debt.

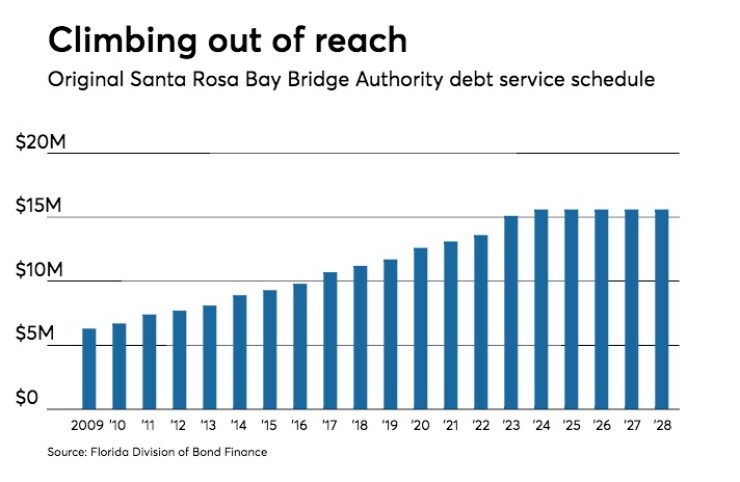

The Garcon Point Bridge opened in 1999, after the bridge authority issued $75.5 million of fixed rate, current-interest bonds and $19.5 million of capital appreciation bonds to finance its construction. Toll collections never met consultants’ projections and when reserves were exhausted, the debt went into default.

The bonds mature in 2028. The trustee accelerated the debt on Jan. 1, 2013, declaring all principal immediately payable as a result of the default.

According to UMB’s lawsuit, $134.9 million of bonds were outstanding as of July 1, 2018. The debt grows at a rate of about $6.8 million a year.

UMB contended in its suit that the LPA requires FDOT to “establish and collect tolls” if the bridge authority is not setting tolls in accordance with the rate covenant and the bond resolution.

“The bondholders made several unsuccessful attempts to resolve this issue outside of the court by offering alternatives to FDOT, the Legislature, and other stakeholders,” Cheng said. “However, all alternatives were rejected and resulted in bondholders losing millions of dollars in additional toll revenues due to FDOT’s failure to increase tolls.

“The bondholders remain willing to explore these previously offered alternatives or other reasonable solutions,” she said.

The litigation isn’t over, however. Bondholders are also seeking damages based on the amount of toll revenues lost from the time the trustee first asked for a rate increase, as well as attorney fees and other costs, counts associated with the case.

FDOT said it is unfortunate that toll collections never met the consultants’ projections, but the bridge clearly “serves a public purpose as evidenced by the more than two million vehicles that crossed the bridge in 2018.”

“The department will continue to work with the Legislature, the bondholders and UMB Bank to attempt to reach an amicable long-term solution that is agreeable to the citizens of the state of Florida,” FDOT said.