CHICAGO — The judge overseeing Preston Hollow Capital LLC’s lawsuit accusing Nuveen Investments of bullying banks to boycott the private lender dropped a defamation claim against the investment behemoth.

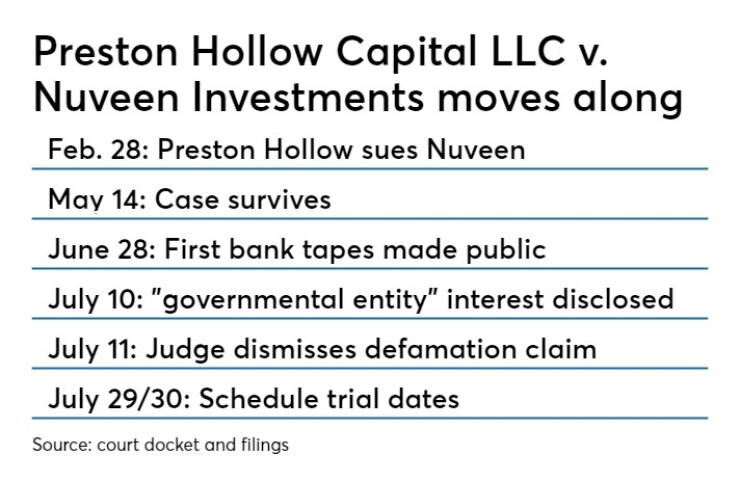

Delaware Chancery Court Vice Chancellor Sam Glasscock III’s ruling during a hearing Thursday follows his May decision to drop one count of tortious interference with a contract.

Two counts — one on tortious interference with prospective business relationships and the other on a violation of New York’s Donnelly Antitrust Act based on the allegation that Nuveen orchestrated a boycott — moved forward after the May ruling while the judge sought additional briefings on the defamation claim.

Glasscock told Nuveen and PHC lawyers

“There will be an opinion that will explain my rationale and will allow, ultimately, an appeal if that needs to be forthcoming,” Glasscock said during the hearing, according a copy of the ruling.

The opinion will rely in part on the Perlman case before his colleague Vice Chancellor Slights, Glasscock said.

Vice Chancellor Joseph R. Slights III recently concluded in the Perlman case that defamation complaints require jury review and so in Chancery Court where a chancellor renders trial decisions, it lacks jurisdiction, according to a report

Glasscock also denied PHC’s motion to file a revised complaint based on the latest information garnered from subpoenaed tapes and other material.

"We were pleased with the court’s decision to dismiss the defamation claim and continue to believe the rest of the allegations have no merit,” said Nuveen spokesman Stewart Lewack.

“We do not expect that the court’s written decision will be on the merits of PHC’s claim. Rather, we expect the decision will be based upon jurisdictional grounds, holding that any claim for defamation should be heard in Delaware’s Superior Court, not the Court of Chancery,” PHC spokesman Jonathan Morgan said in a statement on the hearing.

“Preston Hollow will present extensive evidence at trial concerning the false statements Nuveen representatives made about Preston Hollow in support of its claim for tortious interference with business relationships,” Morgan added.

Without a settlement in the coming weeks, Glasscock will preside over a trial beginning on July 29.

PHC lawyers believe the transcripts of recordings between Nuveen officials, including the investment powerhouse’s head of municipals John Miller, and banks and broker-dealers, provide the best evidence of its anti-trust allegations.

Transcripts of the conversations — recorded under regulatory mandates — between Nuveen and officials from Deutsche Bank, a primary provider of capital to PHC, and Morgan Stanley and Goldman Sachs have been made public.

The newly disclosed involvement of a “governmental entity” that wants to review the original audio recordings from Deutsche Bank led to the latest tussle between Nuveen and PHC after the latter wrote to the court Wednesday seeking guidance on the release of the recordings. PHC lawyers wrote that Nuveen had not consented to forward the recordings and it was seeking guidance as to the release of the recordings requested by a governmental entity.

Nuveen fired back in its own letter Thursday ahead of the hearing that PHC was misleading the court by not revealing that PHC has been the one that initiated the governmental contact and that Nuveen’s lack of consent so far was because it wanted to deal directly with the governmental entity.

During a discussion at the hearing Thursday over what form of approval might be needed, Preston Hollow attorneys told Glasscock that it was a co-counsel for PHC that contacted the governmental entity and it was that lawyer’s comment that “something illegal’s going on” which prompted the government entity’s request for the actual recordings, according to a Law360 report.

“The court and two sides left unsettled on Thursday who, or under what terms, the recordings would be released to the unnamed agency,” said the Law360 article.

Sources following the case said the judge was told by PHC that it doesn’t believe court approval was needed but they believed PHC penned the letter in deference to the court so it would be aware of the government entity’s interest. Sources also said they don’t believe Nuveen’s approval is needed.

The governmental entity has not been disclosed. While the Securities and Exchange Commission regulates banks, it’s the Federal Trade Commission working in tandem with the U.S. Justice Department that enforces federal anti-trust rules.

Brian Kelly, a former federal prosecutor and partner at Nixon Peabody in Boston, said the governmental entity request struck him as "odd" and that there was a good possibility the request came from the FTC.

"But DOJ is not out of the question; they could be curious about the public mention of it and want to review themselves," Kelly said. "And they’d be more likely to call over and ask for it now that it’s public."

Transcripts of the recordings lay out how Nuveen late last year offered Deutsche Bank — PHC’s primary lender — and many other major banks and broker-dealers the same choice: drop any direct placement dealings with its rival or lose Nuveen’s tender-option bond and primary and secondary market trading business.

Confidentiality seals on the transcripts were lifted by the court but the two sides have been hashing out information that remains redacted before transcripts are released. It’s unclear whether additional ones from the handful of broker-dealers subpoenaed will be released before the trial.

“You have to choose who you want to do business with. Because I don't want to do business with those firms that do business with Preston Hollow,” Nuveen's head of municipals, John Miller, reportedly says on a tape recorded conversation during which he accuses PHC of predatory lending practices.

Nuveen has responded in its defense that there’s nothing illegal about the tactics it is accused of using and that banks were offered a choice as Nuveen had made the business decision to no longer work with counterparties that did business with PHC.

The case pits Preston Hollow, which describes itself as a well-capitalized, non-bank finance company specializing in high-yield municipal specialty direct placement financings with more $1.8 billion in assets and $1.3 billion in equity capital, against a firm that is a top high-yield manager with $930 billion of assets under management including $154 billion in municipals.

While the case is headed toward trial, the judge has made clear that he'd like the two sides to settle. Whether that can be accomplished or discussions on that front are underway was not clear.

— Kyle Glazier contributed to this report