The consolidation of Illinois' suburban and downstate police pension fund assets has picked up speed since a

"Since the beginning of the year, the Illinois Police Officers Pension Investment Fund has received approximately $6.54 billion in pension fund assets from 218 local Article 3 funds into our statewide consolidated fund," said Richard White, executive director of the Illinois Police Officers Pension Investment Fund.

Nearly $10 billion of police public pension assets are held by suburban and downstate governments.

A total of 218 of the 357 eligible funds have or are in the process of transferring funds via seven monthly tranches, according to fund spokeswoman Kim Shepherd. Another 113 are scheduled for October transfers. Fifteen local funds that are participating in the litigation have not scheduled transfers and 11 have not transferred as scheduled.

At the time of the May ruling upholding the consolidation as constitutional, just 46 plans representing assets of $1 billion had transferred into the consolidated fund. With an additional 93 funds in the transfer process, it would have raised the asset level to $4 billion at the end of June.

With local governments drowning in pension-related debt, the state legislation that created a single police fund and a single firefighters' fund set a deadline of July 1, but it does not impose penalties for missing it.

The Firefighters' Pension Investment Fund reported in July that at the conclusion of the transition period it had received assets from 289 of the 296 of eligible pension funds, a 98% completion rate. That number has since grown to 292, leaving four still to transfer, according to a statement. The firefighters' consolidation had more widespread support among funds when the legislation was being debated, although two did join the litigation.

Gov. J.B. Pritzker won

Backers tout a reduction in administrative costs and higher-than-expected investment returns — all modest fiscal goals — but rating agencies consider it a positive credit step because municipal budgets are strained by rising payment demands that have forced tax hikes, service cuts, a string of pension obligation bond deals, along with asset sales. It also represented one of the rare actions taken by the state to help local governments on the pension front.

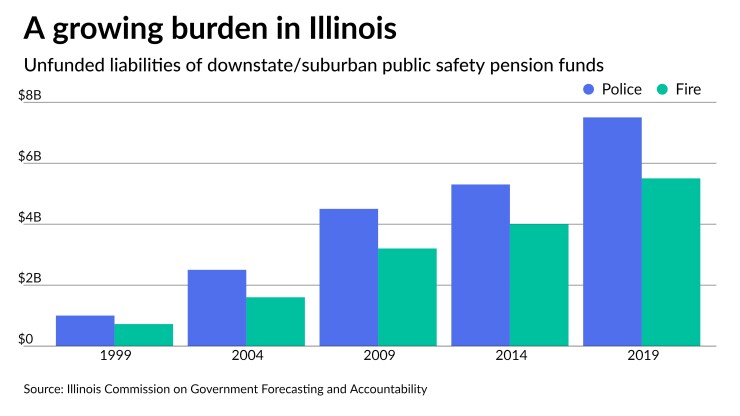

The unfunded liabilities of Illinois' suburban and downstate public safety pensions

The funded health of the public safety pension funds has tumbled over the years. In 1991, the collective ratio was at 75.65% and peaked at 77.31% in 1999. The police funds ended 2019 at 54.98% and firefighters were at 54.35%. The health of some individual funds, however, are far weaker with ratios only in the teens.

Police accounted for $7.5 billion of the total and firefighters for $5.5 billion, according to the most recent

While benefits would continue to be managed by local boards, some police funds and their advocacy organizations resisted the change, and a group of police funds sued, arguing the mandated consolidation equates to a benefit cut. The state constitution's pension clause bars any diminishment or impairment of promised benefits.

In Arlington Heights Police Pension Fund et al v. Jay Robert Pritzker et al, the plaintiffs argue that benefits are damaged because the law "strips plaintiffs of their autonomy and their authority."

The state, represented by Attorney General Kwame Raoul's office, countered that fund management doesn't enjoy the same status as "benefits" with constitutional protections.

Kane County Circuit Court Judge Robert K. Villa in a May ruling sided with the state in his

The plaintiffs filed their opening brief Aug. 31 and the state's is due Friday with the plaintiffs' reply then due Oct. 21. The appellate court will then decide whether it will grant oral argument on the case.

The case could eventually land on the desk of the Illinois Supreme Court for the final word.

The Illinois Municipal League and the Chicago Civic Federation advocate for more substantial change.

The IML's draft

The police fund also announced the hiring of Regina Tuczak to fill the position of finance director and assistant executive director. Tuczak previously was executive director of the County Employees' and Officers' Annuity and Benefit Fund of Cook County and the Forest Preserve District Employees' Annuity and Benefit Fund of Cook County.