The state judge overseeing the constitutional challenge of Illinois’ effort to consolidate suburban Chicago and downstate police pension fund assets will render a decision May 20.

The losing side will appeal, so the case will likely end up before the Illinois Supreme Court, but next month’s decision will impact the course of a consolidation process that is expected to miss a July 1 deadline.

Gov. J.B. Pritzker won

The plan has modest fiscal goals. It is supposed to cut administrative costs and raise investment returns but rating agencies consider it a positive credit step because municipal budgets are strained by rising payment demands that have forced some to raise taxes, cut services, issue pension obligation bonds, and sell off assets. It also represented one of the rare actions taken by the state to help local governments on the pension front.

While benefits would continue to be managed by local boards, some police funds and their advocacy organizations resisted the change and a group of

With the litigation pending, many police funds have held off on moving their assets and the court’s decision will come just a month ahead of the deadline, although funds don’t face any punitive actions for missing the deadline. The new Police Officers’ Pension Investment Fund

“I usually do not take this long to enter rulings on a case even of this size and with this sort of consequence,” Kane County Circuit Court Judge Robert K. Villa said at a Tuesday hearing. “There were several matters about the operation of the legislature and governor that have been knocked around that this court was, I believe, was wisely waiting for some guidance and was provided none.”

Villa set May 20 as the next hearing date and said he would have a written ruling ready by that date. The two sides last year laid out arguments seeking a summary judgment. The plaintiffs dropped their motion to certify class status. Even without class status, all funds would be impacted if the court overturns the legislation.

If the court sides with the plaintiffs and overturns the legislation the appeal would go directly to the Illinois Supreme Court due to the constitutional question at hand. If the court agrees with Attorney General Kwame Raoul’s office which is representing the state, the plaintiffs would appeal through a routine appeals process.

If the legislation is upheld, the police funds are expected to move forward with the transfer process during the appeal. There’s been confusion among the stakeholders over the litigation’s impact should the court overturn the legislation, which would also impact the firefighters' fund.

The firefighters’ fund is further along in the consolidation process and expects to meet the deadline. The firefighters’ consolidation had more widespread support among funds when the 2019 legislation was being debated while some police funds and pension associations opposed it.

"The Illinois Police Officer's Pension Investment Fund (IPOPIF) is pleased that the court has indicated a date on which a written ruling will be issued. The legal limbo brought about by the case has resulted in some local Article 3 pensions plans choosing to not transfer funds as mandated by the Act until a ruling is announced,” Richard White, the fund’s executive director, said in a statement. "No matter the ruling, the case likely will be heard by the Illinois Supreme Court. The IPOPIF team will remain diligent in our interactions with local police plans to assist them in transferring funds to the IPOPIF consolidated fund.”

To date, 32 plans have transferred assets totaling more than $660 million to the IPOPIF with an additional 16 funds scheduled to transfer funds May 2 which would bring the total to more than $1 billion. Nearly $10 billion of assets are managed by local police funds that eventually would be transferred if the consolidation is upheld.

"We also have transfers scheduled for June 1 and June 24. If funds who delayed their transfer wish to transfer after the May 20 court ruling, we will accommodate them as we are able,” White said.

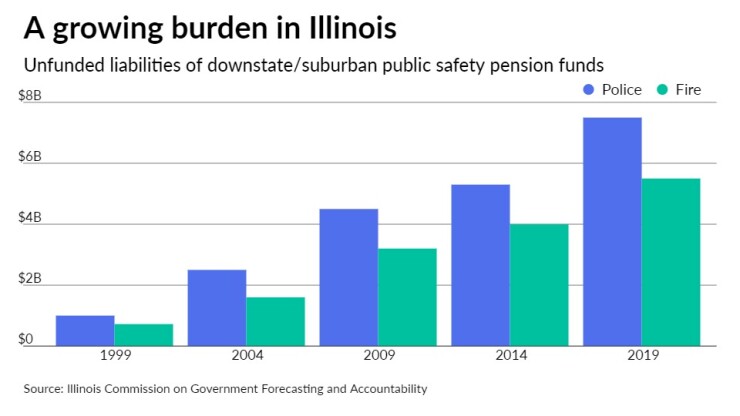

The unfunded liabilities of Illinois’ suburban and downstate public safety pensions

The funded health of the public safety pension funds has tumbled over the years. In 1991, the collective ratio was at 75.65% and peaked at 77.31% in 1999. The police funds ended 2019 at 54.98% and firefighters were at 54.35%. The health of some individual funds, however, are far weaker with ratios only in the teens.

Police accounted for $7.5 billion of the total and firefighters for $5.5 billion, according to the most recent

The court’s decision rests on its interpretation of what constitutes a “benefit.”

The case — Arlington Heights Police Pension Fund et al v. Jay Robert Pritzker et al – argues that benefits are damaged because the law “strips plaintiffs of their autonomy and their authority.”

The lawsuit contends that pension member benefits are being impaired because the transition costs are being covered by loans through the Illinois Finance Authority that the two new consolidated funds must repay.

“The legislation impairs the exclusivity and rights of the local funds to manage their funds locally and impairs and diminishes their ability to vote and to have their vote count,” Daniel Konicek, of Konicek & Dillon which is representing the police funds, said in an interview.

The state, represented by Richard Huszagh, assistant attorney general, has countered that constitutional protections are limited to membership benefits and not fund management.