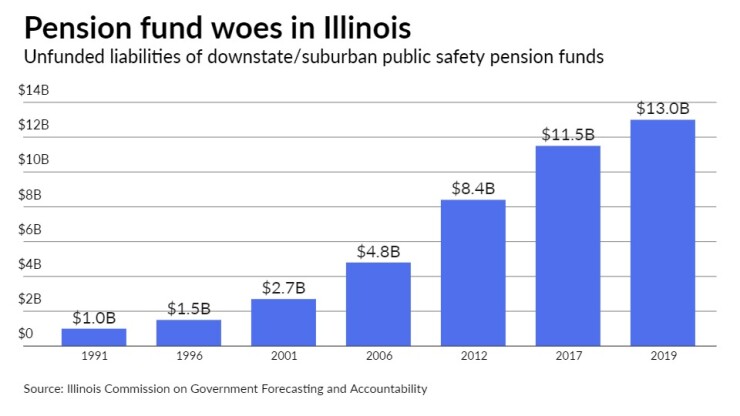

The unfunded liabilities of Illinois’ suburban and downstate public safety pensions rose to $13 billion in the last year of compiled results reported to the state, continuing a 29-year climb that underscores the deep strains on local government budgets.

The unfunded tab for the 295 firefighter funds and 352 police funds outside of Chicago grew to $13 billion in fiscal 2019 from $12.3 billion in 2018 and $11.5 billion in 2017. Police accounted for $7.5 billion of the total and firefighters for $5.5 billion, according to a

The rising tab could help the Illinois Municipal League’s

The League wants a re-amortization of the funding schedule that would extend the target date for achieving 90% funding beyond fiscal 2040, and lower the funding target to 80% from 90%. While both would ease the burdens on governments market participants have warned they are Band-Aid fixes that don’t solve the underlying funding strains.

The unfunded liabilities have climbed every year since at least 1991 when the collective unfunded tally was just $953 million. By 2000, they had risen to $2 billion growing to $7.6 billion in 2010.

“Over the 29-year period…net assets for Police and Fire pension funds have essentially grown at a pace of 6.15% per year while unfunded liabilities have expanded at 9.80% per year,” the new report says.

The results represent actuarial reports for fiscal 2019 and so don’t reflect strong investment returns recorded in fiscal 2021, but they highlight the poor health of many of the funds as the collective funding ratio is in the mid-50s.

Rising contributions are straining the coffers of many local governments, driving rating downgrades. Some local Illinois governments have turned to pension obligation bonds over the last two years as state actions to help so far have been limited to legislation to consolidate the funds to save on management costs. While the consolidation is underway, it’s facing a legal challenge.

The public safety pension tab brings the overall tally of the state’s public pension funds to roughly $213 billion based on COGFA and Chicago’s published reports.

The state government's unfunded pension liabilities dropped in fiscal 2021 to $139.9 billion for the first time since 2017 after peaking at $141 billion in fiscal 2020 and its funded health improved to 42.4% from 40.4%, propelled by investment returns that topped 20%.

Across the state, only the Illinois Municipal Retirement Fund, which covers local government general employees outside Chicago and Cook County, stands out as reasonably healthy with $4.4 billion of unfunded liabilities in 2019 and a 91% funded ratio.

The IMRF, the Chicago schools, the Chicago water reclamation district, Chicago Transit Authority and the Chicago Park District together add another $27.1 billion to the unfunded statewide based on 2019 results.

The funded health of the public safety pension funds has tumbled over the years. In 1991, the collective ratio was at 75.65% and peaked at 77.31% in 1999.

The police funds ended 2019 at 54.98% and firefighters were at 54.35%. The health of some individual funds, however, are far weaker with ratios only in the teens.

“Police and Fire pension funds bottomed out in the low 50’s in the wake of the 2008 stock market downturn, but have gradually increased each year since 2009,” the report said.

COGFA uses information culled from individual annual pension fund reports submitted to the Public Pension Division of the Illinois Department of Insurance.

Beginning in 2011, the state began requiring local governments to tie contributions to an actuarial level and reach a 90% funded ratio in 2040. In 2016 the state comptroller began enforcing an enforcement mechanism built into the law that allows funds to seek the diversion of various tax funds that flow through the state to municipalities who don’t make the full contribution.

Pressed on funding, some local governments have sold off assets like their water systems. Some market participants believe the pension bond numbers could accelerate amid concern that the window is closing on record low interest rates.

Illinois was the third largest source of POB issuance, behind California and Arizona, among local governments rated by S&P Global Ratings from the start of 2020 through September 2021.

“We expect continued issuance accelerations as issuers compare peers' seemingly successful transactions with their own large and growing unfunded liabilities, and some issuers might anticipate the end of record low interest rates,” S&P said in an October report.

Pension burdens weigh heavily on the ratings of Chicago, the state government and some other struggling local governments due to a flawed funding system and legislative action to date has made little headway in solving the quagmire, S&P Global Ratings

Gov. J.B. Pritzker won l

Under the legislation, local funds must transfer all of their securities, funds, assets, and moneys to the newly created Police Officers’ and Firefighters Pension Investment Funds by a July 1, 2022, deadline. Some transfers began this year and the process continues amid pending litigation filed by 18 individual police and firefighter funds in February.

While some pension funds fought the move most local governments seeking any help in reducing costs supported it and it was endorsed by the Illinois Municipal League. The consolidation’s benefits are limited but rating agencies believe it represented a positive step.

The plaintiffs argue the legislation violates the state constitution’s pension clause that reads membership “in any pension or retirement system of the state, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

The plaintiffs argue their benefits are hurt because the law “strips plaintiffs of their autonomy and their authority.”

The lawsuit further contends that pension members benefits are being impaired because the transition costs are being covered by loans through the Illinois Finance Authority that the two new consolidated funds must repay.

The state attorney general has countered that constitutional protections are limited to membership benefits and not fund management. The case, Arlington Heights Police Pension Fund et al. v. Pritzker et al, asks the court to declare the law unconstitutional and seeks class action status which if approved would impact all funds subject to the consolidation.

The new firefighters fund said it has data to support that it is meeting of the goal of the consolidation by reducing the cost of investing when comparing fees it paid compared to what would have been paid based on its assumption of $874 million of assets in October and $304 million of assets in November with $28 million of savings expected annually. The fund received $550 million in December.

“To date, FPIF has successfully transferred more than $2.8 billion in investment assets from 157 firefighter pension funds,” the firefighters’ reported on its site. The Board this month adopted an actuarial rate of return of 7.125%.

The police fund has hired advisors and issued administrative rules to manage the transition process but the website does not report any transfers yet.

“We anticipate that IPOPIF will be operationally ready to receive and manage assets by March 1, 2022,” executive director Richard Wright writes to pension board trustees in a

The Illinois Municipal League’s 2022 legislative agenda approved Dec. 11 includes efforts to give local governments more breathing room, including cutting the required funding ratio target from 90% to 80%.

“A lower funding rate will allow for flexibility to meet immediate funding for operations and provide sufficient stability for future pension obligations,” the IML said.

A second proposal would extend the amortization date for to at least 2050 or later from 2040 to provide “immediate financial relief to affected communities.” Only Chicago enjoys a longer schedule under its legislatively approved revamp that gives it to 2055 to reach a 90% funded ratio.