An Illinois judge upheld the constitutionality of legislation consolidating suburban Chicago and downstate police pension and firefighter pension fund assets.

The group of local police pension funds that challenged the merger is expected to appeal, which may eventually bring the case to the Illinois Supreme Court for a final decision, but Wednesday’s summary judgment order could speed up the police consolidation process that will miss a July 1 deadline.

Gov. J.B. Pritzker won

While benefits would continue to be managed by local boards, some police funds and their advocacy organizations resisted the change and a group of

In Arlington Heights Police Pension Fund et al v. Jay Robert Pritzker et al, the plaintiffs argue that benefits are damaged because the law “strips plaintiffs of their autonomy and their authority.”

The state, represented by Attorney General Kwame Raoul’s office, countered that fund management doesn’t enjoy the same status as “benefits” with constitutional protections.

Kane County Circuit Court Judge Robert K. Villa sided with the state in his

“In this case, the court finds that it cannot extend the term ‘benefits’ beyond the reach of prior Illinois Supreme Court cases (that this Court is aware of) to find the challenged legislation unconstitutional against the Pension Clause's protections,” Villa wrote.

Villa said prior high court opinions have considered “benefits” as those that “directly affect the value of a plaintiff’s pension benefit.”

Villa’s ruling came in the form of a summary judgment as requested by both sides.

The lawsuit also had argued that the legislation violates the constitution’s takings clause by taking or damaging plaintiff’s property without just compensation because the transition costs are being covered by loans through the Illinois Finance Authority which must be repaid by the consolidated funds.

Villa also rejected that argument.

“Although money damages can be sought in a takings clause claim, there are no allegations or evidence presented that plaintiffs currently drawing their pension benefit have suffered a present or will suffer a future loss in benefit payment,” Villa wrote. “Similarly, there is no evidence that those still employed will suffer a similar fate when they eventually retire.”

Daniel Konicek of Konicek & Dillon, which is representing the police funds, said of the order “the judge didn’t feel comfortable expanding the definition of benefits” despite some case law that has done that.

“We are seriously considering an appeal as there’s obviously some ambiguity and uncertainty that needs to be resolved” over the definition of benefits, Konicek said.

The plaintiffs have 30 days to file an appeal. If the court had overturned the legislation it would have bypassed the appellate court because of the constitutional question at hand and gone directly to the state’s high court.

The plan has modest fiscal goals such as reducing administrative costs and raising investment returns but rating agencies considered it a positive credit step because municipal budgets are strained by rising payment demands that have forced some to raise taxes, cut services, issue pension obligation bonds, and sell off assets. It also represented one of the rare actions taken by the state to help local governments on the pension front.

The attorney general’s office said it was pleased with the court’s decision.

Pritzker cheered the decision even though the court fight is expected to go on.

“This landmark ruling supports another pillar in my efforts to responsibly and comprehensively tackle Illinois’ pension debt, and I’m especially proud that we accomplished this consolidation after 75 years of previous efforts failed,” Pritzker said in a statement.

“We are pleased with the court’s ruling rejecting plaintiff’s constitutional challenges to the statute, granting defendant’s summary judgment motion and denying plaintiffs’ motion,” the new Illinois Police Officers’ Pension Investment Fund said in a statement.

The fund completed a third tranche of asset transfers on May 2 bringing to 46 plans the number of completed transfers with a par total of $1 billion. An additional 93 funds currently are going through the detailed process to transfer funds on either June 1 or June 24 which would bring the total amount to more than $4 billion by June 30.

Nearly $10 billion of assets are managed by local police funds.

With the litigation pending, many police funds have held off on moving their assets, so the fund will miss the legislation’s July 1 deadline although the new consolidated fund and local funds don’t face any punitive actions. Fund officials could not say when they expect all transfers to be completed as it will depend in part on whether all local funds now comply.

The new consolidated fund

The firefighters’ fund is further along in the consolidation process and expects to meet the deadline. The firefighters’ consolidation had more widespread support among funds when the legislation was being debated while some police funds and pension associations opposed it.

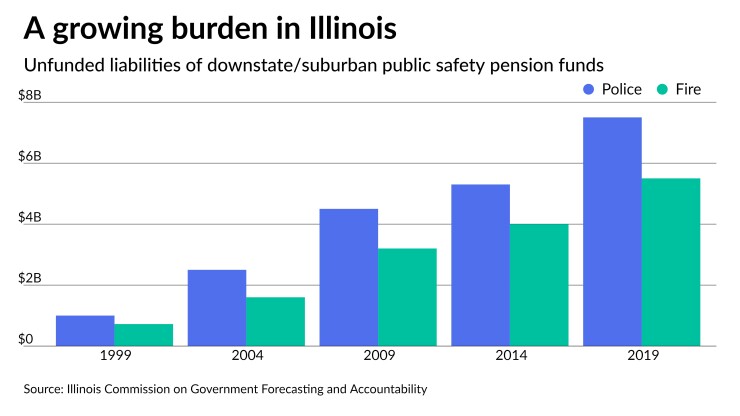

The unfunded liabilities of Illinois’ suburban and downstate public safety pensions

The funded health of the public safety pension funds has tumbled over the years. In 1991, the collective ratio was at 75.65% and peaked at 77.31% in 1999. The police funds ended 2019 at 54.98% and firefighters were at 54.35%. The health of some individual funds, however, are far weaker with ratios only in the teens.

Police accounted for $7.5 billion of the total and firefighters for $5.5 billion, according to the most recent