CHICAGO – Chicago returns to the market Wednesday with $535 million of water revenue-backed paper in a deal that sheds bank credit and counterparty risks, closing the door on a $2.2 billion downgrade-driven liquidity crisis.

The city highlights ratings between single-A and double-A on its water enterprise, support from rising rates pledged to repayment, and the more conservative structure of the portfolio being minted with the transaction.

"These offerings allow the city to completely eliminate variable-rate risk and swap exposure from the city's water credit," Kelly Flannery, deputy chief financial officer, told potential investors in a presentation.

Analysts acknowledge as much, but remain worried over fallout from the city's persistent fiscal strains caused primarily by a $20 billion unfunded pension tab.

"The ratings on Chicago's water revenue bonds will remain pressured by the city's long-term liability burden and its potential impact on the utility's financial margins. If that impact is significantly greater than currently anticipated, causing erosion in system key metrics, a rating downgrade would likely result," Fitch Ratings said.

The deal consists of two pieces. It reoffers $445 million of floating-rate securities, shifting them to a fixed-rate that no longer requires bank credit support.

$100 million will be reoffered from a 2000 deal with maturities between 2028 and 2030, and $345 million from a 2004 issue with maturities between 2017 and 2027.

The second piece consists of $90 million in new money to reimburse city credit lines that were tapped to pay to terminate the swaps.

That piece consists of a taxable $22 million series maturing in 2016 and 2017 to reimburse the city for fees on the 2000 issue. Another $67 million of tax-exempt bonds maturing between 2023 and 2031 will cover the 2004 swap termination fees.

PNC Capital Markets LLC is the bookrunner with nine firms rounding out the syndicate.

Pugh, Jones & Johnson PC and Cotillas & Associates are co-bond counsel and Greenberg Traurig and Golden Holley James LLP are co-disclosure counsel. Sycamore Advisors LLC and Public Alternative Advisors LLC are co-financial advisors.

The borrowing finishes carrying out the costly decision announced by Mayor Rahm Emanuel's administration in early 2015 to shed floating-rate and swap exposure in all but its airport debt portfolios.

The move didn't come soon enough; in May 2015, Moody's Investors Service downgraded the city's general obligation bond rating to junk and moved its water and wastewater debt lower on the investment grade scale. The blows triggered termination events that could have allowed banks to accelerate repayment on existing short-term loans and floating-rate bonds, and demand payments to terminate the associated swaps, dropping a potential $2.2 billion liquidity bomb on the city's balance sheet.

The city last year resolved much of the headache by paying off its short-term lines and converting wastewater, GO, and sales tax bonds to a fixed-rate.

The city had some breathing room to resolve the water issue after it successfully renegotiated terms and/or obtained waivers to remove the near-term liquidity risks.

"Getting out of the swaps position is an important milestone for Chicago. Meant to hedge variable risk, swaps became an expensive and potentially problematic liquidity risk for Chicago that it could ill afford," said Richard Ciccarone, president of Merritt Research Services LLC. "Retiring the swaps for both the water bonds as well as the GOs removes one potential land mine."

RATES

Investors may find the water paper more palatable than the city's GOs but the security "doesn't make them immune from interest rate penalties" demanded due to "the city's fiscal challenges," Ciccarone said.

The deal's timing is good given strong demand for municipals and investor hunger for extra yield that the deal is expected to offer due to the city link, several traders said.

"I think the deal will do very well as a revenue bond with a dedicated revenue source," said Jim Colby, senior municipal strategist at Van Eck Global, who agreed that the sale will benefit from market inflows.

Colby said analysts, whether from rating agencies or investment houses, will look favorably on the city's resolution of the liquidity crisis but that it may not have a notable impact on the pricing. "

It's one last thing off the books that we have to worry about, but whether it makes a significant difference" is questionable," Colby said.

Investors squeezed a more modest penalty out of Chicago on its $419 million wastewater revenue restructuring in October than on its recent GO sales. The city's wastewater credit is closely aligned with the water credit, with ratings ranging from Moody's Baa3 to Fitch's AA.

The 10-year maturity on the bonds paid a yield of 3.46%, 145 basis points over the Municipal Market Data's top-rated benchmark, a 48-basis-point spread to MMD's triple-B scale; 90 points over single-A; and 125 basis points above MMD's double-A scale.

At the time, the city's 10-year GOs hovered at around 250 basis points over MMD. The city's 10-year more recently has been trading at a 280 basis point spread.

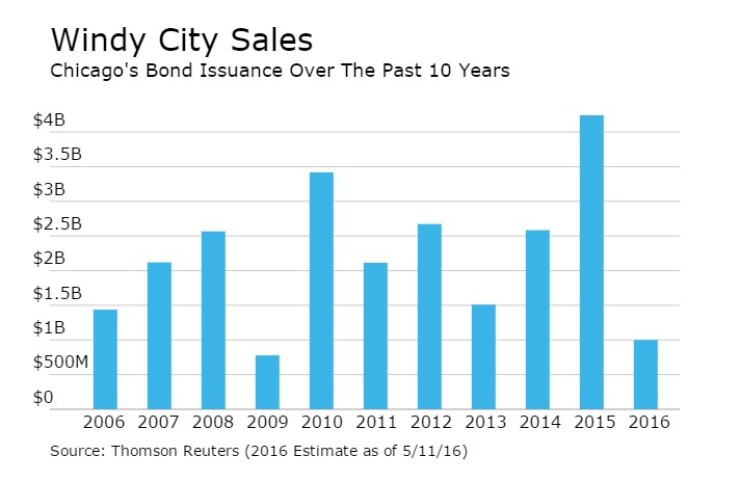

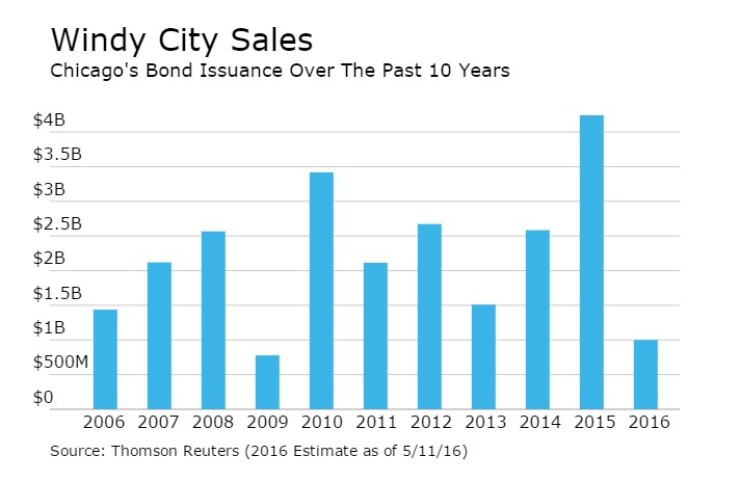

The city has a series of sales planned for the remainder of the year that include more than $1 billion of new money and refunding and restructuring GOs, up to $1 billion of Midway Airport-related borrowing, $400 million of wastewater revenue bonds, $200 million of new money water revenue bonds, and $200 million of new money and refunding sales tax bonds.

The city highlights in its investor presentation for this week's deal the diverse service base for city water that counts 125 suburbs as clients and covers 41% of the state's population with a 21% increase in the service population since 1990. It calls the city's source of water from Lake Michigan among the best in the world.

A series of City Council-approved rate increases began in 2012 to accelerate upgrades of 880 miles of water main and other infrastructure projects in a 10-year $3.8 billion capital program.

Debt service was at 2.6 times last year and will hover around two times through 2019. The city is required to raise rates to cover debt service, said city debt manager Michele Curran.

About 28% of the capital program has been funded on a pay-as-you-go basis since 2012 to limit rising debt.

"We believe this balanced approach is a credit strength," Barrett Murphy, acting commissioner of the Department of Water Management told investors. The deal will bring the city's water debt portfolio up to about $2.3 billion, mostly issued under the second lien.

The bonds are backed by net system revenues after operating and maintenance costs are paid and deposits are made into a rate stabilization fund.

RATINGS

Ahead of the sale, S&P Global Ratings raised the senior lien rating one notch to A-plus and the second lien to A and assigned a stable outlook in recognition of the "removal of counterparty and liquidity risks," said analyst Scott Garrigan.

The water bonds had been on CreditWatch with developing implications since May 2015 due to the risks tied to the termination and bank default events.

"Constraining the rating in the near term are several factors that, in our view, could become longer term constraints to the rating because they are related to the water system's long-term debt profile and the city's overall financial stress," S&P said.

Fitch affirmed the AA-plus rating on $37 million of senior lien water revenue bonds and the AA rating on $2.2 billion of second lien debt, all with a negative outlook.

"The rating outlook remains negative as higher pension contributions and anticipated new debt service, combined with limited expected revenue growth, may materially weaken financial metrics over the next few years," Fitch said.

Kroll Bond Rating Agency affirmed the second lien at AA and stable.

Moody's, which was not asked to rate the deal, assigns a Baa1 rating to outstanding senior lien debt and a Baa2 to the second lien, with a negative outlook.

City finance officials said payments of $20 million, or 2.5% of water revenues, were made to the city's laborers' and municipal employees' pension funds in 2015.

Future liabilities are unclear after the Illinois Supreme Court affirmed a lower court ruling striking reforms to the two funds.

The city's plan called for higher contributions, so there's a near term easing of higher contributions, but without reforms contributions could go up even more to rescue the funds from insolvency that looms in the next decade.

The water system includes two large conventional water purification plants, 12 pump stations, four water intakes from Lake Michigan and transmission network. The city says the James W. Jardine plant on the Lake Michigan shore is the world's largest freshwater treatment facility.