Texas Southern University's finances are the target of an investigation by Texas agencies in the wake of a state audit that uncovered deficiencies in oversight and reporting.

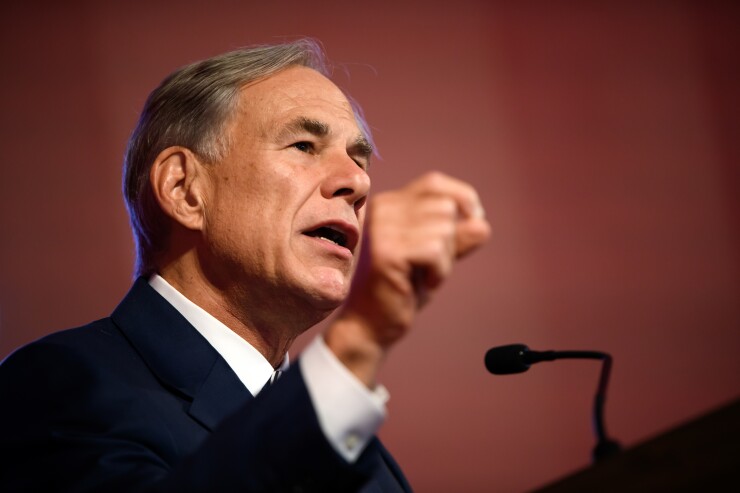

Gov. Greg Abbott this week directed the state comptroller's office and public safety department to probe Houston-based TSU, one of the nation's historically black colleges and universities.

"The Texas State Auditor uncovered significant financial and operational issues with Texas Southern University's accounting procedures, alleging the potential misappropriation of hundreds of millions of dollars," the Republican governor said in a statement, adding, "waste, fraud, and abuse will not be tolerated."

Acting Texas Comptroller Kelly Hancock called the audit findings "alarming."

"They include millions of dollars tied to expired contracts, late financial reports and missing asset records," he said in a statement. "These aren't clerical mistakes; they're systemic failures that demand answers."

Texas Lt. Gov. Dan Patrick also ordered an investigation and planned to discuss a freeze on TSU's state funding with Abbott and House Speaker Dustin Burrows,

In fiscal 2024, TSU received $1.793 million in direct state funding and $5.47 million in state pass-through revenue, which accounted for about 5.3% of its operating revenue, according to

In a statement on Tuesday, the university's board of regents said it has been cooperating with the state auditor.

"The board fully acknowledges that Texas Southern has faced historical challenges related to financial oversight, procurement practices, and compliance with prior state audits," the statement said. "These issues have persisted across multiple administrations and are now being addressed."

The university, which sells debt through the Texas Public Finance Authority, had $137.8 million of outstanding revenue bonds at the end of fiscal 2024, according to its annual audit.

In May, Fitch Ratings upgraded the university's bonds to A-minus with a stable outlook from BBB-plus, citing a "generally improving enrollment trajectory since fiscal 2021."

"This trend has contributed to recent gains in net tuition and fees revenue, a return to positive operating margins, and stronger than historical adjusted cash flow margins, underpinned by TSU's ability to sufficiently reduce operational spending over fiscal years 2023-2024, which, in total, also supports the upgrade," Fitch said in a report.