-

The Montana Facility Finance Authority can directly issue debt for a broader array of organizations following a legislative change.

May 13 -

The $250 million in debt being issued for Montana Renewables is equal to nearly half the state's issuance for last year.

March 20 -

The debt issued through conduit Gallatin County, Montana, benefits an aerial firefighting company that went public through a SPAC weeks after the bonds sold.

August 11 -

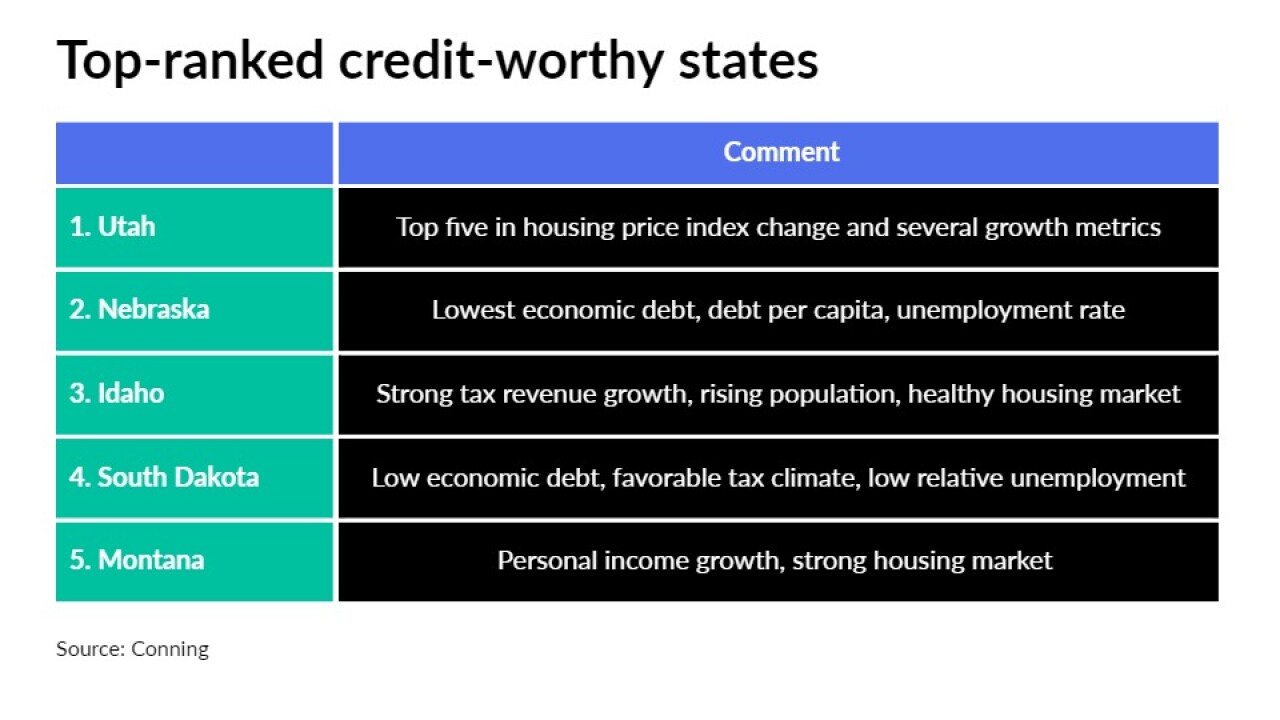

While the report offers many positives for states, headwinds loom, according to investment management firm Conning.

May 19 -

States are well-positioned to emerge from COVID-19, the investment firm said in its annual grading.

May 18 -

In Montana, two school districts and the state government reported that a new state law signed by the governor on May 6 will end the state tax deduction for certain school bonds after 2023 if those bonds are federally taxable.

May 10 -

After eight oil-producing states recovered from the 2014 oil price collapse, they face another downturn, S&P Global Ratings said.

March 11 -

Issuers in the Far West sold $85 billion of municipal bonds in 2019, a 23% increase from 2018.

February 27 -

Dozens of minor-league teams would get the ax under a Major League Baseball proposal, leaving governments holding the bag for stadiums they subsidized.

January 31 -

The Financial Industry Regulatory Authority found D.A. Davidson & Co. provided inaccurate pricing in issue price certificates.

December 6 -

Issuers in the nine-state Far West region sold $34.6 billion of municipal bonds in 2019's first six months.

August 22 -

Voters in three states approved Medicaid expansion, highlighting dozens of ballot measures around the country that will impact budgets and credit.

November 7 -

NASBO Executive Director John Hicks said that deposits made to rainy days funds from budget surpluses will likely bring the total to more than $58 billion for fiscal 2018.

August 29 -

Issuance was down 27% in the region from the first half of 2017, and almost 30% in California, its largest market.

August 23 -

Sen. Jon Tester, D-Mont., and co-sponsors of a recently offered bill want to prevent businesses in their states from being forced to collect sales taxes from e-commerce transactions.

July 3 -

New York, New Jersey and Connecticut are the first states to have created charitable funds that taxpayers can contribute to in order to claim a charitable deduction in lieu of paying state and local taxes.

May 24 -

The IRS notice warns that federal law, not state law, controls how payments for federal income tax purposes are characterized.

May 23 -

Democrats are frustrated that President Trump's infrastructure plan would require state and local governments to come up with the majority of funds for infrastructure projects.

March 14 -

The university expects healthy reception for its higher education bonds in a supply-constrained market.

January 22 -

Economic development leaders on Wednesday cleared a major final hurdle for the development of Glacier Rail Park when the Flathead County commissioners unanimously approved a resolution for port authority revenue bonds needed to finance the relocation of CHS to the rail park.

December 1