Municipal issuers in the Far West sold $37.3 billion of bonds during the first half of 2017, down 27% from the same period a year earlier, according to Thomson Reuters.

The Far West experienced the first-half volume slump more intensely than the national municipal bond market, which saw issuance fall 18.1% nationally to $164.7 billion for the first half.

The nine-state region got off to a particularly slow start, with first quarter volume falling 43.7% year-over-year to $13.4 billion on 219 deals. Second quarter volume fell $12.4% year-over-year, to $23.9 million on 343 deals.

The loss of advance refundings in federal tax law changes passed at the end of 2017 had an impact. Many deals were pulled forward into late 2017 amid eventually unrealized fears that Congress would also ax private activity bonds.

“I think the loss of advance refundings is going to reduce volume by 20% this year – and maybe even next year,” said Raul Amezcua, a managing director with Stifel, Nicolaus & Co. “I don’t see new money offsetting it.”

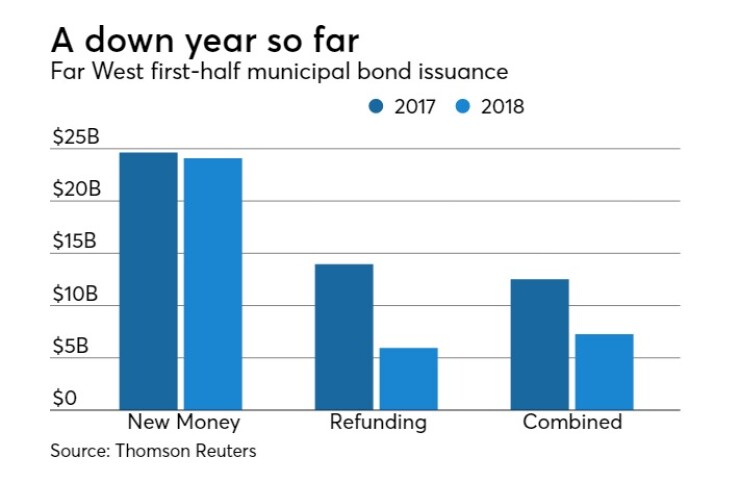

Far West new money bond sales slipped 2% from the first half of 2017, $24.1 billion, while refundings fell 57.4% to $5.9 billion. Deals classified as combining new money and refundings were off 41.9% to $7.3 billion.

The sale of taxable municipal bonds increased by 11.1% in the Far West region to $4.8 billion. There were 73 taxable deals, down from 86 a year earlier.

California was responsible for more than two-thirds of the region’s issuance at $26.7 billion, down 29.9%.

New money issuance from the Golden State was down 7.4% to $16.2 billion while refundings fell 60.9% to $4.2 billion. Combined sales fell 35.8% to $6.3 billion.

Bonds that Thomson Reuters classifies as general purpose were up 23% in California to $7.4 billion, while the education sector fell 44.2% to $7.4 billion and transportation dropped by 5.1% to $4.7 billion. Housing volume grew 85.3% to $1.8 billion.

California's State Treasurer's Office almost doubled the amount of taxable debt it issued in 2018 to $2.15 billion from $1.2 billion in 2017, said Tim Schaefer, deputy treasurer for public finance.

Last year’s taxables were new money, while this year’s have been split with just under $1 billion in new money and $1.2 billion for refunding, Schaefer said.

A combination of taxable Build America Bonds coming due and the elimination of advance refundings have led the state to increase the amount of taxables it issues, Schaefer said.

Many issuers have found savings through issuing taxable debt to refinance tax-exempt bonds that were sold at higher rates.

“Remember that in 2009, at the depths of the great recession, there was a concerted effort on the part of all of the leaders in the state to push out as much bonded indebtedness as we could muster for shovel-ready projects,” Schaefer said. “We are coming up on the 10-year anniversary on that. Last November, we were chipping away at small portions – and not just BABs, but tax-exempts.”

When Congress eliminated advance refundings, one of the tools at California's disposal was to determine whether or not it could refund taxable bonds with tax exempt and still save money, Schaefer said.

“And the answer was, “'We could, and we did,'” he said.

“Because we have this big bubble coming up next year with all the bonds issued in winter and spring 2009, rather than expose ourselves to market risk and some extraordinary size, we took the high average shot, to use a sports metaphor, rather than the low average,” he said. “That accounts for part of the $1.2 billion refunding bonds.”

The California state government sold $4.32 billion in the first half of 2018 compared to $4.64 billion in the first half of 2017 and sold $2.46 billion in new money bonds in first half 2018 compared to $1.76 billion in first half 2017, according to the treasurer’s office.

California general obligation deals were the region’s two largest with a $2.2 billion deal pricing on March 6 and a $2.1 billion deal pricing on April 17. That $4.3 billion made California’s state government the nation's top issuer.

The Golden State Tobacco Securitization Corp. had the Far West's third-largest deal, pricing $1.7 billion in June.

“With respect to the state’s GO bond sales, it is common for the amount we issue for each bond/purpose act to fluctuate substantially from sale to sale due to a host of different factors,” said H.D. Palmer, a state Department of Finance spokesman. “The differences from sale to sale should not be interpreted as an indication of any particular trend.”

Overall volume was down in California, Hawaii, Idaho, Montana, Nevada and Oregon, where volume had the steepest fall at 56.1%, to $1.8 billion.

Alaska was up 78% $296.8 million, on four deals, versus $166.4 million in four sales a year earlier.

Washington remained the Far West state with the second-most municipal bond volume at $4.7 billion, posting a 20% rise in sales. Wyoming was the other state to post an increase, of 4.2% to $77 million.

Throughout the Far West, deals classified as education dropped 41.6% to $10.2 billion from $17.4 billion while transportation dropped 10.5% to $6.1 billion from $6.9 billion.

A Hawaii GO transaction was the largest Far West deal outside of California, with $775 million sold May 10 to be the region’s ninth largest of the first half.

Bank of America Merrill Lynch topped the regional senior manager table, credited by Thomson Reuters with $7.4 billion of volume. Morgan Stanley trailed with $5.3 billion, followed by $5.2 billion for Citi.

Public Resources Advisory Group led the rankings of financial advisors, credited with $7.3 billion of business. Public Financial Management was second with $5.6 billion. Piper Jaffray came in third with $2.2 billion.

Orrick Herrington & Sutcliffe continued its position atop the bond counsel rankings, credited with $15.1 billion. Stradling Yocca Carlson & Rauth came in second at $2.7 billion of business. The third slot went to Hawkins Delafield & Wood with $2.5 billion.