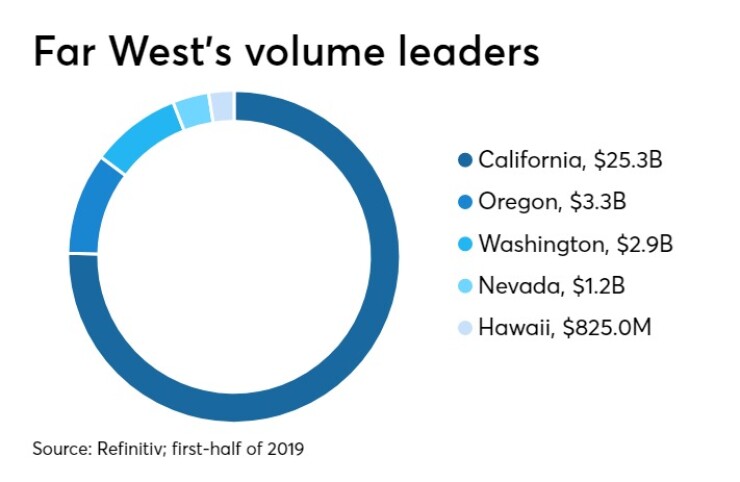

Municipal bond issuers in the nine-state Far West region sold $34.6 billion of debt in the first half of 2019, a 7.4% drop from the same period of 2018, according to data from Refinitiv.

Nationally, bond volume rose 2%, driven by a 34% surge in the Midwest and 9% increase in the Southeast. The Far West was the second-largest source of municipal bonds, behind the $44.9 billion output of the Northeast.

“We have a lot of money chasing fewer bonds,” said Tim Schaefer, deputy treasurer for public finance in California. “The market is in very good technical shape. That benefits California. It is clear that the wind is at California’s back at this point.”

The market has seen eight or nine months of constant inflows into the mutual fund sector — and the mutual fund sector is the dominant buyer of state and local government debt, Schaefer said.

“That is especially true for California,” Schaefer said. “We have a couple of mutual fund complexes that own billions of dollars of our bonds.”

Refundings were the culprit for the decline in the Far West where the region experienced a 42.2% drop. Nationally, refundings were up 9.9% compared to the first half of 2018.

In the full year of 2018, Far West refundings were off 57% from 2017 after federal tax law changes to eliminate advance refundings.

Far West first quarter sales at $18.8 billion in 281 deals outpaced the same period a year ago by 40.4%, but sales plummeted by 34.1% in the second quarter to $15.8 billion in 286 deals.

The region’s largest source of bonds, California, saw a 5.4% decline in volume to $25.3 billion, but hit that figure with a larger number of deals at 405 compared to 380 deals in first half 2018. Alaska and Nevada saw the deepest declines with Alaska falling 48.7% to $152.2 million and the Silver State sliding 41.9% to $1.2 billion.

New money bond sales in the region were down 0.9% year-over-year to $22.2 billion. Deals classified as combining new money and refundings rose 9.9% to $7.9 billion.

The sale of taxables dropped this year by 9.8% to $4.4 billion.

New money issuance from the Golden State rose 3.7% to $14.9 billion while refundings fell 47.9% to $3.1 billion. Combined sales rose 14.3% to $7.2 billion.

Education sector deals in the state were up 13.1% to $8.3 billion while deals Refinitiv classifies as general purpose dropped 6.8% to $6.8 billion and transportation dropped by 5.5% to $4.5 billion. Utilities rose 34.6% to $2.2 billion.

California’s state government was credited with selling $5.2 billion of debt in the first half, making it by far the Far West’s biggest issuer. It sold $2.3 billion in general obligation bonds March 6 and $2 billion in GOs April 11 in negotiated deals, the region's first- and second-largest deals. It also sold $842.9 million in taxables March 26 in a competitive deal, which was the region's fourth-largest.

San Francisco's airport commission priced a $1.8 billion deal in January. The region's third-largest deal also sent San Francisco to the number-two slot among the region's issuers with $1.9 billion.

The California state government's refunding deals landed $1.1 billion in net present value savings in the first half of 2019 compared to $371.8 million during the same period last year, according to the treasurer’s office.

California almost doubled the amount of taxables it issued in first half 2018 to $2.15 billion from $1.2 billion in 2017, Schaefer said. This year, at $842.9 million, the amount is less than both years, according to data from the treasurer’s office.

He attributed last year’s increase in taxables to a combination of BABs coming due and the elimination of advance refundings.

Look to 2009 — and the 10-year call feature common in municipal bonds — for clarity into why the state had so much debt to refund this year.

Refundings nearly doubled to $3.7 billion in first half 2019 compared to $1.9 billion in first quarter 2018, according to the state treasurer's office. New money sales dropped to $1.5 billion in the first half of 2019 compared to $2.5 billion during the same period in 2018.

“If you look back 10 years, the national economy was collapsing. It was the dark days of the recession and people were hurting,” Schaefer said. “So, the state made a conscious decision to look at every project that was eligible for financing and find a way to accelerate them to keep people working.”

That resulted in increased bond sales.

“We had a new avenue available to us, because in January or February 2009 Congress passed ARRA, the [American Recovery and Reinvestment Act], which included the Build America Bond feature,” Schaefer said. “It was taxable bonds you could sell and the U.S. government would make a subsidy payment to you.”

The state of California was one of the largest sellers of BABs, not necessarily because of fondness for BABs as a financing vehicle, he said, but because the state had already made a conscious decision to accelerate projects to keep Californians working.

When issuers refund BABs, they have to weigh interest rate savings against the loss of the federal subsidy.

Speaking hypothetically, Schaefer said, “If you look at the world today. If you are a triple-A issuer, you can issue 30-year bonds with a yield under 2%. If I’m a governmental borrower and I have a triple-A rating, there are investors that will lend at 2% or less. That is about the rate of inflation. If I look up and say the purchasing power of my dollar 30 years from now will erode at 2% a year if inflation remains constant, then I have essentially borrowed free money. So, if I lose my subsidy is that a bad thing, maybe not, if interest rates are favorable.”

California state government sold $5.2 billion in the first half of 2019 compared to $4.3 billion in first half 2018, according to the treasurer’s office.

Oregon, Wyoming and Montana were the only Far West states to see growth in overall volume.

Oregon’s sales volume soared by 76.5% to $3.3 billion in 52 sales from $1.8 billion in 54 sales. Growth in education by 75% to $1 billion and four times the sales in housing to $759 million drove Oregon into producing the second-most municipal bond volume in the Far West.

A $653 million May competitive deal from Portland regional government agency Metro was the region's largest outside California, and sixth-largest overall.

Washington, which typically holds the No. 2 spot, experienced a 38% drop in volume falling to $2.9 billion, as education issuance fell 33% to $983 million and electric power fell by nearly 80% to $270 million.

Bank of America Merrill Lynch topped the regional senior manager table, credited by Refinitiv with $5.8 billion. Goldman Sachs trailed with $4.08 billion, followed closely with $4.01 billion for Morgan Stanley.

Public Resources Advisory Group led the rankings of financial advisors with $7.2 billion. Public Financial Management secured second again, with $5.9 billion. Piper Jaffray came in third with $2.4 billion.

Orrick Herrington & Sutcliffe continued its position atop the bond counsel rankings, credited with $12.5 billion. Stradling Yocca Carlson & Rauth came in second with $3.6 billion in volume. The third slot went to Hawkins Delafield & Wood with $2.3 billion.