States are well-positioned to emerge from the COVID-19 pandemic, investment firm Conning said in its annual

Hartford, Connecticut-based Conning, which manages more than $9 billion of municipal bonds held in client portfolios, uplifted state credit quality to stable from declining. Its indicators include measures of economic activity such as income levels, housing prices, foreclosure rates and a state’s overall business environment, such as the ability to attract new business.

According to Conning, the pandemic impact was less significant than expected and recovery is well on track. Financial markets rebounded quickly, which benefited investment income tax and pension funding levels.

"Overall, it was surprising to see that the pandemic had minimal effect on states’ credit quality. This was due to unprecedented federal aid and quickly improving economic conditions,” said Karel Citroen, Conning head of municipal credit research and lead author of the report.

Work-from-home dynamics also affected population changes and fueled regional housing price growth.

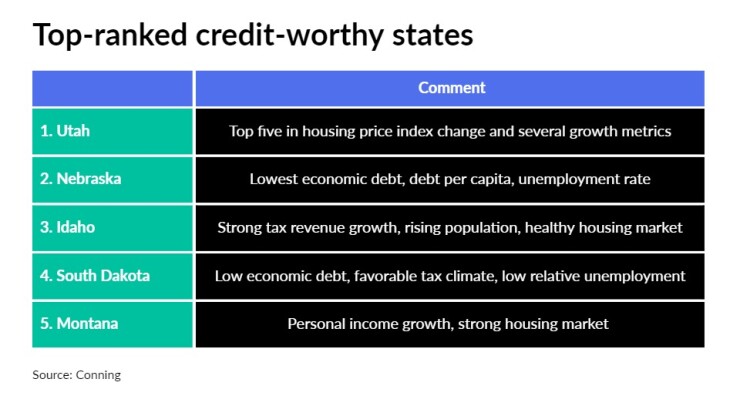

Conning, which analyzed 13 metrics indicative of state credit health, ranked Utah, Nebraska, Idaho, South Dakota and Montana in its top five overall and Illinois, New York, West Virginia, Louisiana and Hawaii in its bottom five.

Its methods continued to place more emphasis on population changes and taxes, a change it made in last year’s report, reflecting how the two influence each other. The report also examined unemployment rates, reserves and gross domestic product growth by state, among other factors.

Utah ranked first for the sixth straight year.

“Strong underlying economic conditions and population growth with low debt levels and a favorable tax climate have been the state’s hallmarks for over half a decade,” the report said.

Illinois received bottom ranking based on a continued population decline, weak reserves and a high economic debt burden. Conning economic debt metric ranks states by total debt burden on a state’s tax base.

Illinois, though, benefited from federal support through the Paycheck Protection Program and the Federal Pandemic Unemployment Program, both of which preserved its personal income revenue stream by keeping residents employed and providing taxable unemployment benefits.

Idaho, the highest-ranked state in four of Conning’s 13 indicators, moved up a spot. Nebraska, South Dakota and Montana were new to the top five while Colorado (seventh), Washington (11th) and South Carolina (18th) dropped out due to adverse employment, adverse employment, GDP growth and tax revenue growth, respectively.

Among the bottom five, California and New York swapped places and Minnesota replaced Arkansas as 46th for business-tax climate.

“We have highlighted in past reports how the socioeconomic and economic success of the states in our rankings is a regional story and this year is no exception, although we have observed a few shifts geographically,” the report said.

Illinois, Hawaii, New York, West Virginia and California were the five states with the worst year-over-year changes in population as migration persists to the West and South. “This year’s population data from the U.S. Census Bureau shows a pattern we have noticed for several years,” Conning said.

Alabama benefited from one of the shortest stay-at-home orders — 26 days, the fourth-shortest — preserving employment and its economy.

“Furthermore, like Illinois, its economy is more dependent on agriculture and non-durable goods manufacturing, both of which did relatively well in 2020,” Conning said.

Most states, according to Citroen, expect to report positive income and sales tax collections as unemployment decreases and the economy reopens.

“Population changes will also continue to be an increasingly significant factor in state credit quality, impacting tax revenue, employment, the housing market, and states’ personal income growth,” he said.

Half the states improved and half worsened by economic debt.

“Despite the extraordinary returns the stock market and, to a lesser extent, the bond market exhibited in 2020, we could see pension funding levels come down for some states in future years as it is possible some states opted not to make full annual plan contributions given budgetary uncertainty,” Conning said.