Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

More municipal supply hit the market on Wednesday with the University of Connecticut’s $240 million general obligation deal attracting interest.

By Chip BarnettApril 24 -

Next week’s calendar should benefit from timing and availability coming on the heels of both the income tax deadline and the holiday-shortened week.

April 18 -

The day after tax day did not diminish demand for munis as customer inquiry, especially on the short end, was strong.

April 16 -

Peter Block addresses the latest trends, developments, and expectations for the municipal market in 2019 and beyond in The Bond Buyer’s latest podcast with the managing director of credit and strategy at Ramirez & Co. John Hallacy and Christine Albano host.

By John HallacyApril 11 -

Retail investors got first shot at California’s $2 billion GO deal Wednesday.

By Chip BarnettApril 10 -

Underwriters circulated a premarketing wire on California’s $2 billion GOs as the NYC water authority deal came to market.

By Chip BarnettApril 9 -

With plenty of cash looking to go to work, investors are not loving the calendar or what small allocations they will be allotted as we draw near the end of tax season.

April 5 -

Undersupply and demand for the muni exemption in high tax states are expected to help municipal bonds outperform in the second quarter.

April 5 -

The Florida Development Finance Corp.’s $1.75 billion bonds for the Virgin Trains USA passenger rail project found $4B of suitors.

By Chip BarnettApril 2 -

Joseph Rosenblum said he wore many hats, sometimes acting as financial analyst, political scientist, attorney, or investigator.

April 1 -

The tax-exempt part of the big Connecticut deal was offered to retail Wednesday as munics continued to rally.

By Chip BarnettMarch 27 -

Deals from the NYC TFA, Chicago, Illinois, California, Maryland and Miami-Dade County help satisfy demand.

By Chip BarnettMarch 26 -

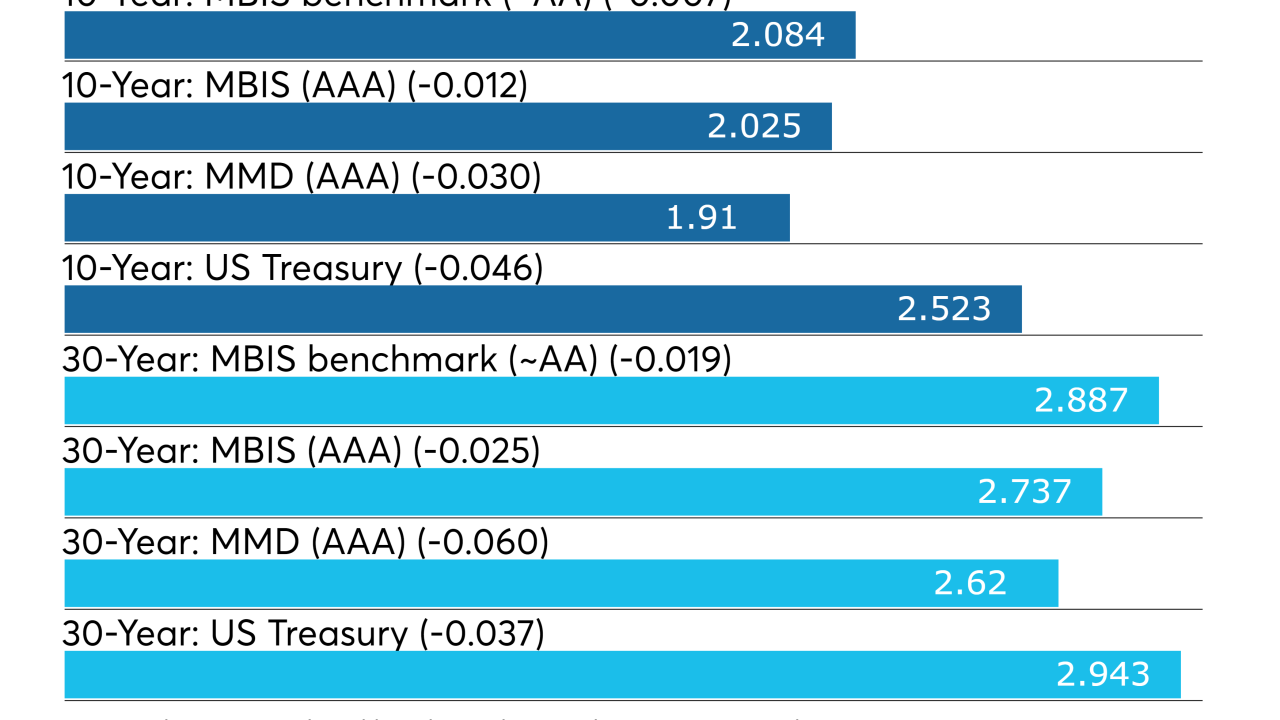

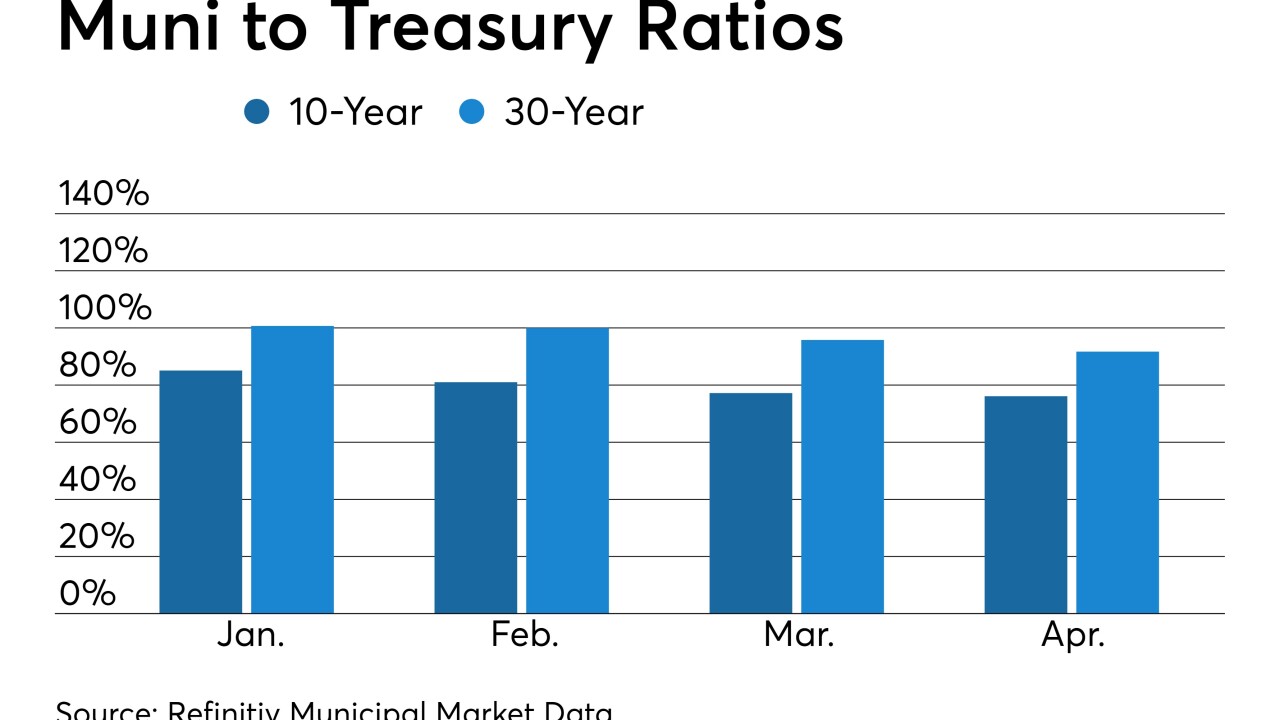

Muni rates and ratios have benefited from macro themes driving rates lower, according to a report released Monday.

By Chip BarnettMarch 25 -

Almost $9 billion of municipal bonds are coming to market with deals from a variety of issuers to quench the thirst of buyers experiencing a supply drought.

By Chip BarnettMarch 22 -

Municipal bonds remained stronger on Thursday as deals from Indianapolis and California issuers came to market.

By Chip BarnettMarch 21 -

In the primary, Academy Securities priced the Calif. Veterans Affairs deal for retail investors on Wednesday.

By Chip BarnettMarch 20 -

Municipal bond market participants will be waiting for the Fed's decision on rates and the look ahead.

By Chip BarnettMarch 19 -

The calendar leaves much to be desired for investors, as the week only brings $2.4 billion of new deals.

March 18 -

Munis have been grooving along but next week will bring tiny issuance, less than $3 billion, along with a Federal Open Market Committee meeting.

March 15 -

Preston Hollow's accusations against Nuveen of bully tactics underscore the cutthroat competition for market share.

March 15