Underwriters circulated a premarketing wire on California’s $2 billion of general obligation bonds as the New York City Municipal Water Finance Authority deal came to market on Tuesday.

Primary market

Morgan Stanley circulated a premarketing wire on California’s (Aa3/AA-/AA-) $2.05 billion sale of GOs. The underwriter is set to price the mostly refunding deal on Thursday after a retail order period on Wednesday.

Premarketing wire shows the 10-year maturity with a 5% coupon to yield 2.11%. The 10-year from the March sale with a 5% coupon was priced at 2.31% and recently traded in blocks on April 1 at 1.94%.

Siebert Cisneros Shank & Co. priced the NYC MWFA’s (Aa1/AA+/AA+) $500 million of tax-exempt fixed-rate second general resolution revenue bonds for institutions after a one-day retail order period.

The pricey paper did little to quench investors’ insatiable thirst, according to John Mousseau, president and CEO of Cumberland Advisors, who added that this could lead to changing investor behavior going forward.

The high prices, he said, are reflective of the fears stemming from the new state and local tax deductions. “High-income folks can’t have enough New York exempt paper,” Mousseau said. “It’s getting tremendously expensive.”

If New York prices continue to rise, he said, investors may eventually consider buying some out-of-state paper in the short-end of the curve to provide a geographic hedge against any looming problems after income tax season.

Potential problems, according to Mousseau, could include a cut in taxes without a cut in expenses reducing debt service coverage in the state in general. “We need to keep a sharp eye on any outward migration issues because of SALT,” he said.

The Dormitory Authority of the State of New York came to market with two separate deals totaling $254.96 million.

BofA Securities priced DASNY’s $140.79 million of Series 2019A revenue bonds for the Catholic Health System Obligated Group (Baa1/BBB+/NR) while Citigroup priced DASNY’s $114.17 million of Series 2019A revenue bonds for Cornell University (Aa1/AA/NR). JPMorgan Securities priced Houston’s (A2/A/NR) $106.57 million of Series 2019 Convention & Entertainment Facilities Department’s hotel occupancy tax and special revenue and refunding bonds.

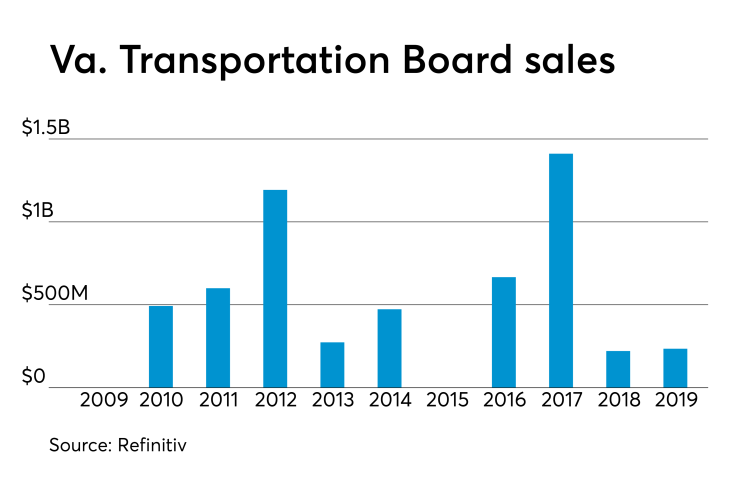

In the competitive arena, the Virginia Commonwealth Transportation Board (Aa1/AA+/AA+) sold $235.97 million of Series 2019 transportation capital projects revenue bonds. BofA Securities won the bonds with a true interest cost of 2.9957%. Proceeds will be used to finance certain transportation projects. The financial advisor is Public Resources Advisory Group; the bond counsel is Kutak Rock.

Since 2009, the board has sold about $6 billion of debt, with the most issuance occurring in 2017 when it sold $1.4 billion of debt. It did not come to market in 2015.

The East Side Union High School District, Calif., (Aa3/AA/NR) sold $140 million of Series B 2016 Election GOs. BofA won the bonds with a TIC of 2.717%. The deal was insured by Assured Guaranty Municipal. Proceeds will be used for school facility projects and increasing student computer and technology access. Dale Scott Co. is the financial advisor; Jones Hall is the bond counsel.

Round Rock, Texas, (PSF: NR/NR/AAA) sold $159.49 million of Series 2019 unlimited tax school building bonds. Wells Fargo Securities won the bonds with a TIC of 2.4449%. Hilltop Securities is the financial advisor; Bracewell and the state Attorney General are the bond counsel.

The Missouri Highways and Transportation Commission (Aa1/AA+/AA) sold $104.8 million of Series 2019A federal reimbursement refunding state road bonds. Goldman Sachs won the bonds with a TIC of 1.6664%. PFM Financial Advisors is the financial advisor; Gilmore & Bell and Bushyhead are the bond counsel. Proceeds will be used to refund some Series 2008 and 2009 bonds.

Tuesday’s bond sales

Bond Buyer 30-day visible supply at $8.55B

The calendar rose $190.7 million to $8.55 billion on Tuesday, composed of $2.28 billion of competitive sales and $6.27 billion of negotiated deals.

Secondary market

Munis were slightly weaker on the MBIS benchmark scale Tuesday, which showed yields rising less than a basis point in the 10-year and 30-year maturities. High-grade munis were also weaker, with yields gaining less than one basis point in the 10- and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO muni and the 30-year muni fell one basis point.

The 10-year muni-to-Treasury ratio was calculated at 76.8% while the 30-year muni-to-Treasury ratio stood at 92.4%, according to MMD.

Treasuries were stronger as stocks traded lower.

Previous session's activity

The MSRB reported 34,789 trades Monday on volume of $7.74 billion. California, New York and Texas were most traded, with the Golden State taking 14.611% of the market, the Empire State taking 12.252% and the Lone Star State taking 12.179%. The most actively traded issue was the Louisiana Series 2019A GO 5s of 2037 which traded seven times on volume of $35.57 million.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $34.999 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury auctions 3-year notes

The Treasury Department auctioned $38 billion of three-year notes with a 2 1/4% coupon at a 2.301% high yield, a price of 99.852977. The bid-to-cover ratio was 2.49.

Tenders at the high yield were allotted 21.36%. All competitive tenders at lower yields were accepted in full. The median yield was 2.275%. The low yield was 1.988%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.