New issues drove market attention on Tuesday following Monday’s selloff. Morgan Stanley on Monday priced the Florida Development Finance Corp.’s $1.75 billion of Series 2019A (NR/NR/NR) surface transportation facility revenue bonds for the Virgin Trains USA passenger rail project and found strong demand.

The issue, which was sold to qualified institutional buyers under Rule 144A of the Securities Act of 1933 as a private activity placement, was increased in size from the originally planned $1.5 billion.

The Virgin Trains USA name debuted in the market Monday to finance the privately owned Florida passenger train after a name change from Brightline, under which $600 million of debt was issued. Proceeds will pay or reimburse costs for building the 236-mile passenger rail line between Miami and Orlando, refund the $600 million of PABs issued in 2017, pay capitalized interest, fund reserves and pay issuance costs.

The company announced plans to rebrand from Brightline, the name it used to begin operations between Miami and West Palm Beach in 2018, after Britain's Virgin Group took a small stake in the operation. Before construction started, it was known as All Aboard Florida.

Sources told The Bond Buyer that Monday’s deal received about $4 billion of orders. Other sources said that 67 investors participated in the deal with 20 in for $50 million or more, 22 in for $25 million or more and the balance of investors in for less than $25 million each. Market participants were hearing after the deal that that "bids for those Florida Virgin Train bonds are now up 27-32 basis points from where the deal priced."

On Tuesday, BofA Securities priced the Illinois Finance Authority’s (NR/AAA/AAA) $450 million of state revolving fund green bonds for retail investors ahead of institutional pricing on Wednesday. A New York trader said the Illinois Finance Authority deal received strong initial indications of interest.

“Municipals finished March with one of the strongest price rallies in the last few years with municipals being very expensive from a historical perspective especially two- to 10-years,” the trader said.

Citigroup priced the Michigan Finance Authority’s (Aa2/AA+/NR) $300 million of Series 2019A taxable Series 2-019A school loan revolving fund term-rate revenue bonds.

BofA priced the Lee Memorial Health System (A2/A+/NR) in Florida’s $423.41 million issue of Series 2019A-1 fixed-rate and Series 2019A-2 term-rate hospital revenue and revenue refunding bonds.

Barclays Capital priced the Public Finance Authority’s (A2/NR/A+) $208.08 million of Series 2019A hospital revenue bonds for WakeMed.

JPMorgan Securities priced the Board of Regents of the Arizona State University System’s (Aa2/AA/NR) $196.21 million of green revenue and revenue bonds

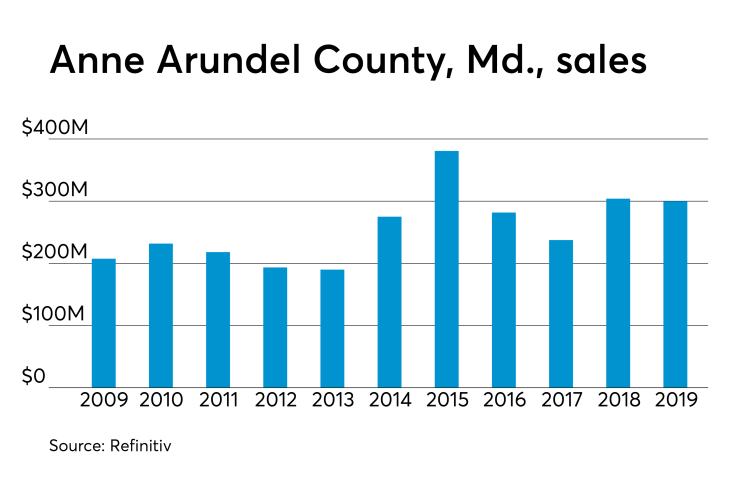

Anne Arundel County, Md., (Aa1/AAA/NR) competitively sold $302 million of GOs in two sales.

Citigroup won the $224.05 million consolidated general improvement GOs with a true interest cost of 3.1908%.

BofA won the $78.32 million of consolidated water and sewer GOs with a TIC of 3.1%.

Since 2009, the county has sold about $2.8 billion of debt with the most issuance occurring in 2015 when it sold $380.8 million. It sold the least amount of debt in 2013 when it issued $189.9 million.

Tuesday’s bond sales

Bond Buyer 30-day visible supply at $7.43B

The supply calendar rose $48.0 million to $7.43 billion Tuesday and is composed of $2.31 billion of competitive sales and $5.11 billion of negotiated deals.

Secondary market

Munis were stronger on the MBIS benchmark scale Tuesday, which showed yields falling one basis point in the 10-year maturity and less than a basis point in the 30-year maturity. High-grade munis were also stronger, with yields falling one basis point in the 10-year maturity and less than a basis point the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO and 30-year munis remained unchanged.

The imbalance of more demand than supply has contributed to the strong performance of municipals, the New York trader noted. Despite the continued decline in rates the forward calendar has remained manageable with only about $5 billion for this week, he added.

“The big question is how municipals will perform coming into tax season,” he said. “SALT has contributed to excellent performance in high-tax states, like New York, California, New Jersey, and Connecticut, but tax bills might be greater than investors expected, which could negatively affect price performance.” Bid lists on Tuesday were reasonable with solid demand, despite the ratios shorter than 10 years.

“The ICE Muni Yield curve was up 0.7 basis points in the five-year, with the rest of the curve unchanged,” ICE Data Service said in a Tuesday comment. “High-yield is mixed with no move at present. Tobaccos are flat to up one basis point in yield in quiet trading.”

The 10-year muni-to-Treasury ratio was calculated at 76.7% while the 30-year muni-to-Treasury ratio stood at 91.8%, according to MMD.

Treasuries were stronger as stocks traded mixed.

"It is a snoozefest," said one Southern trader. “I was hoping for more weakness today, as ratios and absolute levels seem rich. We have had so many weeks of large inflows. It will be interesting to see if as we approach tax day those inflows turn to outflows. If so, we could see ratios and levels move much higher — at least that is my hope.”

Previous session's activity

The MSRB reported 35,608 trades Monday on volume of $9.51 billion. California, New York and Texas were most traded, with the Golden State taking 16.127% of the market, the Empire State taking 11.601% and the Lone Star State taking 10.065. The most actively traded issue was the Chicago Series 2019 GOs of 2044 which traded 28 times on volume of $56.5 million.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $34.999 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Aaron Weitzman and Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.