Underwriters held a second retail order period on the New York City Transitional Finance Authority’s $850 million tax-exempt deal on Monday.

In the secondary, municipals remained stronger as the market geared up to see a spate of new issues hit the screens this week. Volume hits $8.9 billion this week, with the calendar made up of $5 billion of negotiated deals and $3.9 billion of competitive sales.

“All systems go”

With the Treasury market continuing to rally to lower yields and municipals in its shadow, the municipal market was poised on Monday to launch $8 billion in new issues amid a strong technical backdrop, according to a New York trader.

“The Treasury market keeps on getting stronger and stronger, which is surprising” in such a short time frame, he said on Monday as the 10-year Treasury was hovering at 2.40%.

At the same time, supply is starting to ramp up and provide some balance to the market for a first time in a while. Yet he expects the week’s new issue slate to be quickly snapped up and likely oversubscribed given the continued hearty appetite among individual investors and steady fund flows into municipal mutual funds.

“The funds continue to see money coming in, so that supply should not be a problem and should be eaten up,” he explained, pointing to the $850 million New York Transitional Finance Authority revenue offering and $700 million Chicago sales slated for this week.

He said it is a positive scenario for sellers and buyers.“It’s all systems go,” he said, noting that investors should take advantage of this window of opportunity ahead of the April 15 tax deadline when volume and activity typically slows.

The trader said Monday was a day for investors and the market to absorb the rally that occurred on Thursday and Friday and “take a breather” before the week’s new deals begin pricing.With the rally, he said the percentages of municipals to Treasuries was improving as a result of the stronger market and declining yields.

“It’s going to be interesting to see what happens,” he said, noting that the large deals will find eager buyers -- especially the Chicago sale since investors are “dying for yield.”He said the triple-B-plus credit will likely command yields that are relatively more attractive than the plain vanilla market and satisfy yield hungry buyers.

“With the Treasury market going the way it’s going, the lower yields, and with advanced refundings out of the picture, we are in a period where we have more supply right now than we have had in a while,” the trader said. “The market desperately needs this -- and you get a better market with more supply,” he added.

Primary market

Goldman Sachs held a second day or retail orders for the TFA’s (Aa1/AAA/AAA) $850 million of tax-exempt Fiscal 2019 Series C future tax-secured subordinate revenue bonds for NYC’s Department of Administrative Services. The bonds, which were priced for retail on Friday, will be priced for institutions on Tuesday.

“Yields largely moved in sync with MMD curve adjustments on Friday, although 2029-2032 spots were bumped 7-8 bps versus 6 bps general market improvements for the previous session,” Greg Saulnier, research analyst at Refinitiv MMD, said about Monday's pricing. “[The] 5s of 11/2024 at 1.71% were +4 bps to implied. 5s of 2029 at 2.06% were +10 bps to implied. 5s of 2034 at 2.48% were +20 bps, as were max 5s in 2039 at 2.71%. 4s of 2042 at 3.09% were +50 bps to current MMD (+19 bps to 4% MMD) while 3.25% coupons of 2043 at 3.30% were +69 bps to current MMD (+11 bps to 3.25% MMD).”

Citigroup priced the New York State Housing Finance Agency (Aa2-VMIG1/NR/NR) $134.27 million of Series 2019F affordable housing revenue bonds.

On Tuesday, the TFA also is competitively selling $600 million of taxable in two sales consisting of $300 million of Fiscal 2019 Series C Subseries C-2 future tax secured subordinate revenue bonds and $300 million of $300 million of Fiscal 2019 Series C Subseries C-3 future tax-secured subordinate revenue bonds.

In the competitive arena on Tuesday, California (Aa3/AA-/AA-) is selling $842 million of taxable GOs on Tuesday in two sales consisting of $422 million of Bid Group B various purpose GOs and $420.79 million of Bid Group A various purpose GOs.

Maryland (Aaa/AAA/AAA) is selling $489.6 million of state and local facilities loan of 2019 GOs in two sales on Tuesday consisting of $265.04 million of Bidding Group 1 GOs and $224.96 million of Bidding Group 2 GOs.

Illinois (Baa3/BBB-/BBB) will sell $452 million of GOs on Tuesday in two sales consisting of $300 million of taxable Series of April 2019A bonds and $152 million of tax-exempt Series of April 2019B.

And Miami-Dade County (/AA/AA) will sell $239.17 million of Series 2019 transit system sales surtax revenue refunding bonds. The financial advisor is PFM Financial Advisors; the bond counsel are Hogan Lovells and Steve E. Bullock. Proceeds will be used to current refund certain outstanding debt.

Bond sales

Bond Buyer 30-day visible supply at $10.52B

The supply calendar rose $592.3 million to $10.52 billion on Monday; it’s composed of $5.01 billion of competitive sales and $5.51 billion of negotiated deals.

10-year AAA moving toward 1.80% or lower

Muni rates and ratios have benefited from macro themes driving rates lower, including last week's Fed meeting, though there are other factors afoot, according to BofA research.

Among those are declining global growth, political uncertainties domestically and abroad, and deflationary pressures, just to name a few, according to a report released on Monday. “Adding to that, munis have significant micro market influences, as usual,” said the report. “Light issuance, surging demand, SALT-induced tax increases and solid credit profiles. All this has us keeping our positive posture on the sector.”

BofA has been bullish on the muni market for 2019 and its 2% target for the 10-year AAA has already been achieved. On Friday, MMD data showed the 10-year AAA rate came down to 1.92%, while the Bloomberg BVAL is showing a 1.97% low print.

“With a clear economic slowdown and surprisingly dovish central bank postures around the world, we think that the 10-year AAA is moving toward 1.80% or possibly lower this year,” the report said. “A much lower target is possible, but we think the Fed's patience is likely to prolong the process, pushing muni yield declines into 2020.”

CreditSights: Muni market rocks as cash stacks up

The already strong demand for bonds will get a further boost next week when $17.1 billion in April 1 principal payments are returned to investors, which will be the bulk of redemptions for the month, which is expected to total $24.4 billion, according to Patrick Luby, Senior Municipal Strategist at CreditSights.

“Even with the recent decline in yields, this week's new issue calendar, with over 30 loans of $100 million or more and totaling $9.5 billion, is sure to draw buyers in from the sidelines,” he said. “Expected volume drops to just $2.8 billion next week as the strong market performance is good news for bondholders, but investors with money to put to work seem to be struggling to find value because cash appears to be stacking up on the sidelines.”

Luby said the abundance of cash on the sidelines plus the coming acceleration in redemptions in May, June and July may add urgency to buying demand. “For those muni investors seeking at least a 2% yield, the recent rally now means extending out to around 11-years,” he said. “While tactical investors may extend duration in anticipation of positive market technicals in the months ahead, we would expect that most long-term buying demand will be concentrated in the 10- to 15-year part of the curve.”

Luby added that the strong market conditions also provide an opportunity for investors to sell poorly structured bonds, such as those with low coupons or short calls.

He also said that there have now been 11 consecutive weeks of billion dollar plus mutual fund inflows, averaging $2.1 billion per week and that the year-to-date total is over 5 1/2 times last year's total. “It appears that at least part of the flow of new money is being held on the sidelines, because demand for seven-day variable-rate demand obligations has been strong enough to drive rates lower, even as Fed Funds have been steady and one-month LIBOR has risen,” Luby said.

Secondary market

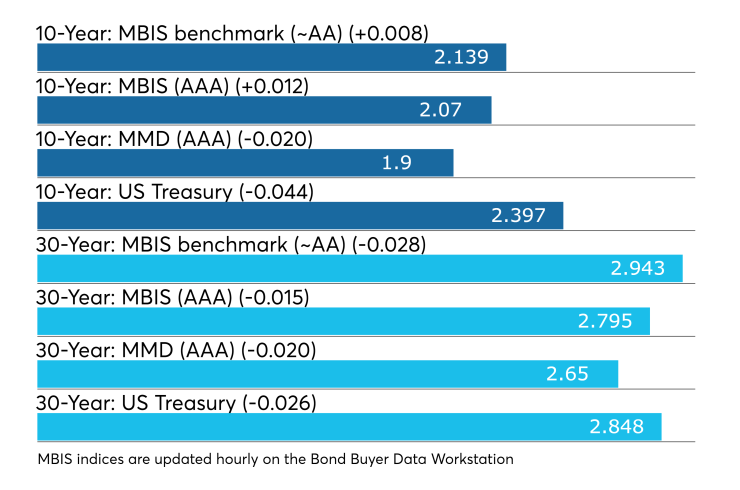

Munis were mostly stronger on the MBIS benchmark scale Monday, which showed yields rising less than one basis point in the 10-year maturity while falling two basis points in the 30-year maturity. High-grade munis were also mostly stronger, with yields rising one basis point in the 10-year maturity and falling one basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO muni dropped two basis points while the yield on the 30-year muni also declined by two basis points.

The 10-year muni-to-Treasury ratio was calculated at 78.5% while the 30-year muni-to-Treasury ratio stood at 92.4%, according to MMD.

Treasuries were stronger as stocks traded down.

“The ICE Muni Yield Curve is 1.5 bps lower for the 15- through 30-year maturities. Yields were significantly lower at the end of last week,” ICE Data Services said in a Monday Comment. “The high-yield and tobacco segments are quiet and unchanged today. The taxable sector is 2.8 bps lower in yield in the five-year maturity. Puerto Rico is also unchanged.”

Previous session's activity

The MSRB reported 33,779 trades Friday on volume of $10.59 billion. California, Texas and New York, California and Texas were most traded, with the Golden State taking 17.548% of the market, the Lone Star State taking 11.255% and the Empire State taking 8.325%. The most actively traded issue was the California EFA Series 2019 V-1 revenue 5s of 2049 which traded 45 times on volume of $106.36 million.

Week's actively traded issues

Revenue bonds comprised 54.52% of total new issuance in the week ended March 22, down from 55.28% in the prior week, according to

Some of the most actively traded munis by type were from Puerto Rico and California issuers. In the GO bond sector, the Puerto Rico 8s of 2035 traded 23 times. In the revenue bond sector, the Puerto Rico Sales Tax Financing Corp. 5s of 2058 traded 60 times. In the taxable bond sector, the Regents of the University of California 3.349s of 2029 traded 24 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $48 billion of three-months incurred a 2.410% high rate, unchanged from 2.410% the prior week, and the $39 billion of six-months incurred a 2.415% high rate, off from 2.450% the week before.

Coupon equivalents were 2.465% and 2.486%, respectively. The price for the 91s was 99.390806 and that for the 182s was 98.779083.

The median bid on the 91s was 2.380%. The low bid was 2.360%. Tenders at the high rate were allotted 83.84%. The bid-to-cover ratio was 2.87.

The median bid for the 182s was 2.390%. The low bid was 2.360%. Tenders at the high rate were allotted 69.26%. The bid-to-cover ratio was 2.88.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.