The day after tax day did not bring a downdraft to demand for munis, as customer inquiry has been strong. Investors will have to wait at least until next week for meaningful new-issue supply, though.

Overwhelming demand continues to drive the muni market to tighter spreads and richer ratios, according to Peter Delahunt, managing director at Raymond James & Associates.

“There has been some push back recently to the current offerings,” he said. “However, the negative net supply vis-à-vis the strong inflows allow sellers to be a bit more resilient with their offerings.”

Delahunt said he observed over-subscribed demand for new issues that have been priced today leading to bumps in price.

“Not surprisingly, with low raw rates and rich ratios, there continues to be a strong flow of money staying in the front of the curve inside of 8 years,” Delahunt said.

“For those willing to extend a bit, the 12 year offers value in the roll-down and a 4% coupon in 12 years picks up another 20 basis points over 5s while still offering a full premium price protection over a short call period.”

He also added that AMT bonds provide an additional 25 basis points for the many more investors no longer subject to the tax.

In the negotiated space, JPMorgan priced Miami Beach's (Aa2/AA+NR) $162.215 million of GO and refunding bonds on Tuesday.

Competitively, Jefferies won California Department of Water Resources’ (Aa1/AAA/NR) $299.6 million of central valley project water system revenue bonds with a true interest cost of 2.354%.

The bonds will refinance certain State Water Project capital improvements, including a portion of the costs of the Oroville Dam Spillways Response, Recovery and Restoration Project.

"These funds will be used to finance the reconstruction of the Oroville dam spillways to help provide flood control and water supply throughout California," said California State Treasurer Fiona Ma.

She added that the State Treasurer’s Office, as agent for the sale, received 10 bids from broker-dealers and that the bonds were sold on behalf of DWR to refund a portion of DWR’s outstanding commercial paper notes, fund interest on a portion of the bonds, fund a deposit to the debt service reserve account, and pay issuance costs.

The main spillway chute of Oroville Dam experienced damage in 2017 due to heavy rains during the wettest January and February in 110 years of Feather River hydrologic record. To ensure public safety, DWR has reconstructed the main spillway and continues working on restoration activities around the dam facilities.

The State Water Project is a statewide complex system of dams, water storage facilities, aqueducts, pumping stations and electric generation facilities that have been constructed by DWR to deliver water and protect against flooding.

BofA won Rhode Island’s $123.6 million of GO consolidated capital improvement loan of 2019 bonds with a TIC of 2.9317%.

Tuesday’s bond sales

Secondary market

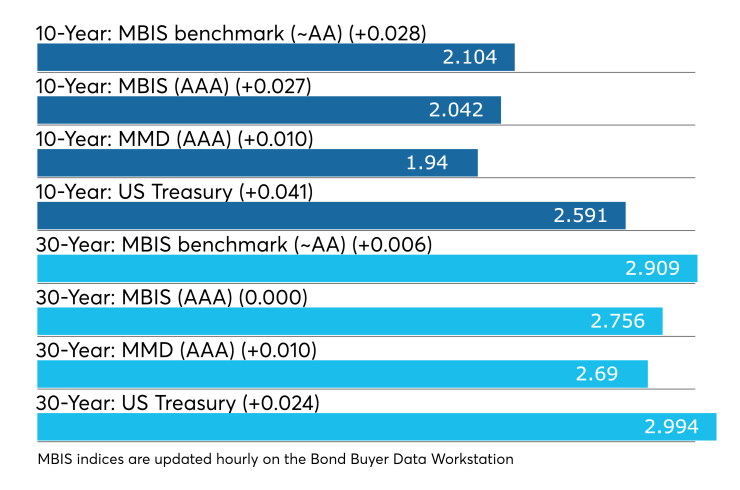

Munis were mostly weaker on the MBIS benchmark scale Tuesday, which showed yields two basis points higher on the 10-year maturity, while rising less than a basis point in the 30-year maturity. High-grade munis were weaker, with yields increasing as much as three basis points in the 10-year and dipping less than one basis point in the 30-year.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yields on both the 10-year muni GO and the 30-year muni increased by one basis point.

The 10-year muni-to-Treasury ratio was calculated at 74.8% while the 30-year muni-to-Treasury ratio stood at 90.0%, according to MMD.

Previous session's activity

The MSRB reported 36,680 trades Monday on volume of $11.240 billion.

California, Texas and New York were most traded, with the Golden State taking 17.921% of the market, the Lone Star State taking 11.115% and the Empire State taking 10.962%.

The Puerto Rico Sales Tax Financing Corp. 4.55s of 2040 traded 84 times with a par of $31.67 million.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $35.002 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.