Municipal bonds were stronger after the Federal Reserve kept its interest rate target unchanged Wednesday.

The Federal Open Market Committee voted 10-0 to hold rates at a range of 2.25% to 2.5% and its Summary of Economic Projections suggested no further rate hikes this year and one in 2020. Separately, the Fed said it will slow balance sheet reduction in May “by reducing the cap on monthly redemptions from the current level of $30 billion to $15 billion” and stop after September.

In October, “principal payments received from agency debt and agency MBS will be reinvested in Treasury securities subject to a maximum amount of $20 billion per month; any principal payments in excess of that maximum will continue to be reinvested in agency MBS,” the Fed said.

In a press conference, Chair Jerome Powell said the Fed has still to determine the future composition of its balance sheet and that it will not rush that decision, but the discussion will start soon.

“The statement and the new projections reinforce the pivot that became apparent at the January press conference,” said Brian Coulton, chief economist at Fitch Ratings. “Patience means waiting until next year for the next rate hike according to the new summary of economic projections and the new dot plot. But the Fed is still fairly sanguine about the U.S. growth outlook and it’s notable that they still see further rate hikes in the pipeline over the medium term."

He added that China will remain a focus. “We think the concerns about declining growth in China that likely played a part in the Fed’s recent shift in tone will ease in the second half of the year and they will start talking about near-term rate hikes again,” Coulton said.

Muni buyers watched from the sidelines for most of the day, cushioning themselves from any possible surprises, which kept secondary activity subdued and primary market action mostly quiet except for the Cal Vets deal.

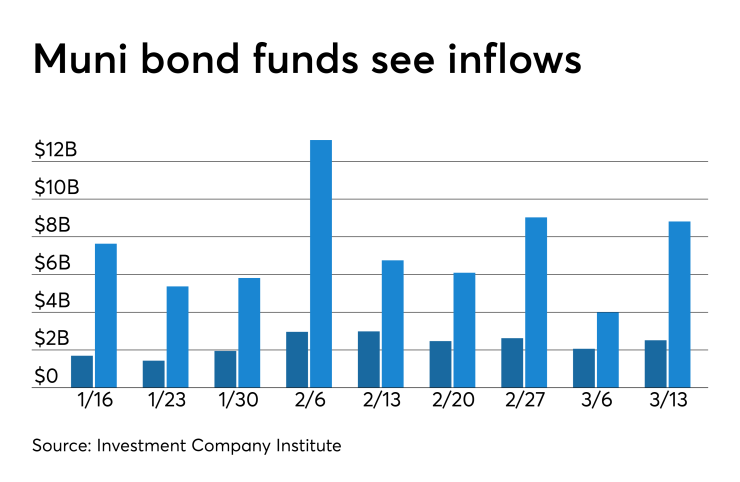

ICI: Muni funds see $2.52B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.515 billion in the week ended March 13, the Investment Company Institute reported on Wednesday. It was the 10th straight week the funds saw inflows.

This followed an inflow of $2.064 billion into tax-exempt mutual funds in the week ended March 6.

Long-term muni funds alone saw an inflow of $2.040 billion after an inflow of $1.890 billion in the previous week while ETF muni funds saw an inflow of $475 million after an inflow of $174 million in the prior week.

Taxable bond funds saw combined inflows of $8.814 billion in the latest reporting week after inflows of $3.994 billion in the previous week.

ICI said the total combined estimated inflows into all long-term mutual funds and exchange-traded funds were $22.431 billion for the week ended March 13 after outflows of $100 million in the prior week.

So far this year, municipal bond funds have seen inflows of about $15 billion.

“This is the best start to a year in more than a decade, with evidence that demand is being stimulated by investors in higher tax rate states seeking a degree of relief from the pain forced upon them by President Donald Trump’s new limit of $10,000 on the Federal deductibility of state and local taxes (SALT), which includes property taxes,” according to Michael Cohick, senior ETF product manager at Van Eck.

“These record inflows have, on the basis of historic averages, driven tax-exempt municipal bonds, with maturities from two-years out to 10-years, to look rich compared to U.S. Treasuries. In particular, the 10-year AAA rated muni to U.S. Treasury ratio (77.3%) is at its richest since the first quarter of 2010,” he wrote in a market comment.

Janney commented on the resurgent strength of muni ETFs.

“We often comment on fund flows as a proxy for municipal bond investor demand. The ‘fund’ category is comprised mostly of mutual funds, but also includes exchange traded funds (ETFs). After a strong fourth quarter surge in new share creation, ETF inflows became outflows during four weeks in late January-early February, but assets are again building,” Janney said. “MUB, the largest tax-free ETF, has been growing in size since mid-February, and now has a market cap of $11.9 billion. VTEB, a close MUB competitor, reached record size ($4.4 billion) yesterday with $36 million of new shares added.”

Short-end weakness seen

Investor behavior and demand among retail investors is being tempered by historically low ratios on the short end of the municipal market and interest rate uncertainty on the long end the curve, according to a New York trader.

The impact of year-to-date low ratios — which he said are also historically tight in the 10-year area around 60% — is keeping conservative mom and pop investors on the sidelines.

“It’s been quiet and there’s been weakness in the 10-year part of the curve,” he said, explaining that the percentage of municipals to Treasuries year to date has gotten worse recently and is hindering investor demand. "It’s stopping investors from participating in that segment of the market,” he said.

At the same time, even though ratios are currently between 95% and 100% on the long end of the market beyond 20 years, demand is lagging in that range as well, he said.

“There’s not much demand out long — even with ratios higher — and that’s been the trend for most of the year,” the trader said, adding that the pattern is the result of interest rate uncertainty and continued reliance on direction from the Fed.

“There’s not much going on with the light calendar,” he said of the volume just above $3 billion this week and little reaction following the FOMC meeting.

He said the low volume so far in 2019 continues to hang over the new-issue market, while there is also a general lack of activity in the secondary market so far this week as investors were slow to commit during Fed week.

Primary market

Academy Securities opened a retail order period on the Department of Veterans Affairs (Aa3/AA/AA-) of the State of California’s $78.22 million of Series 2019A home purchase non-AMT revenue bonds.

Academy, which released a premarketing scale on the deal on Tuesday, plans to price the bonds for institutions on Thursday.

On Thursday, BofA Securities is expected to price the Indianapolis Local Public Improvement Bond Bank's (NR/NR/AAA) $623 million of community justice campus bonds for its courthouse and jail project.

Bond sales

Bond Buyer 30-day visible supply at $7.6B

The supply calendar rose $332.1 million to $7.60 billion Wednesday, composed of $4.18 billion of competitive sales and $3.41 billion of negotiated deals.

Secondary market

Municipal bonds were stronger on Wednesday on news the FOMC left rates unchanged, the MBIS benchmark scale showed as muni yields fell three basis points in the 10-year maturity and less than a basis point in the 30-year maturity. High-grade munis were also mostly stronger, with yields dropping seven basis points in the 10-year maturity and rising less than a basis point in the 30-year maturity.

Investment-grade municipals were stronger on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year GO muni falling two basis points while the yield on the 30-year muni dropped four basis points.

The 10-year muni-to-Treasury ratio was calculated at 79.7% while the 30-year muni-to-Treasury ratio stood at 94.2%, according to MMD.

Treasuries were stronger as equities turned around to trade slightly higher.

Previous session's activity

The MSRB reported 39,319 trades on Tuesday on $11.11 billion of volume. California, Texas and New York, California and Texas were most traded, with the Golden State taking 12.81% of the market, the Lone Star State taking 12.415% and the Empire State taking 10.976%. The most actively traded issue was the NYS UDC Series 2019A PIT 5s of 2042 which traded 28 times on volume of $34.78 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.