More supply hit the municipal bond market on Wednesday, as retail investors got first crack at the tax-exempt portion of an $850 million Connecticut general obligation bond deal.

Primary market

Barclays Capital priced Connecticut’s (A1/A/A+/AA-) $600 million of tax-exempt Series 2019A GOs for retail investors ahead of the institutional pricing on Thursday, when the $250 million of taxable GOs will also be priced.

Santa Clara Unified School District, Calif., (Aaa/AA+/NR) competitively sold $360 million of Series 2019 Election of 2018 GOs.

BofA Securities won the bonds with a true interest cost of 3.33%.

Santa Clara USD also sold $46 million of Election of 2014 GOs which were won by Citigroup with a TIC of 2.7845% and sold $18 million of refunding GOs which were won by Wells Fargo Securities with a TIC of 1.5138%

The financial advisor is Government Financial Strategies and the bond counsel is Parker & Covert.

Proceeds will be used to finance the specific school facilities projects.

Goldman Sachs priced the Oregon (Aa2/AAA/NR) Department of Administrative Services’ $100.8 million of state lottery revenue bonds.

JPMorgan Securities priced the Nebraska Investment Finance Authority’s (NR/AA+/NR) $147.31 million of single-family housing revenue bonds, Series 2019A non-AMT and Series 2019B AMT bonds.

Bond sales

Bond Buyer 30-day visible supply at $6.56B

The supply calendar fell $4.93 billion to $6.56 billion on Wednesday; it’s composed of $2.28 billion of competitive sales and $4.28 billion of negotiated deals.

Secondary market

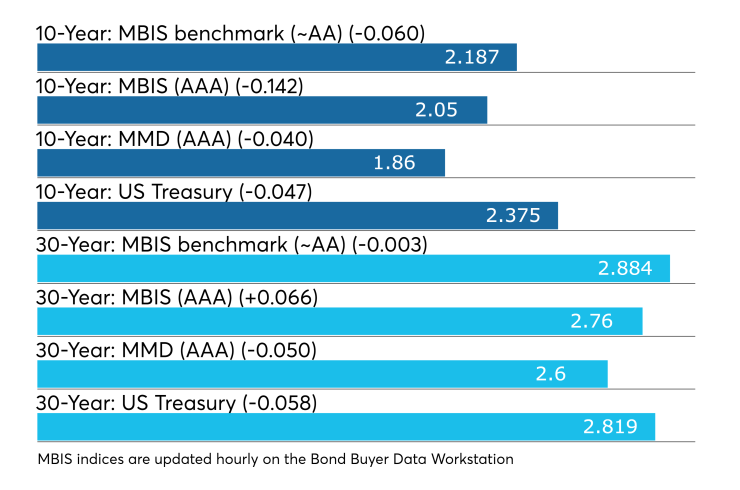

Municipals were stronger on the MBIS benchmark scale Wednesday, which showed yields falling six basis points in the 10-year maturity while falling less than a basis point in the 30-year maturity. High-grade munis were also stronger on the MBIS AAA scale.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO muni declined four basis points while the yield on the 30-year muni dropped five basis points.

The 10-year muni-to-Treasury ratio was calculated at 78.3% while the 30-year muni-to-Treasury ratio stood at 92.2%, according to MMD.

Treasuries were stronger as stocks traded down.

“The ICE Muni Yield Curve is three basis points lower in the long end,” ICE Data Services said in a market comment. “Tobaccos and high yield are joining the rally, both dropping two basis points in yield. The yields on taxables are also lower with the biggest move in the five-year, which is down 5.6 basis points.”

Previous session's activity

The MSRB reported 41,272 trades Tuesday on volume of $11.15 billion. California, Texas and New York were most traded, with the Golden State taking 17.892% of the market, the Lone Star State taking 12.08% and the Empire State taking 10.23%. The most actively traded issue was the California Series 2019 GO refunding 5s of 2036 which traded 12 times on volume of $32.92 million.

Pause expected

A combination of price aversion and seasonal investment patterns could interrupt the current market behavior, according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management.

He said the firm expects a short term pause in the municipal bond market rally as investors grow a bit more reluctant to chase yields lower. “We also expect to see some slowing of inflows into the market as the tax deadline draws some money out of the market,” Pietronico said on Wednesday.

In the meantime, any reversal higher in rates will be viewed as a buying opportunity, according to Pietronico. “The upcoming summer months will prove to be a very difficult environment to put cash to work,” especially since he expects the summer months to continue to be light on supply and heavy on demand, he said.

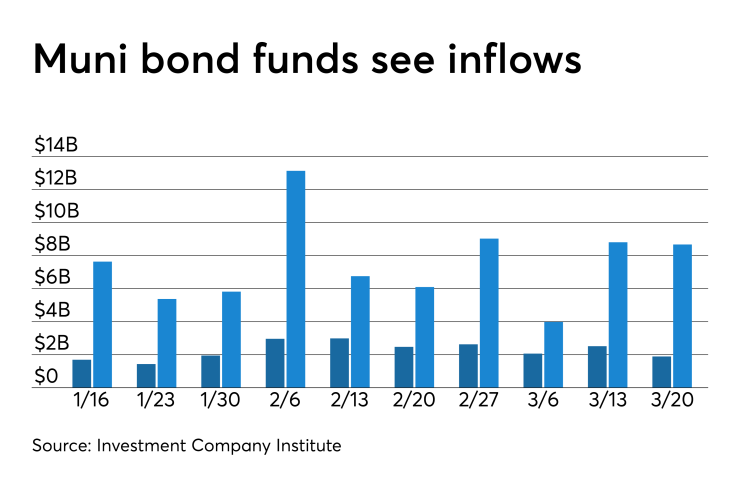

ICI: Muni funds see $1.89B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $1.892 billion in the week ended March 20, the Investment Company Institute reported on Wednesday. It was the 11th straight week the funds saw inflows.

This followed an inflow of $2.515 billion from the tax-exempt mutual funds in the week ended March 13.

Long-term muni funds alone saw an inflow of $1.630 billion after an inflow of $2.040 billion in the previous week while ETF muni funds saw an inflow of $262 million after an inflow of $475 million in the prior week.

Taxable bond funds saw combined inflows of $8.673 billion in the latest reporting week after inflows of $8.807 billion in the previous week.

ICI said the total combined estimated inflows into all long-term mutual funds and exchange-traded funds were $8.169 billion for the week ended March 20 after inflows of $22.420 billion in the prior week.

Treasury auctions floating rate notes

The Treasury Department Wednesday auctioned $18 billion of one-year 10-month floating rate notes with a high discount margin of 0.180%, at a 0.115% spread, a price of 99.880671. The bid-to-cover ratio was 3.78.

Tenders at the high margin were allotted 9.80%. The median discount margin was 0.160%. The low discount margin was 0.140%. The index determination date is March 25 and the index determination rate is 2.410%.

Treasury also auctioned $41 billion of five-year notes, with a 2 1/8% coupon, a 2.172% high yield, a price of 99.778500. The bid-to-cover ratio was 2.35.

Tenders at the high yield were allotted 76.16%. All competitive tenders at lower yields were accepted in full. The median yield was 2.125%. The low yield was 2.050%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.